How the Bank of England decides whether to put up interest rates

Millions of UK homeowners will find out on Thursday if their mortgage is about to get more expensive.

The Bank of England’s Monetary Policy Committee is to report its decision whether to raise interest rates for the first time in a decade – or not.

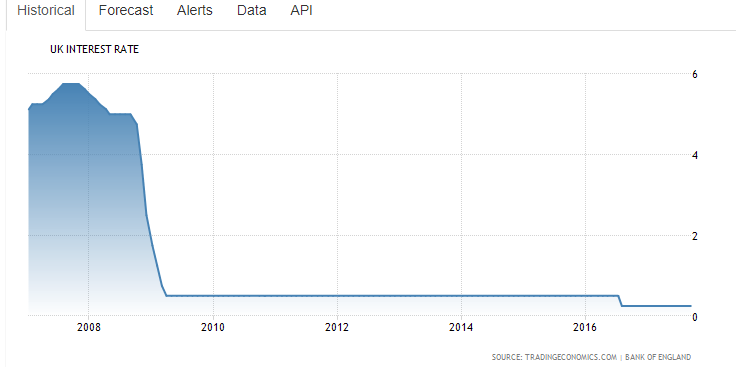

Rates are at a record low of 0.25% – and higher rates would hit borrowers, but benefit savers.

So, who’s making the decision?

The MPC is headed by BoE governor Mark Carney. The Canadian has been at the helm of the Bank since 2013 and is known to be ‘hawkish’ – he sees keeping inflation under control as a priority. He’s also come under fire for ‘talking down’ UK economic prospects post-Brexit.

MORE: Banks need Brexit transition deal by end of year, warns FCA chief

There are eight other members of the committee:

Ben Broadbent, governor of monetary policy;

Andrew Haldane, chief economist;

Dave Ramsden, deputy governor of markets and banking;

Jon Cunliffe, deputy governor of financial stability;

Silvana Tenreyro, external member – Ms Tenreyro is a professor in economics at the London School of Economics;

Ian McCafferty, external member – in effect, the business voice on the committee having worked at the CBI;

Michael Saunders, external member – was a UK economist at Citigroup from 1990 to 2016;

Gertjan Vlieghe, external member – worked at the BoE under Mervyn King from 1998-2005;

How do they reach a decision?

The MPC meets formally eight times a year, although members convene several times before casting their votes.

This includes a designated pre-MPC meeting, where Bank economists provide members with an update on the state of the UK economy a week before the interest rate decision.

As well as seeing a raft of economic data, graphs, charts etc, the committee also hears from its regional agents, which are described by the Bank as its “eyes, ears and voice” across the UK.

Those reports help give a broader perspective on what life for people and business is like outside of the London “bubble”.

MORE: Brexit vote has cost each UK household £600 a year – and we’ve not even left yet

Do they vote straight away?

No – the policymakers then meet over three days; at the first meeting, normally held on the Thursday prior to the MPC decision, members discuss their views on how to interpret the most recent economic data.

At the MPC’s second meeting – the first of two policy meetings, normally held the following Monday – members debate what the appropriate stance of policy should be.

The MPC’s final meeting – its second policy meeting – is normally held on the Wednesday. Following further discussion on the appropriate stance of monetary policy, the Governor puts to the meeting the policy which he believes will command a majority and members of the MPC vote.

Any member in a minority is asked to say what level of interest rates he or she would have preferred.

The interest rate decision is published alongside the minutes of the MPC’s meetings at 12 noon on the Thursday.

Why are we talking about a rate rise now?

The last time rates increased, Gordon Brown was prime minister and the iPhone had only just been unveiled to the world.

Back then, interest rates rose 0.25% to 5.75% – and then the financial crisis struck, sweeping across the globe and sending national economies into recession.

The MPC cut rates regularly to try to keep the credit crunch at bay, eventually reaching a then record low in March 2009 of 0.5%.

The Brexit vote saw the economy wobble once more and rates were cut to a new low of 0.25% in August 2016.

MORE: City urges Hammond to avoid Budget surprises amid fears over hard Brexit

Now, however, with inflation at a five-year high of 2.9%, the pressure is on for a rise to cool the situation. On top of that, household debt and unsecured borrowing continues to soar – at some £200bn – and there is a feeling that it’s “too affordable” to get credit.

Many economists want to encourage savers and deter borrowers.

But, members will also be conscious of the squeeze on household incomes from stagnating wages, and the sluggish economic growth and productivity.

Yahoo Finance

Yahoo Finance