Bank of Montreal And Two More TSX Dividend Stocks To Consider

As the U.S. presidential campaign stirs discussions on key economic issues such as government debt and trade policies, investors might seek stability in dividend-paying stocks amidst potential market fluctuations. In this context, companies like the Bank of Montreal that offer regular dividends could be considered by those looking to add a measure of predictability and income to their portfolios during uncertain times.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.58% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.07% | ★★★★★★ |

Secure Energy Services (TSX:SES) | 3.48% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.19% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.31% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.75% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 8.78% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 3.08% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.43% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.19% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top TSX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

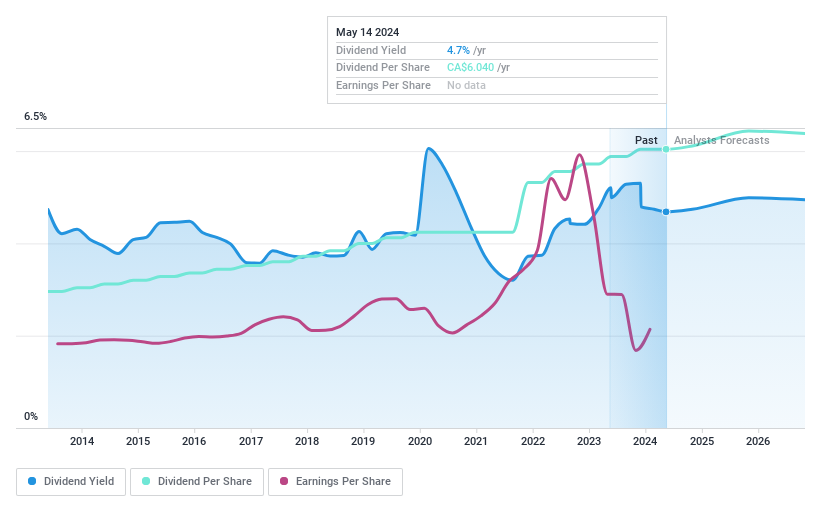

Bank of Montreal

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Montreal offers a range of financial services mainly in North America, with a market capitalization of approximately CA$86.12 billion.

Operations: Bank of Montreal generates revenue through various segments, including BMO Capital Markets at CA$6.38 billion, BMO Wealth Management at CA$7.68 billion, U.S. Personal and Commercial Banking at CA$9.04 billion, and Canadian Personal and Commercial Banking at CA$10.14 billion.

Dividend Yield: 5.2%

Bank of Montreal's recent fixed-income offerings and preferred share activities demonstrate a robust capital management strategy, enhancing its appeal to dividend investors. Despite a dividend yield of 5.23%, which is below the top quartile in the Canadian market, BMO has consistently increased dividends over the past decade. The dividends are well-covered by earnings with a current payout ratio of 71.6% and are projected to remain sustainable with an anticipated payout ratio of 52.5% in three years, underpinning future reliability. However, BMO's valuation suggests it trades at a significant discount (39.6% below fair value), potentially indicating undervaluation or investor caution regarding its financial health metrics like its low allowance for bad loans at 76%.

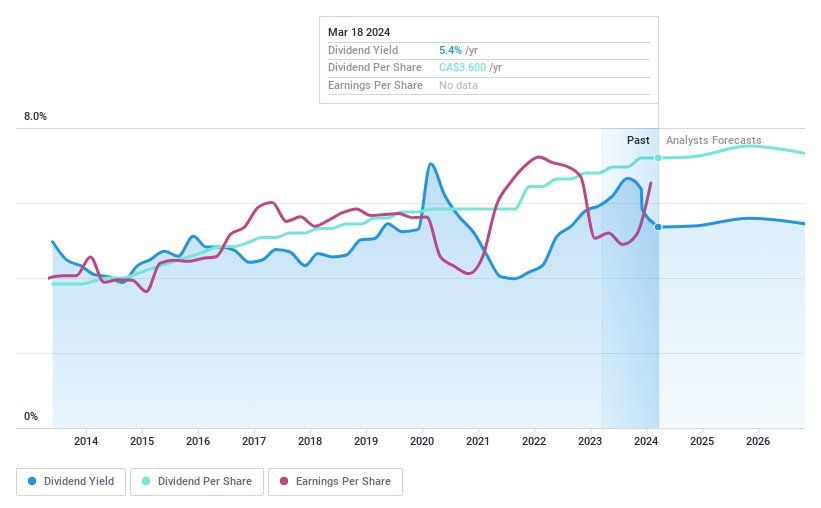

Canadian Imperial Bank of Commerce

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Imperial Bank of Commerce (TSX:CM) is a diversified financial institution offering a range of financial products and services to various clients in Canada, the U.S., and globally, with a market capitalization of CA$63.17 billion.

Operations: Canadian Imperial Bank of Commerce generates revenue through Canadian Personal and Business Banking (CA$8.53 billion), Capital Markets and Financial Services (CA$5.66 billion), U.S. Commercial Banking and Wealth Management (CA$1.75 billion), and Canadian Commercial Banking and Wealth Management (CA$5.37 billion).

Dividend Yield: 5.3%

Canadian Imperial Bank of Commerce (CIBC) has been active in the capital markets, recently completing several fixed-income offerings, including significant issuances of senior unsecured notes. These moves demonstrate CIBC's focus on maintaining a robust capital structure. Financially, CIBC reported a solid increase in net income and earnings per share in its latest quarterly results, reflecting operational strength. While its dividend yield of 5.28% is below the top quartile for Canadian dividend payers, the dividends appear sustainable with a current payout ratio of 53.9%, which is projected to remain covered by earnings over the next three years at 51.1%. This suggests reliability in its dividend payments amidst a backdrop of consistent financial performance and strategic capital management activities.

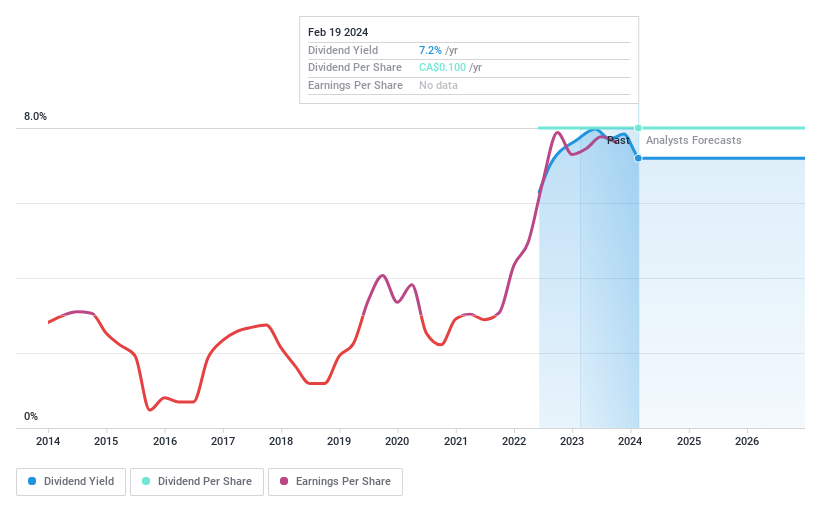

Hemisphere Energy

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hemisphere Energy Corporation, operating in Canada, focuses on the acquisition, exploration, development, and production of petroleum and natural gas interests with a market capitalization of approximately CA$178.04 million.

Operations: Hemisphere Energy Corporation generates its revenue primarily from petroleum and natural gas interests, totaling CA$69.30 million.

Dividend Yield: 7.3%

Hemisphere Energy's recent share repurchase program and special dividend announcement underscore its commitment to returning value to shareholders. While the company has a relatively short history of dividend payments, with regular and special dividends announced recently, its dividends are supported by solid earnings coverage and cash flows. However, it's worth noting the forecasted decline in earnings over the next three years could impact future dividend sustainability. The company's proactive financial management is evidenced by renewing a CA$35 million credit facility and maintaining a low payout ratio, which supports ongoing dividend payments amidst operational challenges.

Turning Ideas Into Actions

Dive into all 34 of the Top TSX Dividend Stocks we have identified here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:BMOTSX:CM and TSXV:HME.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com