Azul (AZUL) Gears Up for Q2 Earnings: A Beat in the Offing?

We expect Azul AZUL to beat expectations when it reports second-quarter 2019 results on Aug 8, before market open. The Zacks Consensus Estimate is 9 cents for second-quarter earnings and $659.6 million for revenues.

In the last reported quarter, this Latin-American carrier delivered a positive earnings surprise of approximately 14%. However, the bottom line declined 14% on a year-over-year basis. This downside can be attributed to the depreciation of the Brazilian Real against the U.S. dollar.

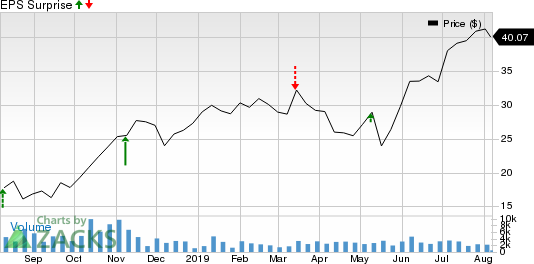

As far as earnings surprises are concerned, the company has an impressive record. Azul outpaced the Zacks Consensus Estimate thrice in the trailing four quarters. This is depicted in the graph below.

AZUL SA Price and EPS Surprise

AZUL SA price-eps-surprise | AZUL SA Quote

Given this backdrop, let’s delve deeper and find out the factors likely to impact Azul’s performance in second-quarter 2019.

We expect upbeat passenger revenues to boost the company’s top line in the to-be-reported quarter on the back of solid demand for air travel. Load factor (% of seats filled by passengers) is anticipated to increase as traffic growth outpaced capacity expansion in the three-month period (April to June). Cargo revenues are also expected to be strong in the second quarter.

Furthermore, favorable airfares are anticipated to aid quarterly revenues. Azul’s efforts to reduce non-fuel unit costs are an added positive. Moreover, the suspension of Avianca Holdings' AVH Brazilian operations by the country’s civil aviation regulator National Civil Aviation Agency in May might boost Azul’s second-quarter 2019 results.

However, factors like unfavorable currency fluctuations are likely to hurt Azul’s results in the quarter to be reported as was the case with another Brazilian carrier — GOL Linhas GOL, which announced its second-quarter 2019 results on Aug 1.

What Does the Zacks Model Say?

Our proven model shows that Azul is likely to beat earnings estimates in second-quarter 2019 as it has the right combination of two key ingredients. A stock needs to have both — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat. Zacks Rank #4 (Sell) or 5 (Strong Sell) stocks are best avoided, especially if they have a negative Earnings ESP. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Azul has an Earnings ESP of +55.56%.

Zacks Rank: Azul carries a Zacks Rank #2 (Buy) You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Another Stock to Consider

Investors interested in the Zacks Airline industry can also check out Mesa Air Group MESA as it possesses the right combination of elements to come up with an earnings beat in its next release.

Mesa Air Group has an Earnings ESP of +6.63% and a Zacks Rank #3. The company is scheduled to report third-quarter fiscal 2019 earnings on Aug 8.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gol Linhas Aereas Inteligentes S.A. (GOL) : Free Stock Analysis Report

Avianca Holdings S.A. (AVH) : Free Stock Analysis Report

AZUL SA (AZUL) : Free Stock Analysis Report

Mesa Air Group, Inc. (MESA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance