Ball Corporation (BLL) Down 2.6% Since Earnings Report: Can It Rebound?

A month has gone by since the last earnings report for Ball Corporation BLL. Shares have lost about 2.6% in that time frame.

Will the recent negative trend continue leading up to its next earnings release, or is BLL due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Ball Corp Beats on Q1 Earnings & Sales, Keeps View

Ball Corporation reported first-quarter 2018 adjusted earnings of 50 cents per share, beating the Zacks Consensus Estimate of 45 cents. Earnings also jumped 32% year over year, mainly driven by improved performance in all product lines, along with lower corporate costs.

On a reported basis, the company posted earnings of 35 cents per share compared to 19 cents per share recorded in the prior-year quarter.

Total revenues increased 12.6% year over year to $2,785 million in the reported quarter. The revenue figure also surpassed the Zacks Consensus Estimate of $2,603 million. In Ball Corporation’s global beverage can business, overall volumes were up in low single-digits in the quarter, driven largely by continued strong performance in South America and Europe.

Operational Update

Cost of sales went up 13.3% year over year to $2,237 million. Gross profit improved 10% year over year to $548 million. Gross margin contracted 30 basis points (bps) to 19.7%.

Selling, general and administrative expenses dropped 21.7% year over year to $112 million. Adjusted operating income increased 22.8% to $436 million from the $355 million reported in the year-ago quarter. The company reported operating margin of 15.7%, up 130 bps year over year.

Segment Performance

The Beverage packaging’s North and Central America segment’s revenues went up 9% year over year to $1,035 million in the first quarter. Operating earnings of $113 million decreased 8% year over year.

Sales at the Beverage packaging, Europe segment came in at $609 million in the quarter, advancing 20% year over year. Operating earnings surged 27.7% year over year to $60 million.

The Beverage packaging South America segment’s revenues jumped 23.7% year over year to $459 million in the reported quarter. Operating earnings of $98 million recorded a substantial improvement from $58 million recorded in the prior-year quarter.

The Food and Aerosol Packaging segment’s sales came in at $275 million, inching up 1.1% year over year. Operating earnings rose 9.5% year over year to $23 million.

In the Aerospace and Technologies segment, sales went up 11.9% year over year to $264 million. Operating earnings increased 19% year over year to $25 million. The segment’s backlog came in at around $1.7 billion at the end of the first quarter.

Financial Condition

Ball Corporation reported cash and cash equivalents of $477 million at the end of the first quarter, up from $458 million at the end of the year-ago quarter. The company used $74 million of cash in operating activities during the quarter compared with the cash usage of $401 million recorded in the prior-year period. Ball Corporation’s long-term debt decreased to $7,131 million as of Mar 31, 2018, from $7,476 million as of Mar 31, 2017.

The company initiated a share-repurchase program during the first quarter and increased share repurchase authorization to 25 million shares, which will help return significant value to shareholders in 2018.

Outlook

Ball Corporation reaffirmed its financial goals for 2018. The company expects its free cash flow to be around $900 million and capital spending will be at least $600 million. Notably, Ball Corporation reaffirms that its comparable EBITDA will be $2 billion and free cash flow will be in excess of $1 billion in 2019. The company's recent $750 million senior notes offering also bodes well for the long term.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There have been two revisions higher for the current quarter compared to three lower.

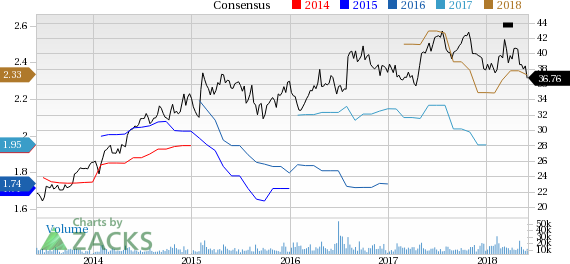

Ball Corporation Price and Consensus

Ball Corporation Price and Consensus | Ball Corporation Quote

VGM Scores

At this time, BLL has a subpar Growth Score of D. Its Momentum is doing a lot better with a B. However, the stock was also allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for momentum based on our styles scores.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions indicates a downward shift. Notably, BLL has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ball Corporation (BLL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance