The Bancorp Inc (TBBK) Aligns with Q1 Earnings Projections and Affirms Full-Year Guidance

Net Income: Reported at $56.429 million for Q1 2024, surpassing the estimated $56.51 million.

Earnings Per Share (EPS): Achieved $1.06 in diluted EPS, meeting the analyst estimate of $1.06.

Revenue: Net interest income for the quarter was $94.418 million, indicating robust income generation capabilities.

Return on Equity (ROE): Impressive at 28%, highlighting efficient equity utilization and profitability.

Guidance: Reaffirmed 2024 EPS guidance at $4.25, excluding impacts from significant share buybacks planned for the year.

Share Buyback: Additional $50 million buyback announced for Q2 2024, reflecting strong financial health and commitment to shareholder value.

Operational Highlights: Continued focus on expanding client relationships and investing in future capabilities, supporting sustained growth.

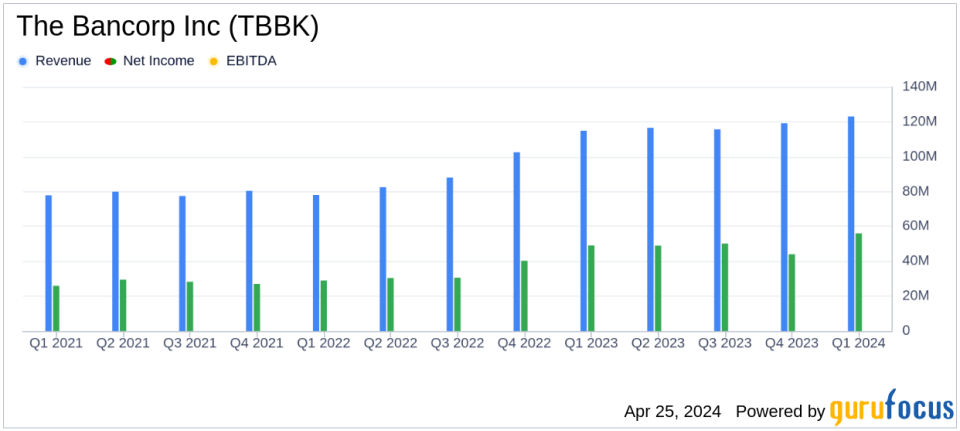

The Bancorp Inc (NASDAQ:TBBK), a prominent financial holding company, disclosed its first quarter results for 2024 on April 25, closely matching analyst expectations. The company announced earnings per share (EPS) of $1.06, aligning with the estimated EPS of $1.06. Net income for the quarter stood at $56.43 million, slightly under the forecast of $56.51 million. The detailed financial outcomes were released in their recent 8-K filing.

About The Bancorp Inc

Headquartered in Wilmington, Delaware, The Bancorp Inc operates through its subsidiary, The Bancorp Bank, National Association. It offers a range of services including Fintech Solutions, Institutional Banking, Commercial Lending, and Real Estate Bridge Lending. The company is recognized for its significant role in the prepaid card market in the U.S. and its expertise in providing securities-backed lines of credit and commercial vehicle leasing.

Q1 Performance Highlights

For Q1 2024, The Bancorp reported a robust net interest income of $94.42 million, up from $85.82 million in the same quarter the previous year. The provision for credit losses was $2.17 million. Non-interest income was reported at $29.38 million. Total non-interest expense for the quarter was $46.71 million, showing a slight decrease from the previous year's $48.03 million.

Strategic Developments and Future Outlook

President and CEO Damian Kozlowski remarked on the company's strategic advancements and optimistic outlook for 2024.

We had another quarter of continued progress and a strong start to 2024 with earnings of $1.06 a share and an ROE of 28%," said Kozlowski. "We expect continued increases in volumes and profitability throughout 2024 and beyond as we continue to invest and build our capabilities for the future, while adding new business partners and expanding our current client relationships."

The company also reaffirmed its 2024 guidance of $4.25 per share, factoring in the impact of significant share buybacks planned for the year.

Financial Position and Liquidity

The Bancorp's balance sheet remains strong with total assets amounting to $7.92 billion as of March 31, 2024. The company's deposit portfolio showed a healthy increase, totaling $6.89 billion, up from $6.68 billion at the end of 2023. Shareholders' equity also saw a rise, reaching $816.77 million.

Investor Relations and Future Engagements

The Bancorp has scheduled a live webcast for its quarterly earnings conference call on April 26, 2024, providing an opportunity for investors to gain further insights into the companys performance and strategic directions. The call can be accessed through The Bancorp's homepage or via teleconference.

For detailed financial figures and future projections, stakeholders and potential investors are encouraged to view the full earnings report and tune into the upcoming webcast. The Bancorp continues to uphold its reputation as a resilient player in the financial services sector, backed by a strategic focus on technological integration and customer-centric solutions.

Explore the complete 8-K earnings release (here) from The Bancorp Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance