Baillie Gifford Bolsters Stake in Mobileye Global Inc

Significant Addition to Baillie Gifford (Trades, Portfolio)'s Portfolio

On March 1, 2024, Baillie Gifford (Trades, Portfolio), a renowned investment management firm, made a notable addition to its investment portfolio by acquiring 7,560,929 shares of Mobileye Global Inc (NASDAQ:MBLY), a leader in autonomous driving technologies. This transaction increased Baillie Gifford (Trades, Portfolio)'s total holdings in the company to 15,985,212 shares, reflecting a significant trade impact of 0.16% on its portfolio. The shares were purchased at a price of $27.05 each, and as of the trade date, Mobileye represented 0.34% of Baillie Gifford (Trades, Portfolio)'s portfolio, with the firm holding a 16.87% stake in the traded stock.

Investment Management with a Century of Expertise

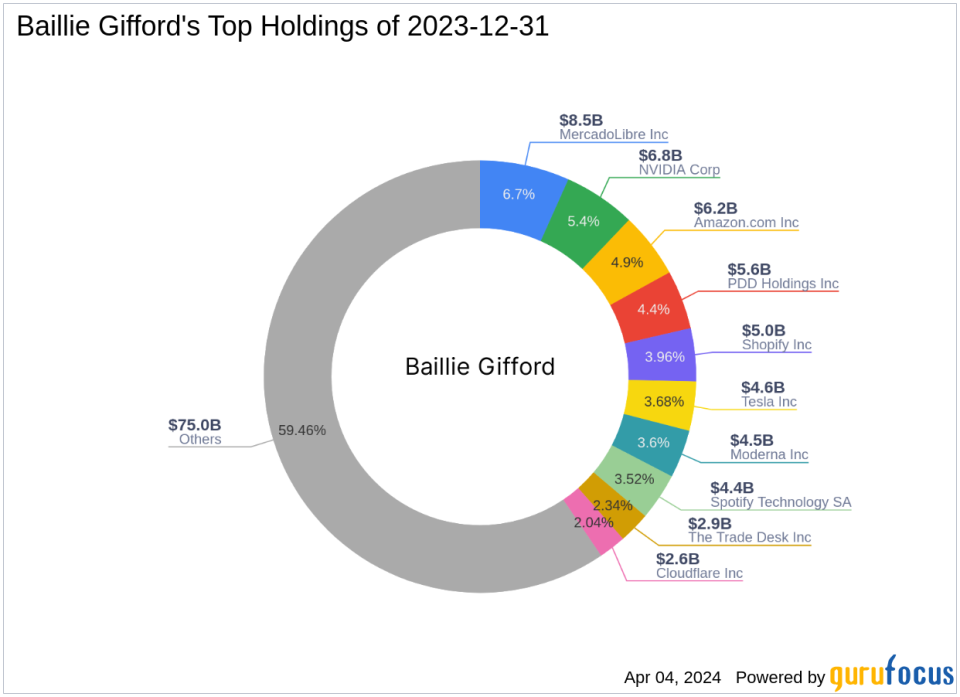

Baillie Gifford (Trades, Portfolio), with over a century of experience in investment management, is known for its commitment to professional excellence and a client-centric approach. The firm manages assets for some of the world's largest professional investors, focusing on long-term, bottom-up investing. Baillie Gifford (Trades, Portfolio)'s investment philosophy is rooted in fundamental analysis and proprietary research, aiming to identify companies with the potential for sustainable, above-average growth. With a portfolio of 288 stocks and a total equity of $126.19 billion, Baillie Gifford (Trades, Portfolio)'s top holdings include Amazon.com Inc (NASDAQ:AMZN), MercadoLibre Inc (NASDAQ:MELI), and NVIDIA Corp (NASDAQ:NVDA), predominantly in the Technology and Consumer Cyclical sectors.

Mobileye Global Inc: Driving the Future of Autonomous Technology

Mobileye Global Inc, headquartered in Israel, has been at the forefront of Advanced Driver Assistance Systems (ADAS) and autonomous driving technologies since its IPO on October 26, 2022. The company's comprehensive suite of software and hardware solutions is designed to meet the evolving needs of autonomous driving. With a market capitalization of $26.65 billion and a current stock price of $33.058, Mobileye has shown a promising IPO performance, with a 23.77% increase since its market debut. However, the company's PE ratio stands at 0.00, indicating it is currently not profitable.

Deciphering Baillie Gifford (Trades, Portfolio)'s Increased Stake in Mobileye

The decision by Baillie Gifford (Trades, Portfolio) to increase its position in Mobileye may be attributed to the firm's confidence in the company's growth potential and strategic direction. Mobileye's role in the Vehicles & Parts industry and its innovative approach to ADAS and autonomous driving solutions align with Baillie Gifford (Trades, Portfolio)'s investment philosophy of identifying companies with long-term growth prospects.

Assessing Mobileye's Financial and Market Performance

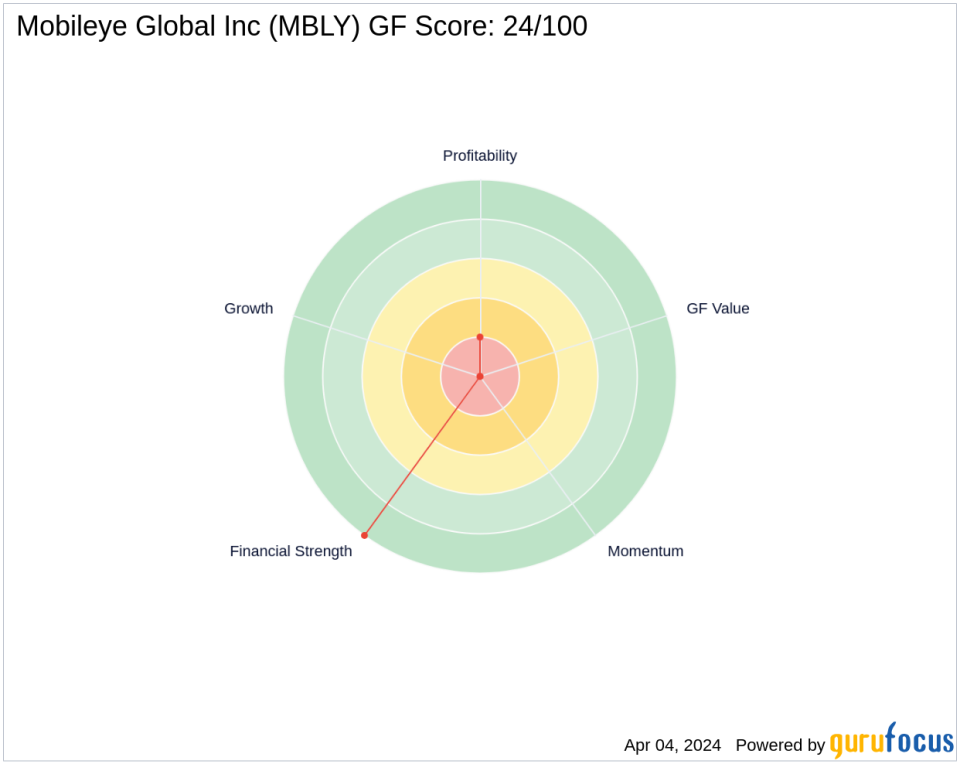

Despite Mobileye's lack of profitability, as indicated by its PE ratio of 0.00, the company has demonstrated strong financial health with a Financial Strength rank of 10/10. However, its Profitability Rank is low at 2/10, and it has not yet established a Growth Rank or GF Value Rank. The stock's GF Score of 24/100 suggests that it may have limited potential for future performance. Since Baillie Gifford (Trades, Portfolio)'s trade, Mobileye's stock has gained 22.21%, yet it has experienced a year-to-date decline of 20.03%.

Industry Insights and Comparative Analysis

Mobileye's positioning within the Vehicles & Parts industry is crucial to understanding Baillie Gifford (Trades, Portfolio)'s investment strategy. The firm's top sectors include Technology and Consumer Cyclical, which are closely related to Mobileye's business. When compared to Baron Funds, the largest guru shareholder in Mobileye, Baillie Gifford (Trades, Portfolio)'s increased stake underscores its belief in the company's potential and strategic fit within its portfolio.

Concluding Thoughts on Baillie Gifford (Trades, Portfolio)'s Strategic Move

In conclusion, Baillie Gifford (Trades, Portfolio)'s recent acquisition of shares in Mobileye Global Inc is a strategic move that reflects the firm's confidence in the company's future growth and its alignment with the firm's long-term investment philosophy. While Mobileye's current financial metrics present a mixed picture, Baillie Gifford (Trades, Portfolio)'s decision to bolster its stake may be indicative of the firm's belief in the company's potential to overcome current challenges and capitalize on the opportunities within the autonomous driving industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance