Will Baidu's (BIDU) Q1 Earnings Benefit From iQIYI Momentum?

Baidu, Inc.’s BIDU first-quarter 2021 results, which are scheduled to be released on May 18, are expected to reflect the impacts of the strong iQIYI segment.

Notably, the segment became an integral division of Baidu as it has been driving the company’s membership services and online marketing revenues for a while now.

In the last reported quarter, the iQIYI segment generated RMB 7.5 billion in revenues, accounting for 24.8% of the company’s total revenues.

The iQIYI segment’s self-producing, long-form video series and Baidu's search plus feed ecosystem are expected to have continued driving the segment’s performance in the first quarter.

Click here to know how the company’s overall first-quarter performance is likely to have been.

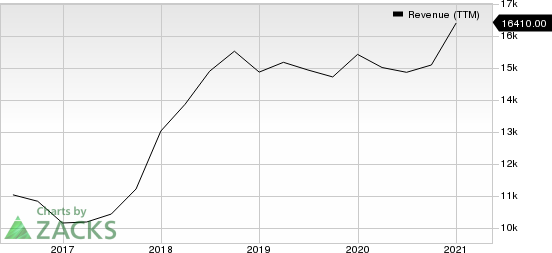

Baidu, Inc. Revenue (TTM)

Baidu, Inc. revenue-ttm | Baidu, Inc. Quote

Factors at Play

We note that the underlined segment witnessed a decline in its subscriber base, which stood at 101.7 million in fourth-quarter 2020 and 106.9 million in fourth-quarter 2019.

Nevertheless, Baidu’ssolid momentum across iQIYI’stheatre-themed content portfolio is anticipated to have driven growth in the subscriber base for the service in the quarter under review.

Moreover, the strengthening ofiQIYI’s overall content portfolio is anticipated to have continued to bolsterBaidu’s footprint in the country’s online video-streaming market.

Further, solid demand for the company-produced drama series, original movies and variety shows is expected to have benefited the segment’s first-quarter performance.

Additionally, growing momentum across interactive adsis expected to get reflected in the company’s first-quarter results.

Apart from this, the company’s deepened focus on bolstering its membership portfolio is anticipated to have contributed well to the segment’s top line in the to-be-reported quarter.

Zacks Rank & Stocks to Consider

Currently, Baidu sports a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the broader technology sector worth consideration are Agilent Technologies A, Pure Storage PSTG and NVIDIA NVDA. All the stocks carry a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank(Strong Buy) stocks here.

Long-term earnings growth rate of Pure Storage, NVIDIA and Agilent, is pegged at 52.21%, 15.23% and 9%, respectively.

Zacks' Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create "the world's first trillionaires." Zacks' urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance