Axis Capital Holdings Ltd Surpasses Analyst Earnings Projections in Q1 2024

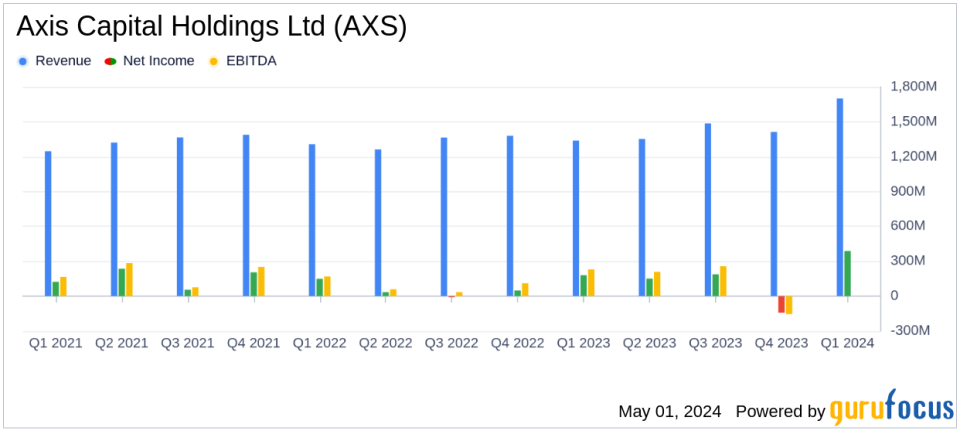

Net Income: Reported at $388 million, significantly surpassing the estimated $210.58 million.

Earnings Per Share (EPS): Achieved $4.53, well above the estimated $2.40.

Operating Income: Reached $220 million or $2.57 per diluted common share, indicating robust operational performance.

Revenue: Gross premiums written increased by 11% to $2.7 billion, reflecting strong market conditions and business growth.

Book Value Per Share: Increased to $57.13, up 5.7% from the previous quarter, driven by net income and despite unrealized investment losses.

Combined Ratio: Stood at 91.1%, demonstrating efficient underwriting and profitability in core operations.

Return on Equity: Annualized return on average common equity impressively recorded at 32.1%, highlighting effective capital management.

On May 1, 2024, Axis Capital Holdings Ltd (NYSE:AXS) released its 8-K filing, unveiling a significant outperformance in its first-quarter earnings. The company reported a net income available to common shareholders of $388 million, translating to $4.53 per diluted common share, substantially exceeding the estimated earnings per share of $2.40. This robust performance underscores the company's effective strategy and operational efficiency in a competitive market.

Axis Capital Holdings Ltd, a key player in the property and casualty insurance sector, operates through a network of subsidiaries and branches across Bermuda, the United States, Canada, Europe, and Singapore. The company focuses on delivering comprehensive insurance and reinsurance solutions through its AXIS Insurance and AXIS Reinsurance platforms.

Financial Highlights and Strategic Achievements

The company's financial results for the first quarter of 2024 were particularly strong, with an operating income of $220 million or $2.57 per diluted common share, compared to $200 million or $2.33 per diluted common share in the first quarter of 2023. This growth was supported by a notable increase in net investment income, which surged by 25% to $167 million, primarily due to higher yields in the fixed maturities portfolio.

President and CEO Vince Tizzio commented on the results, stating,

The results of the first quarter once again evidence that AXIS is elevating its financial performance, producing consistent returns and strong metrics. Reflecting the increased resiliency and consistency of our portfolio, AXIS delivered 18.2% annualized operating ROE and a combined ratio of 91.1%."

Operational Excellence and Market Adaptability

Axis Capital's insurance segment saw gross premiums written increase by 11% to $1.6 billion, with the North America and London-based Global Markets divisions experiencing double-digit growth. The reinsurance segment also reported an 11.8% increase in gross premiums written, amounting to $1.08 billion. These figures reflect the company's strategic focus on expanding its specialty insurance offerings and capitalizing on favorable market conditions.

The company's combined ratio, an essential measure of underwriting profitability, stood at 91.1%, indicating strong underwriting discipline and effective cost management. This performance is critical for maintaining competitiveness and profitability in the insurance industry.

Challenges and Forward Outlook

Despite its strong performance, Axis Capital faces challenges, including the impending corporate income tax in Bermuda, which could impact future financial results. The company recorded a net deferred tax benefit of $163 million in anticipation of these changes, which will likely influence its strategic financial planning.

Looking ahead, Axis Capital is well-positioned to continue its growth trajectory, supported by strategic investments in its operational capabilities and expansion into new insurance markets. The company's focus on enhancing its underwriting platform and leveraging favorable market conditions promises sustained financial health and shareholder value.

For detailed financial figures and future outlooks, interested parties can access the full earnings report and join the upcoming conference call scheduled for May 2, 2024, as detailed in the company's recent filings and announcements.

Explore the complete 8-K earnings release (here) from Axis Capital Holdings Ltd for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance