Bank First Corp (BFC) Exceeds Analyst Expectations in Q1 2024 Earnings

Net Income: Reported at $15.4 million, surpassing the estimated $15.02 million.

Earnings Per Share (EPS): Achieved $1.51, beating the forecast of $1.47.

Revenue: Net interest income reached $33.3 million, contributing to robust financial health.

Asset Quality: Nonperforming assets increased slightly to $12.5 million, indicating a need for close monitoring.

Capital Position: Stockholders' equity stood at $609.3 million, with a tangible book value per share of $40.35.

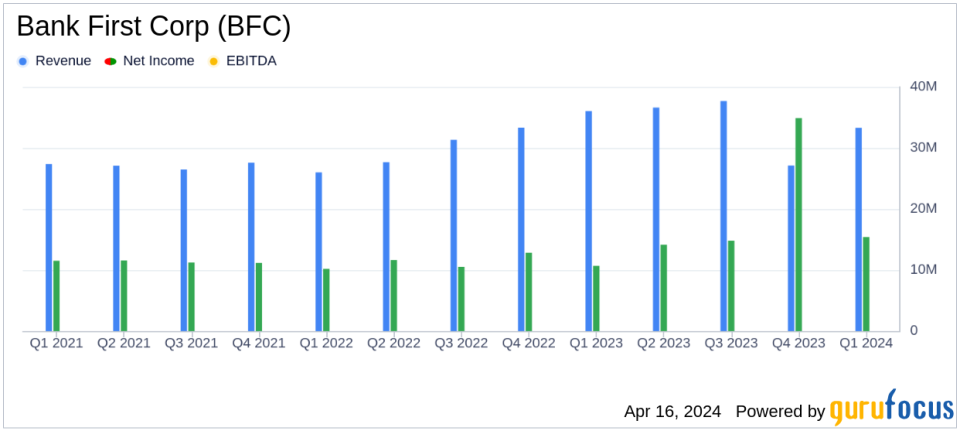

On April 16, 2024, Bank First Corp (NASDAQ:BFC) released its 8-K filing, announcing a strong start to the year with first-quarter earnings that exceeded analyst expectations. The company reported a net income of $15.4 million, or $1.51 per share, for the three months ended March 31, 2024, reflecting a significant increase from $10.7 million, or $1.09 per share, in the same period last year.

Bank First Corp, based in Wisconsin, offers a comprehensive suite of financial services including consumer and commercial banking products, insurance, and investment services. With a strategic focus on community banking, BFC has expanded its footprint through acquisitions and organic growth, enhancing its market presence in the region.

Financial Highlights and Operational Performance

The bank's net interest income for the quarter was $33.3 million, a modest increase from the previous year, driven by effective asset and liability management. The net interest margin (NIM) stood at 3.62%, slightly down from 3.74% a year ago, influenced by the competitive interest rate environment and acquisition activities. Despite these challenges, the bank managed a healthy annualized return on average assets of 1.50%.

During the quarter, BFC also focused on optimizing its balance sheet. Total assets were reported at $4.10 billion, with a notable growth in the loan portfolio to $3.38 billion, up from the previous quarter. This loan growth is expected to positively impact future earnings. However, total deposits slightly decreased to $3.42 billion, reflecting a shift in the deposit mix towards more interest-bearing accounts.

Strategic Moves and Market Positioning

The first quarter also saw BFC repurchasing 261,340 common shares, demonstrating confidence in its financial stability and commitment to delivering shareholder value. The bank declared a quarterly cash dividend of $0.35 per share, consistent with the previous quarter and up 16.7% from the same period last year.

Challenges such as an increase in nonperforming assets, which totaled $12.5 million, up from $9.1 million at the end of the previous quarter, were noted. This rise is attributed mainly to loans acquired through recent mergers. Despite this, the bank maintains a robust capital position with a stockholders' equity of $609.3 million.

Looking Forward

Bank First Corp's strategic acquisitions and consistent financial performance position it well for sustained growth. While monitoring asset quality will be crucial, the bank's proactive management and strong market position bode well for its future prospects.

For detailed financial figures and further information, please refer to the full earnings report by visiting the SEC filing.

Explore the complete 8-K earnings release (here) from Bank First Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance