Bank of England faces echoes of the 2007 crunch as Brits are back to their bad old habits racking up debt

There are eery echoes of 2007. A decade on from the financial crisis, Britons are back to their bad old habits, buying on the never never, racking up debt hand over fist.

It is not a precise re-run of that giant boom and bust. The economy is not surging, and households are being squeezed by higher inflation and weak wage growth, topping up spending with credit cards.

If the system was overheating, the Bank of England could raise interest rates. This is a bubble in just one market.

Policymakers at the Bank are engaged in a civil war as three of the eight-member Monetary Policy Committee (MPC) voted to hike rates while five voted to stick this month. Meanwhile, the chief economist said he is tempted to raise rates this year too.

The hawks who want to hike think the economy is relatively healthy and higher rates will help control inflation. The doves, including the Governor Mark Carney, fear that would squash growth unnecessarily.

Luckily, then, the Bank has more tools than just the battering ram of interest rates, that blunt instrument which has profound effects across the whole economy.

In the wake of the financial crisis the Old Lady of Threadneedle Street was seriously beefed up, receiving more powers to try to target bubbles in individual markets. Its Financial Policy Committee is responsible for those, and was set up to deal with just this scenario. This week it will announce its latest assessment of the threats to the economy in its Financial Stability Report, along with any steps to deal with the risks.

If officials are not yet ready to go the whole hog and raise interest rates, they can try to calm specific overheating markets with more precise measures, the so-called macroprudential tools.

The FPC has already done this with mortgages, limiting the proportion of loans which banks could give at very high multiples of borrowers’ incomes and tightening lending standards.

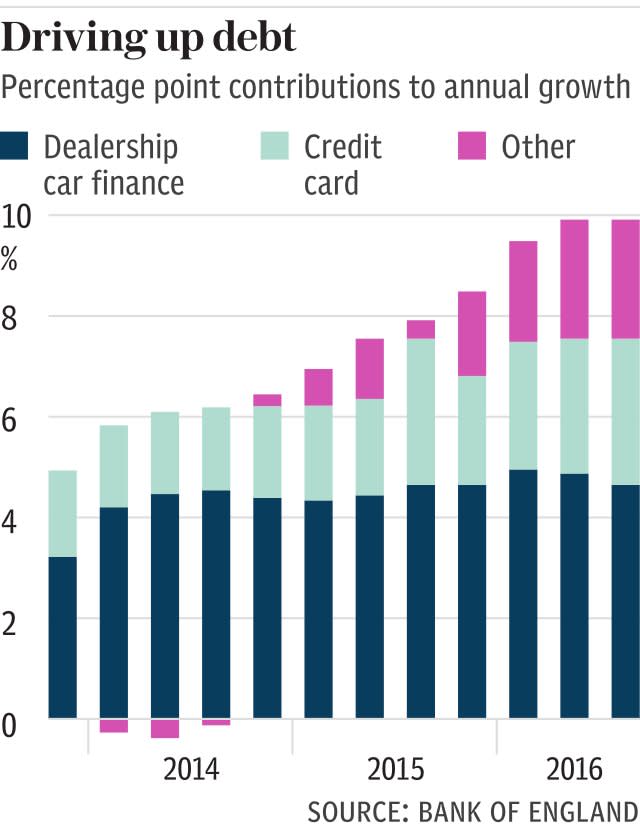

With limited options in the mortgage market, banks are now giving out unsecured consumer loans enthusiastically. As a result, unsecured loans such as credit cards and car finance are booming, rising at an annual rate of 10pc.

That is the fastest pace of growth since the years before the financial crisis which, now, are viewed as heady days of wild overconfidence and consumer excess.

Hence the growing concerns about a possible re-run.

At the start of the year Carney said the Financial Policy Committee would “think about” taking steps to trim lending, but said any real action would be “a big call” – a gentle hint that lenders should be careful with loans.

With limited options in the mortgage market, banks are now giving out unsecured consumer loans enthusiastically. As a result, unsecured loans such as credit cards and car finance are booming, rising at an annual rate of 10pc. That is the fastest pace of growth since the years before the financial crisis

In April he moved further and the FPC said debts are “high by historical standards”, pointing to credit cards, consumer loans and car finance as trouble spots.

The Bank of England’s surveys of lending indicate banks are becoming less fussy about the type of customers they take on. “The credit conditions survey … clearly shows that in the latest quarter credit scoring criteria were loosened significantly, the proportion of loan requests being approved shot up, and the average credit quality went down. That is the sort of toxic mix that the [FPC] won’t like the look of at all,” says analyst John Wraith at UBS.

As a result the FPC may think “hang on a minute, you’re playing a bit fast and loose”, he says.

Since late in 2016 banks and other lenders have told the Bank of England that they are tightening lending standards. But there is little sign of this in the data so far.

Indeed, the opposite appears to be happening – credit card lending soared by 9.7pc in the 12 months to April, according to Bank of England data, the fastest rate since early 2006, at the height of the pre-crisis boom.

Other consumer lending is rising even more quickly. Lending excluding credit cards and student loans jumped by 10.7pc in the same 12-month period – though that is the slowest expansion since early 2016, showing the extraordinary pace of the recent expansion. One substantial factor driving that is the growth of almost 5pc year-on-year in car dealership finance. Nine in every 10 cars is now bought using finance.

The expansion of this sector has caused fears of a bubble in the United States, where comparisons have been drawn with the sub-prime mortgage bubble which led to the financial crisis.

Using figures from the Finance and Leasing Association the growth in UK car loans has been even bigger than the Bank of England figures suggest.

The industry body’s numbers show car loans rising at around 10pc annually in recent years.

Regulators at the Financial Conduct Authority are already cracking down on parts of the credit card market, fearing that heavily indebted customers are not getting enough help. Now they are also probing the car finance sector to see if customers are being fairly treated.

Officials have already made it more difficult to get a mortgage, forcing borrowers to show their bank or building society more financial information so the lender can check if the borrower will be able to pay their debts if interest rates shoot up, or if they get into financial trouble. Even the hurdle of substantially more paperwork has slowed mortgage lending.

That could be replicated here.

Officials can “make it more difficult for car financing to be agreed and arranged, with people going through more hoops to get it,” says economist David Owen at Jefferies.

Alternatives could include forcing banks to hold more capital against unsecured loans, making it more expensive to lend and limiting the amount of debt on offer. But officials have a tricky balance to strike.

“It is not simple for the FPC, if they are uncomfortable at the pace with which it is growing. It is because that is growing that the consumer has been able to perform as well as they have – if you choke it off too aggressively, you can have knock-on consequences which give you a much bigger headache than the one which you’re trying to cure,” says Wraith.

“You don’t want to stop the consumer in its tracks.”

Yahoo Finance

Yahoo Finance