Bank of England poised to act as credit card market overheats

The Bank of England is poised to order banks to rein in lending to prevent the UK credit card market from dangerously overheating.

Mark Carney, the Bank’s Governor, is reluctant to hike interest rates because it would risk slowing the entire economy but officials are worried about a boom in household debt as Britons splurge on credit cards and car loans.

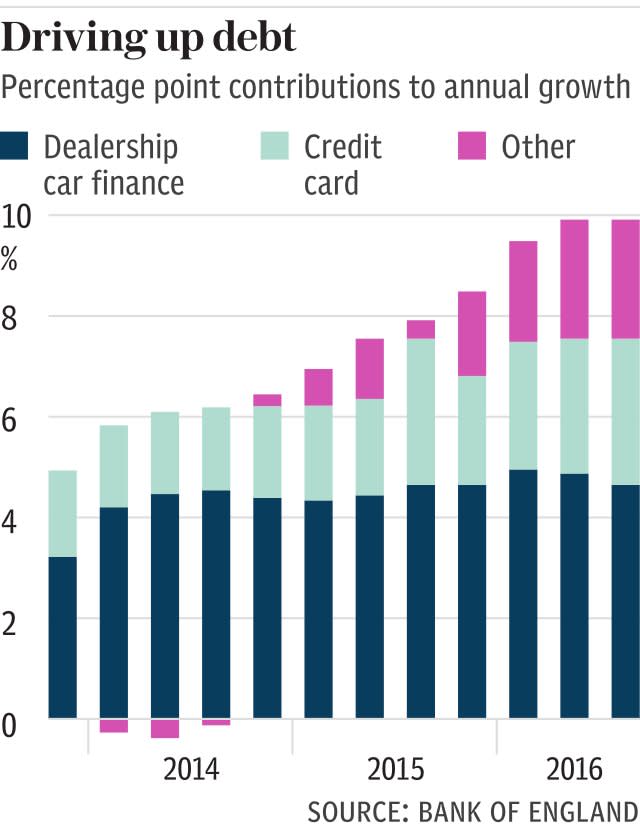

Consumer credit is rising at a rate of around 10pc per year, a pace not seen since before the financial crisis.

Mr Carney has publicly acknowledged the acceleration in lending but banks have so far not shown many signs of improving lending standards.

As a result, economists expect banks will be told to stop giving out ever-lower quality loans in an effort to chase higher volumes of business.

The Bank’s Financial Policy Committee (FPC) – a powerful group of officials headed by Mr Carney – will on Tuesday publish its recommendations for any action on risks in the economy in its Financial Stability Report.

The FPC is also looking at scrapping one of the emergency policies it brought in last year after the Brexit vote, as the economy has proved more resilient than officials expected.

Banks were told they could release some of their capital buffers, a move which encourages more lending. As lending has surged officials are now expected to reverse the move.

The idea is that banks put aside more capital in good years, then if the economy weakens they are allowed to release those funds to shore up lending and help the economy to stay afloat. This link to the economic cycle means the system is called a countercyclical capital buffer, often shortened to CCyB.

A year ago the Bank of England cut this CCyB to zero, meaning banks did not have to hold back anything extra.

Now, analysts think officials will be confident enough to tell banks to start increasing the buffer once more.

Goldman Sachs said: “We expect the BoE to reverse its 0.5pc cut in the CCyB rate for UK exposures of banks at its June FPC meeting, and to recommend banks maintain credit quality of new lending, which could slow unsecured lending growth.”

That will have the combined effect of making banks store up that capital for a rainy day, and also reducing the pace of lending in areas such as credit cards. However, the Bank is still cautious because it does not want to force banks to slash lending as that could damage the economy.

“In all of this, there will be a very careful approach where, whether it is the CCyB, regulating different parts of consumer credit more tightly, potentially raising interest rates, or ending the term funding scheme early – these are all possible approaches, but they are not going to do them all at once,” said analyst John Wraith at UBS. “I think the approach will be to try to tiptoe into reversing some of the policies that have been put in place for earlier, harder times, and then sit back to judge what impact it has.”

Any clampdown by the FPC will come just a week after the Bank of England revealed a growing split among policymakers over interest rates.

Andy Haldane, the Bank’s chief economist, surprised markets by signalling that he was poised to vote for a rate hike in the second half of this year if the economy continued to grow at a steady pace.

His comments came less than a week after three out of eight policymakers on the Monetary Policy Committee (MPC) voted to hike rates in the biggest split since 2011.

However, economists remain sceptical of any imminent move, with market-implied odds of a 0.25 percentage point rise to 0.5pc by the end of this year still below 50pc.

Kristin Forbes, the Bank’s most hawkish policymaker, warned last week there were clear signs that the UK’s “overstimulated” economy is “behind the curve” on rate hikes.

Brian Hilliard, chief UK economist at Société Générale, said a rate cut remained more likely than a hike.

He said: “The debate about tightening appears more intense than we thought but ultimately the mounting evidence of a deceleration in activity should bring that debate to an end.”

Alan Clarke, an economist at Scotiabank, said the recent fall in oil prices would help to keep a lid on inflation, though it was still on course to rise to 3.2pc in August, and could be pushed up further if sterling’s weakness persists.

Yahoo Finance

Yahoo Finance