Is B&M European Value Retail S.A.'s (LON:BME) CEO Overpaid Relative To Its Peers?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Simon Arora has been the CEO of B&M European Value Retail S.A. (LON:BME) since 2004. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. The aim of all this is to consider the appropriateness of CEO pay levels.

Check out our latest analysis for B&M European Value Retail

How Does Simon Arora's Compensation Compare With Similar Sized Companies?

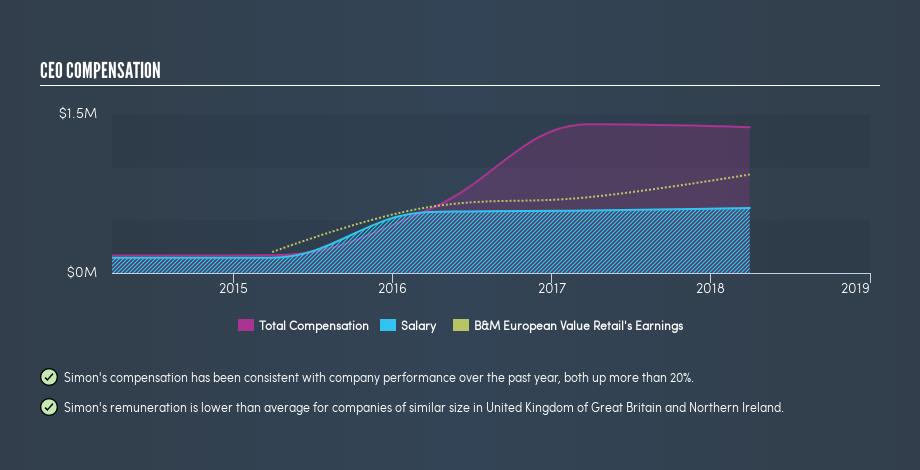

According to our data, B&M European Value Retail S.A. has a market capitalization of UK£3.4b, and pays its CEO total annual compensation worth UK£1.4m. (This figure is for the year to March 2018). We think total compensation is more important but we note that the CEO salary is lower, at UK£612k. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of UK£1.6b to UK£5.0b. The median total CEO compensation was UK£2.0m.

This would give shareholders a good impression of the company, since most similar size companies have to pay more, leaving less for shareholders. While this is a good thing, you'll need to understand the business better before you can form an opinion.

The graphic below shows how CEO compensation at B&M European Value Retail has changed from year to year.

Is B&M European Value Retail S.A. Growing?

B&M European Value Retail S.A. has increased its earnings per share (EPS) by an average of 20% a year, over the last three years (using a line of best fit). Its revenue is up 15% over last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's a real positive to see this sort of growth in a single year. That suggests a healthy and growing business. It could be important to check this free visual depiction of what analysts expect for the future.

Has B&M European Value Retail S.A. Been A Good Investment?

Boasting a total shareholder return of 39% over three years, B&M European Value Retail S.A. has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

It looks like B&M European Value Retail S.A. pays its CEO less than similar sized companies. Many would consider this to indicate that the pay is modest since the business is growing. And given most shareholders are probably very happy with recent returns, you might even think that Simon Arora deserves a raise!

It's not often we see shareholders do so well, and yet the CEO is paid modestly. But it is even better if company insiders are also buying shares with their own money. Whatever your view on compensation, you might want to check if insiders are buying or selling B&M European Value Retail shares (free trial).

Important note: B&M European Value Retail may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance