What Awaits Mid-America Apartment (MAA) This Earnings Season?

Mid-America Apartment Communities MAA — commonly known as MAA — is a real estate investment trust (REIT) that focuses on owning, operating and acquiring apartment communities throughout the southeastern and southwestern United States. MAA is slated to report first-quarter 2023 results on Apr 26 after market close.

The Germantown, TN-based residential REIT delivered a surprise of 1.75% in terms of FFO per share in the last reported quarter. Its quarterly results were driven by an increase in the average effective rent per unit for the same-store portfolio.

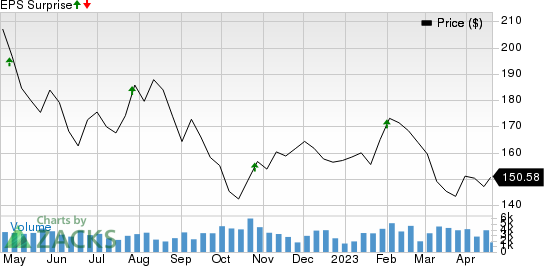

MAA has a decent surprise history. Over the trailing four quarters, MAA surpassed the Zacks Consensus Estimate on all occasions, the average being 2.53%. This is depicted in the chart below:

Mid-America Apartment Communities, Inc. Price and EPS Surprise

Mid-America Apartment Communities, Inc. price-eps-surprise | Mid-America Apartment Communities, Inc. Quote

Factors to Consider

As we approach the release of MAA's first-quarter 2023 earnings report, it is important to examine how this residential REIT is likely to have performed amid the current market conditions.

Per the first-quarter data from RealPage Market Analytics, the U.S. apartment market witnessed a rebound in net apartment demand to positive territory in the quarter. This ended a streak of three consecutive quarters of negative absorption, and the U.S. apartment market added 19,243 net new renters in the quarter.

Occupancy rates continued to slide but at a much lesser degree than before, coming at 94.7% in March, matching the pre-pandemic decade average. Similarly for rents, in March, same-store effective asking rents for new lease signers increased 0.3%. In March, effective asking rents were up 3.9% year over year, though marking the first time below 4% since April 2021.

Overall, the recent trends suggest that somewhat normal seasonality is returning to the market. This follows a three-year absence, with the pandemic erasing normal seasonal patterns.

Amid these, MAA’s diversified Sunbelt portfolio is well-poised to benefit from the favorable fundamentals of this market. The pandemic accelerated employment shifts and a population inflow into the company’s markets as renters seek more business-friendly, lower-taxed and low-density cities. These favorable longer-term secular dynamic trends are increasing the desirability of its markets.

MAA has been focusing on expanding its portfolio by acquiring new properties in high-growth areas. Additionally, MAA has been investing in its existing properties to attract new tenants and retain current ones. The company has been upgrading its amenities and technology to meet the evolving needs of renters. These improvements are likely to result in higher occupancy rates and rental income for MAA.

Particularly, MAA continues to implement its three internal investment programs — interior redevelopment, property repositioning projects and Smart Home installations. The programs are expected to have helped the company capture the upside potential in rent growth, generate accretive returns and boost earnings from its existing asset base.

We expect same-store net operating income to increase 4.5% year over year in the first quarter. Meanwhile, we project average physical occupancy of 95.5%, slightly lower than the prior quarter.

The Zacks Consensus Estimate for quarterly revenues is pegged at $525.1 million, suggesting a 10.3% rise from the year-ago quarter’s reported figure.

MAA projected first-quarter 2023 core FFO per share in the band of $2.14-$2.30, with $2.22 at the midpoint.

Before the first-quarter earnings release, the company’s activities were not adequate to gain analysts’ confidence. The Zacks Consensus Estimate for the quarterly FFO per share has been revised a cent downward to $2.25 in the past month. However, this suggests year-over-year growth of 14.2%.

Overall, MAA is well-positioned to have a strong first quarter in 2023. The company's focus on expanding its portfolio, investing in its existing properties and operating in a rebounding residential real estate market are all positive factors that are likely to contribute to its success. Investors should keep an eye on MAA's first-quarter earnings report for further insights into the company's performance and future growth prospects.

Here Is What Our Quantitative Model Predicts

Our proven model predicts a surprise in terms of FFO per share for MAA this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an FFO beat, which is the case here.

MAA currently carries a Zacks Rank of 3 and has an Earnings ESP of +1.41%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks That Warrant a Look

Here are two other stocks from the residential REIT sector — Equity Residential EQR and Independence Realty Trust, Inc. IRT — you may want to consider as our model shows that these also have the right combination of elements to report a surprise this quarter.

Equity Residential is slated to report quarterly numbers on Apr 25. MAA has an Earnings ESP of +0.31% and carries a Zacks Rank of 3 presently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Independence Realty Trust, scheduled to report quarterly numbers on Apr 26, has an Earnings ESP of +4.82% and carries a Zacks Rank of 3.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equity Residential (EQR) : Free Stock Analysis Report

Mid-America Apartment Communities, Inc. (MAA) : Free Stock Analysis Report

Independence Realty Trust, Inc. (IRT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance