The Bank of England is warning about a debt-fuelled 'spiral of complacency' that threatens financial stability

David O'Hare/Flickr (CC)

LONDON — The Bank of England's financial stability chief issued a stark warning about a "spiral of complacency" as Brits take on ever more personal debt.

Alex Brazier, executive director of financial stability strategy and risk at the central bank, highlighted the danger of "excess" when it comes to borrowing, in a speech in Liverpool on Monday evening.

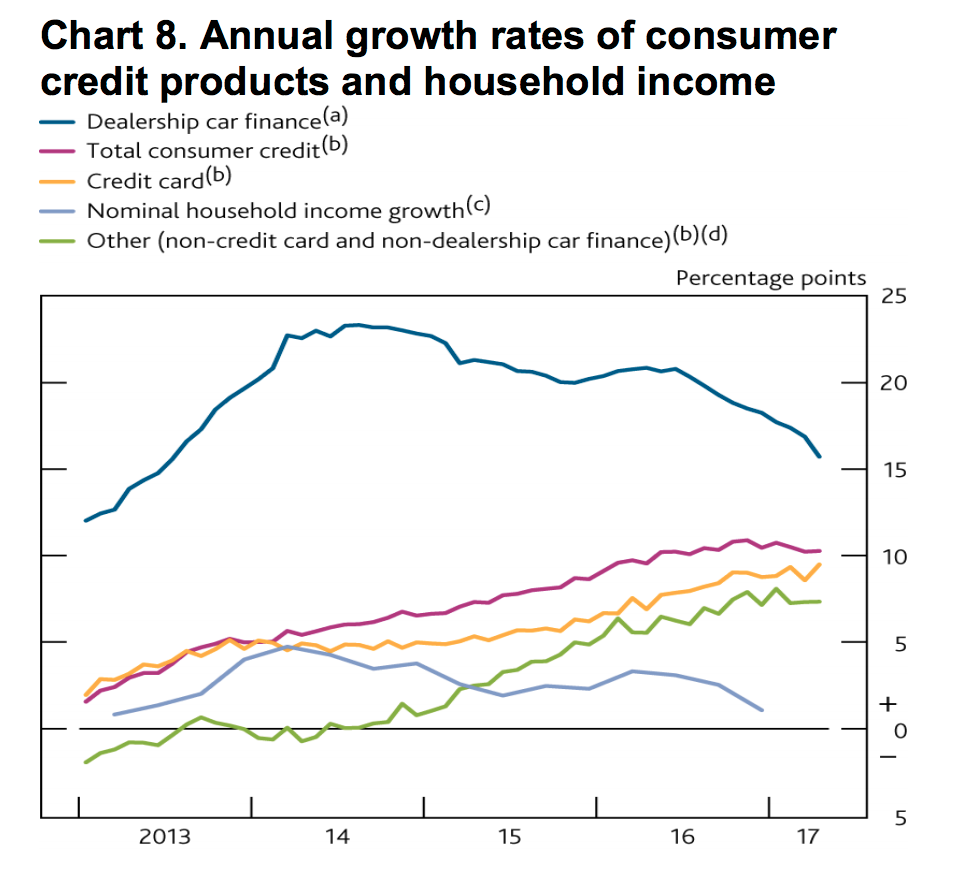

He noted that outstanding car loans, credit card balance transfers and personal loans have all increased by more than 10%. Over the same period, household incomes have only risen by 1.5%, Brazier added.

"Household debt – like most things that are good in moderation – can be dangerous in excess. Dangerous to borrowers, lenders and, most importantly from our perspective, everyone else in the economy," Brazier told the University of Liverpool's Institute for Risk and Uncertainty.

The chart below illustrates that dichotomy:

Bank of England

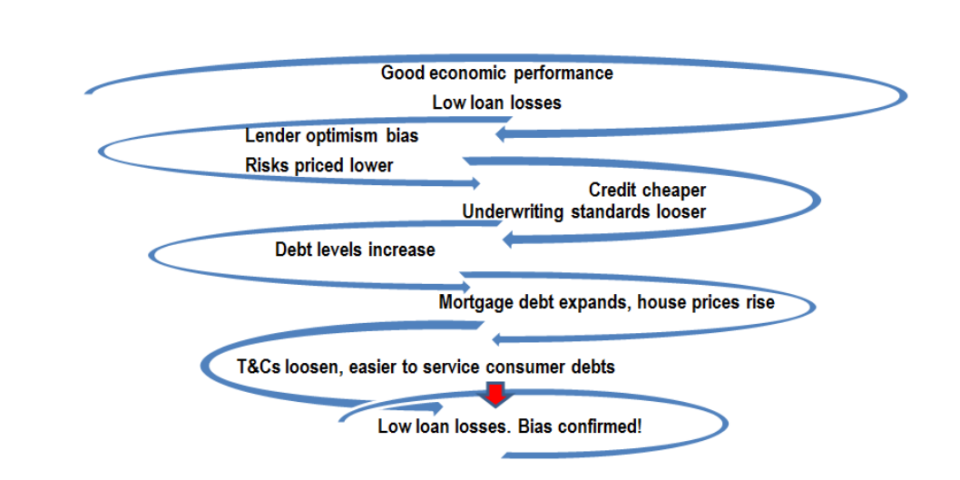

The "spiral of complacency," Brazier told audience members, comes when lenders do not realise the dangers their lending could cause

"Lenders are the first line of defence against the wider economic risks of high debt levels," Brazier said.

"An enlightened lender should factor in the risks of losses on the rest of their business from high levels of mortgage debt. And they should factor in the risks of losses from the consumer credit they’ve extended.

Without doing so, that spiral of complacency can occur. The diagram below illustrates the phenomenon:

Bank of England

"Lending standards can go from responsible to reckless very quickly," he said

"The sorry fact is that as lenders think the risks they face are falling, the risks they - and the wider economy face - are actually growing,"

Brazier's comments come just a few weeks after the bank warned in its latest Financial Stability Report about the risks around lending, and mandated that Britain's banks must set aside a combined £11.4 billion of capital in the next 18 months as a means to protect themselves from the risks of an economic downturn.

The bank increased the so-called counter cyclical capital buffer (CCB) from 0% to 0.5%, with the expectation that that buffer will be increased to 1% at the next stability report in November.

Banks are expected to set aside £5.7 billion in the next six months, with a further £5.7 billion to be put away by the end of 2018.

The buffer is put in place to ensure that lenders do not get themselves into the same positions that they did during the financial crisis, protecting themselves from debt going bad and triggering another credit crunch.

This is done by setting aside capital in good times so that banks can keep lending during a downturn, and are protected if customers begin to struggle to make repayments on their debt.

NOW WATCH: These are the watches worn by some of the most powerful men in finance

See Also:

Yahoo Finance

Yahoo Finance