Axalta Coating Systems Ltd (AXTA) Q1 2024 Earnings: Mixed Results Amid Transformation Initiative

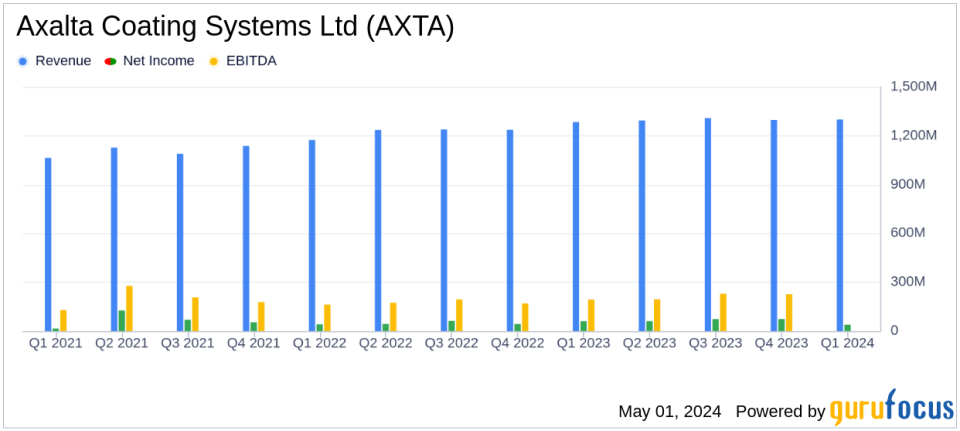

Revenue: Reported $1.3 billion, a slight increase of 0.8% year-over-year, closely aligning with estimates of $1.294 billion.

Net Income: Fell to $39 million, a significant decline from $61 million year-over-year, falling short of the estimated $89.3 million.

Earnings Per Share (EPS): Diluted EPS decreased to $0.18 from $0.27 year-over-year, below the estimated $0.40.

Adjusted EBITDA: Rose to $259 million from $213 million in the previous year, with margin improving by 340 basis points to 20.0%.

Free Cash Flow: Improved to $15 million, compared to a cash use of $88 million in the same period last year.

Debt Management: Reduced total net leverage ratio to 2.8x and paid down $75 million of term loan principal.

Share Repurchase: Board approved a new $700 million share repurchase program in April 2024.

Axalta Coating Systems Ltd (NYSE:AXTA) disclosed its financial outcomes for the first quarter ended March 31, 2024, in its recent 8-K filing. The company, a global leader in the coatings industry, reported a slight revenue increase but faced a decline in earnings per share due to significant restructuring charges.

Company Overview

Axalta Coating Systems Ltd operates through two segments: Performance Coatings and Mobility Coatings, providing advanced coating solutions across a wide range of industries including automotive and industrial applications. The company serves a global market, with operations spanning North America, EMEA, Asia-Pacific, and Latin America.

Financial Performance Highlights

The first quarter saw Axalta achieving a net sales of $1.3 billion, a modest increase of 0.8% year-over-year, aligning closely with analyst expectations of $1,294.10 million. However, net income experienced a downturn, dropping to $39 million compared to $61 million in the previous year, primarily due to $55 million in restructuring charges linked to the company's 2024 Transformation Initiative. This initiative is expected to generate significant annual savings by 2026.

Despite the lower net income, Axalta reported a record first-quarter Adjusted EBITDA of $259 million, up from $213 million year-over-year, with the Adjusted EBITDA margin expanding by 340 basis points to 20.0%. This improvement reflects effective cost management and operational efficiencies. Adjusted diluted earnings per share rose by 37% to $0.48, surpassing the estimated $0.40, showcasing underlying operational strength excluding restructuring impacts.

Segment Performance

The Performance Coatings segment maintained stable sales at $848 million, with notable growth in the Refinish business, offset by declines in Industrial sales. The Mobility Coatings segment saw a 2% increase in sales to $446 million, driven by robust volume growth in China's Light Vehicle market, despite challenges in the Commercial Vehicle sector.

Strategic Developments and Outlook

Axalta's management remains positive about the company's strategic direction, underscored by a new $700 million share repurchase authorization and an optimistic outlook for 2024, raising guidance for Adjusted EBITDA, EPS, and free cash flow. The company anticipates continued revenue growth and operational improvements as it progresses through its transformation plan.

Financial Position and Cash Flow

The company ended the quarter with $624 million in cash and cash equivalents and reduced its total net leverage ratio from 3.7x to 2.8x year-over-year. Axalta also improved its cash flow, with cash provided by operating activities turning positive at $34 million compared to a cash use of $52 million in the prior year's corresponding period.

Analysis

While the restructuring charges have temporarily impacted net income, Axalta's strategic initiatives appear poised to enhance long-term shareholder value. The company's ability to raise its financial outlook amidst these charges suggests confidence in its operational resilience and market positioning. However, investors might remain cautious until the tangible benefits of the transformation initiative are realized in the financials.

Conclusion

Axalta's first quarter of 2024 reflects a period of strategic realignment with mixed financial results. As the company continues to navigate its transformation, the outcomes of these initiatives will be critical in determining its trajectory in the competitive coatings industry.

Explore the complete 8-K earnings release (here) from Axalta Coating Systems Ltd for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance