Bangladesh Embedded Finance Business Report 2024: Market to Grow by 54.2% to Reach $980+ Million this Year - Forecasts to 2029

Bangladeshi Embedded Finance Business and Investment Opportunities Market

Dublin, May 22, 2024 (GLOBE NEWSWIRE) -- The "Bangladesh Embedded Finance Business and Investment Opportunities Databook - 75+ KPIs on Embedded Lending, Insurance, Payment, and Wealth Segments - Q1 2024 Update" report has been added to ResearchAndMarkets.com's offering.

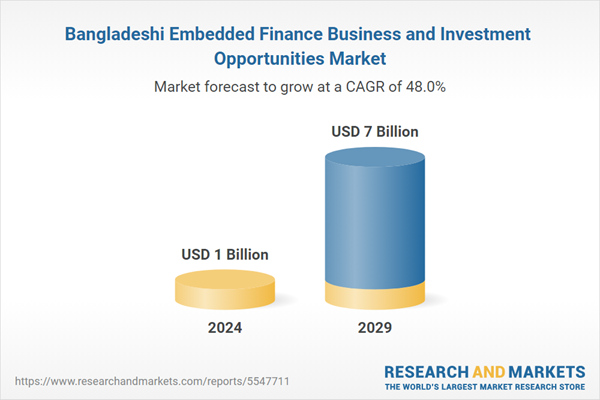

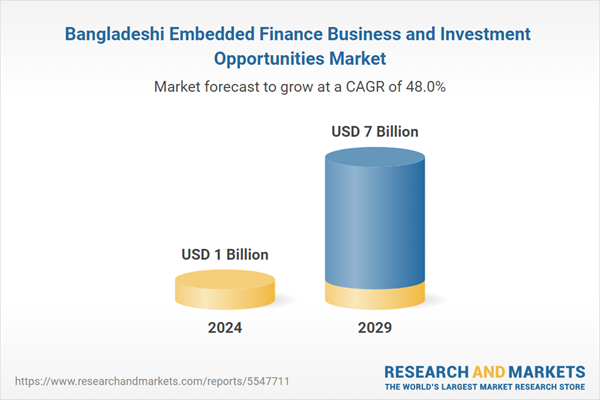

The Embedded Finance industry in Bangladesh is experiencing a significant growth rate, projected at 54.2% annually, and expected to reach a market size of US$980.5 million in 2024. This trajectory suggests a robust expansion of the sector with a compound annual growth rate (CAGR) of 48.0% between 2024 and 2029, culminating in a projected market value of US$6.96 billion by 2029. These figures underscore the rapidly developing landscape of Embedded Finance in Bangladesh, driven by innovation and increasing digital financial services adoption.

The report offers an exhaustive analysis of the industry, presenting over 75 key performance indicators (KPIs) that provide a complete understanding of the market. It encompasses various segments including lending, insurance, payment, wealth, and asset-based finance, offering a granular view of each area. Furthermore, the research delves into the distribution models and business models, from platforms to regulatory entities, providing stakeholders with essential insights into the ecosystem's operation.

Sector-Specific Opportunities

A detailed segmentation of the Embedded Finance market is presented within the report, highlighting specific sectors such as retail, logistics, and telecommunications. Special attention is also given to emerging segments, which include but are not limited to consumer health and manufacturing. The assessment of these sectors presents a framework for understanding the relative growth opportunities within the Embedded Finance market in Bangladesh.

Embedded Insurance Market Promises Diversified Growth

The market size and forecasts for Embedded Insurance in Bangladesh also form a core part of the report, with a focus on consumer products, automotive, and healthcare, amongst other industries. The report evaluates each segment thoroughly and provides an outline of the customer segments, offerings, business models, and distribution channels. Moreover, insurance types ranging from life to non-life, including various sub-categories, are explored, indicating the depth of the market's potential.

Embedded Lending and Payment Trends

In the arena of Embedded Lending, the report identifies business and retail lending as key consumer segments, with special attention to sectors such as IT and software services, as well as healthcare and wellness. Various lending types, like Buy Now Pay Later (BNPL) and Point of Sale (POS) lending, are scrutinized. Similarly, the Embedded Payment sector is dissected by consumer segments and end-use sectors, offering insights into the dynamics governing embedded payment in diverse markets such as utility bill payment and office supplies.

Strategic Industry Insights

The findings within the report are instrumental for those seeking to develop sector-specific strategies, as they encapsulate market-specific trends, drivers, and risks. By harvesting insights from proprietary surveys, the report enables stakeholders to pinpoint emerging opportunities within key segments of the Embedded Finance ecosystem, including lending, insurance, payment, and wealth management sectors. This intelligence is vital for strategic decision-making and opportunity identification in the evolving landscape of Bangladesh's Embedded Finance industry.

Key Attributes:

Report Attribute | Details |

No. of Pages | 130 |

Forecast Period | 2024 - 2029 |

Estimated Market Value (USD) in 2024 | $1 Billion |

Forecasted Market Value (USD) by 2029 | $7 Billion |

Compound Annual Growth Rate | 48.0% |

Regions Covered | Bangladesh |

For more information about this report visit https://www.researchandmarkets.com/r/dpor5z

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance