Azenta Inc (AZTA) Q2 Fiscal 2024 Earnings: Revenue Growth Amid Challenges

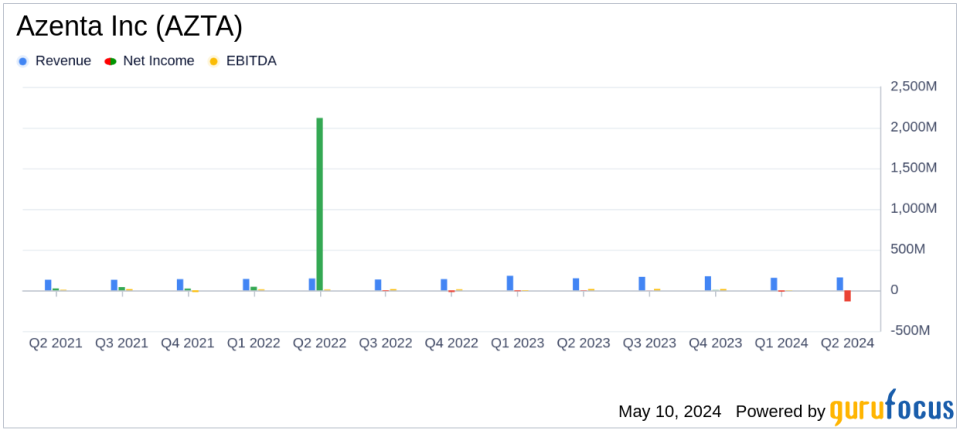

Revenue: Reported $159 million for the quarter, up 7% year-over-year and falling slightly below estimates of $159.89 million.

Net Income: Significant loss reported at $136.88 million due to impairment charges, falling well below the estimated net income of $0.81 million.

Earnings Per Share (EPS): GAAP EPS was $(2.47), significantly lower due to impairment charges; Non-GAAP EPS was $0.05, exceeding the estimated $0.02.

Adjusted EBITDA: Grew to $9 million from a loss of $2 million in the prior year, indicating strong operational improvements.

Gross Margin: Improved by 400 basis points year-over-year to 39.8%, reflecting higher revenue and efficiency gains.

Free Cash Flow: Positive for the fourth consecutive quarter, highlighting effective cash management and operational efficiency.

Guidance: Management remains confident in full-year projections, emphasizing ongoing cost reduction and market opportunity capture.

Azenta Inc (NASDAQ:AZTA) released its 8-K filing on May 8, 2024, detailing the financial outcomes for the second quarter ended March 31, 2024. The company, a leading provider of life sciences solutions, reported a revenue of $159 million, exceeding the estimated $159.89 million and marking a 7% increase from the previous year. This growth was primarily driven by its B Medical Systems segment, which saw a substantial 51% year-over-year increase.

Financial Performance Overview

The quarter witnessed a notable revenue increase across various segments, with B Medical Systems achieving an 81% growth compared to the previous quarter. However, the company faced a significant net loss of $136.88 million, a stark contrast to the $4.93 million loss reported in the same quarter of the previous year. This loss was largely due to a substantial $115.98 million impairment of goodwill and intangible assets. Despite these challenges, Azenta achieved a gross margin improvement of 400 basis points year-over-year, primarily due to higher revenue and effective cost management strategies.

Operational Highlights and Challenges

While Azenta Inc reported growth in revenue, the company's earnings per share (EPS) presented a different story. The diluted EPS from continuing operations stood at -$2.47, significantly impacted by non-recurring charges such as the impairment of goodwill. On a non-GAAP basis, the diluted EPS was $0.05, aligning with analysts' expectations and showing an improvement from the -$0.06 reported in the prior year. This adjustment reflects the company's ongoing efforts to stabilize its financial position through strategic initiatives.

Strategic Initiatives and Future Outlook

Steve Schwartz, President and CEO of Azenta, highlighted the company's resilience and strategic efforts.

We saw continued momentum in the second quarter with strong organic revenue growth, and improved profitability as a result of our ongoing cost reduction and transformation initiatives,"

said Schwartz. These efforts are part of Azenta's broader strategy to enhance operational efficiency and capitalize on market opportunities, particularly in the life sciences sector.

Investor and Market Reactions

The market's reaction to Azenta's financial results may be mixed due to the significant net loss and the challenges posed by impairment charges. However, the company's strong revenue performance and strategic adjustments to improve profitability provide a positive outlook for long-term growth. Azenta remains confident in its market position and its ability to capture upcoming opportunities in the evolving life sciences landscape.

For a detailed analysis and future updates, investors and stakeholders are encouraged to follow the earnings conference call and access further details on Azenta's Investor Relations website.

Azenta's journey through fiscal 2024 continues to be a testament to its strategic resilience and commitment to delivering value in the competitive life sciences sector. Despite the financial challenges, the company's focus on innovation and market expansion sets a foundational path for recovery and growth.

Explore the complete 8-K earnings release (here) from Azenta Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance