Bank of England raises interest rates to 0.75%

The Bank of England has raised interest rates to 0.75% – the highest level since the financial crisis – after a unanimous decision by its rate-setting committee.

In a hugely symbolic day for the Bank of England, the Monetary Policy Committee voted to increase the rate from 0.5% in only the second rate rise in a decade.

Today’s rise will push up mortgage payments for around 3.5 million customers with variable and tracker rate loans by an estimated £400 a year and may offer some relief to savers on rock-bottom rates.

The MPC said that any future increases “are likely to be at a gradual pace and to a limited extent” and said that the outlook for the economy could be “influenced significantly” by Brexit.

Bank of England governor Mark Carney, who chairs the MPC, said that while the outcome from the Brexit talks was not known, it was consumer and business reaction to the UK’s exit from the EU that would help determine the future path of rates.

“Thus far British households have been resilient but not indifferent to Brexit news,” said Carney.

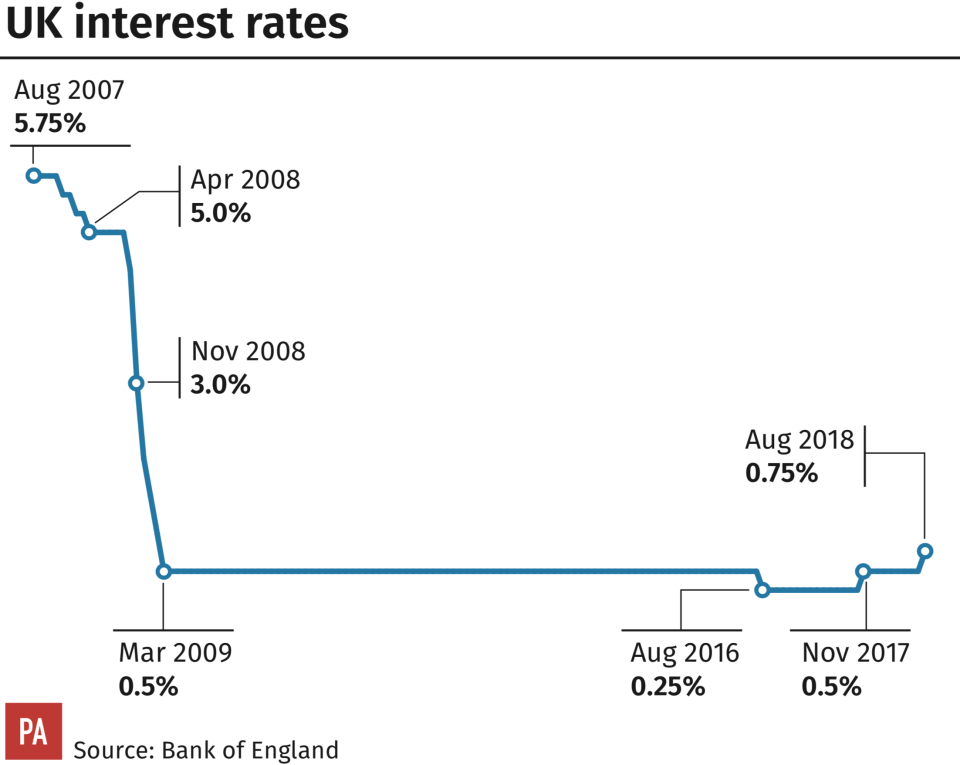

Interest rates were cut to 0.5% in March 2009 when the markets were in the grip of the banking crisis and remained at that level until August 2016 when they were cut to 0.25% in the aftermath of the EU referendum. In November, rates were increased back up to 0.5%.

The debt charity StepChange warned that the latest rate rise would have an impact on its struggling customers with mortgages, leaving one in 10 having more money going out than coming in.

Phil Andrew, chief executive at StepChange, said: “Many households are walking a precarious budget tightrope.”

“Policymakers mustn’t lose sight of what a rate rise means for real people on a tight budget,” said Andrew.

Carney countered that, saying households have paid back a lot of debt while rates have been so low and cited research showing that interest rates could rise two full percentage points before their debt-service levels went back to historic levels.

Businesses were also concerned about the impact of higher borrowing costs. Tej Parikh, senior economist at the Institute of Directors, said the bank had “jumped the gun” and said the MPC should have held off until November.

Laith Khalaf, senior analyst at Hargreaves Lansdown, said it was a “hugely symbolic day” as although the markets had been expecting the Bank of England to move, it meant that rates were higher than 0.5% for the first time since the financial crisis.

While the markets had been expecting the MPC to vote to raise rates, it had not been expecting the decision to be unanimous among the nine members of the committee.

Meanwhile, research by credit checking agency Experian found that the rate rise would push up mortgage bills by £400m a year for those on standard variable rates and trackers. The calculation is based on a standard variable rate of 3.99% on a £250,000 20-year mortgage and a tracker rate 2% above the Bank rate.

Savers – stuck on rock-bottom rates for a decade – were being encouraged to shop around for higher rates. “Many put up with paltry 0.1% returns – or worse,” said Guy Anker, deputy editor of MoneySavingExpert.com.

Rate rises are rarely passed on in full to savers and Hannah Maundrell, editor-in-chief of Money.co.uk, said: “Savers – don’t bank on this rate increase to make things better; banks are notoriously slow to pass on any rises so its best to take matters into your own hands.”

Carney justified the rate rise on the basis that the UK economy “has a very limited degree of slack” and that the slower pace of growth than expected in the first three months of the year – 0.2% – was caused by the bad weather.

“Today, employment is at a record high, there is very limited spare capacity, real wages are picking up and external price pressures are declining. With domestically generated inflation building and the prospect of excess demand emerging, a modest tightening of monetary policy is now appropriate to return inflation to the 2% target and keep it there,” said Carney.

Sterling slipped against the dollar (GBP/USD) as Carney spoke and indicated that rates would rise only slowly in the years ahead as monetary policy “needs to walk, not run to stand still”.

He explained that the MPC also published an estimate of where interest rates would be if inflation is to be kept at 2% – a rate known by economists as R* (R-star) – and the economy at full capacity. This was put at 2 to 3%, lower than the 5% levels before the financial crisis.

The rate decision was made alongside the Bank’s latest forecasts for the economy: GDP growth in 2019, was increased from 1.7% to 1.8%; the unemployment rate is expected to fall to 3.9%, from 4%, and inflation lifted slightly to 2.5% this year.

Yahoo Finance

Yahoo Finance