Baidu (BIDU) Down 8.4% on Target Price Cut by Susquehanna

Baidu, Inc. BIDU has reportedly been downgraded by analysts at Susquehanna. Analysts lowered the target price by 20% to $170, prompting a decline of 8.4% in its share price.

The company’s growth has been hampered by weak macro environment and overall slowdown in the China market.

Notably, Baidu’s shares have lost 23.5% after the company announced weak first-quarter earnings on May 16. Also, the stock has underperformed the industry in the past year. While its industry has declined 2.9%, the stock has lost 49.3% in the said period.

Why the Downgrade?

Baidu reported dismal first-quarter earnings due to a slowdown in China and higher expenses. Moreover, the challenging online marketing market in the near term is a concern.

Hence, analysts at Susquehanna lowered its target price.

First-Quarter Results: The company reported adjusted first-quarter 2019 earnings of 41 cents per share, which was down 78.6% sequentially and 84.2% year over year. However, the search engine reported revenues of RMB24.1 billion ($3.59 billion), up 15% year over year.

First-quarter gross margin of 35.3% was down significantly from the year-ago period.

Baidu reported total operating expenses of RMB10.2 billion, up 58.8% from RMB6.4 billion incurred in the year-ago quarter. As a percentage of sales, selling, general & administrative expenses decreased, while R&D expenses increased.

This resulted in a GAAP operating margin of (3.9%) compared with 21.8% in the year-ago quarter.

For second-quarter 2019, Baidu expects total revenues in the range of RMB25.1 billion (or $3.74 billion) to RMB26.6 billion (or $3.96 billion), indicating a year-over-year increase of (3)-2%.

Conclusion

Baidu’s continuous efforts to strengthen its mobile search engine and AI technologies are positives. Moreover, strong focus on leveraging the AI platform is aiding it to provide an improved user experience.

However, slowing economy and macroeconomic headwinds in China remain risks.Also, increasing competition from players like Google, Alibaba and WeChat remains a concern.

The company is making heavy investments in a bid to continuously diversify business from mobile internet into smart home, cloud and autonomous driving markets. These mounting investment costs might further increase operating expenses of the company and impact the bottomline.

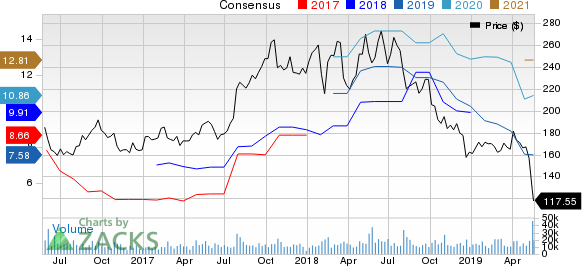

Baidu, Inc. Price and Consensus

Baidu, Inc. price-consensus-chart | Baidu, Inc. Quote

Zacks Rank and Stocks to Consider

Currently, Baidu has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader technology sector include Facebook, Inc. FB, IAC/InterActiveCorp IAC and AXT, Inc. AXTI, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for Facebook, IAC/InterActiveCorp and AXT is currently projected at 20.2%, 20.5% and 15%, respectively.

Will you retire a millionaire?

One out of every six people retires a multimillionaire. Get smart tips you can do today to become one of them in a new Special Report, “7 Things You Can Do Now to Retire a Multimillionaire.”

Click to get it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

IAC/InterActiveCorp (IAC) : Free Stock Analysis Report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Facebook, Inc. (FB) : Free Stock Analysis Report

AXT Inc (AXTI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance