Bank of Nova Scotia Reports Solid 2016 Earnings

- By Ben Reynolds

The Canadian economy is primarily centered on two sectors - the financial sector and the energy sector.

In particular, Canada is known to have one of the soundest banking systems in the world. The Canadian banks have been ranked by the World Economic Forum as the world soundest banks for eight years in a row.

The Canadian banks are a relatively small peer group and are concentrated in five companies known as the "Big Five":

The Royal Bank of Canada (RBC)

The Toronto-Dominon Bank (TD)

The Bank of Nova Scotia (BNS)

The Bank of Montreal (BMO)

The Canadian Imperial Bank of Commerce (CIBC)

Warning! GuruFocus has detected 4 Warning Signs with BNS. Click here to check it out.

The intrinsic value of BNS

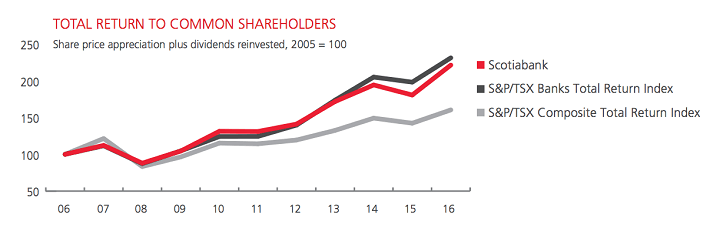

These companies have a phenomenal record of delivering value to shareholders, demonstrating total returns well in excess of the S&P/TSX Composite Index.

Source: Bank of Nova Scotia 2016 Annual Report

We will assess the dividend prospects of one bank in particular - the Bank of Nova Scotia. Known as Canada's most international bank, they are the third-largest in their peer group as measured by both total assets and by market capitalization.

They are also a member of the Canadian Dividend Aristocrats Index, Canadian stocks with at least five years of consecutive dividend increases. Note that this is different than the traditional Dividend Aristocrats Index, which are companies with at least 25 years of consecutive dividend increases. You can see all 50 traditional Dividend Aristocrats here.

Investors with an eye on the Canadian markets will know that it is earnings week for Canadian banks. On Nov. 29, the Bank of Nova Scotia reported earnings for the ninety-day and one-year period ending Oct. 31. We will cover that earnings release in detail.

Business overview

The Bank of Nova Scotia was founded in 1832 and since then has grown into a diversified financial services conglomerate with more than 85,000 employees. They divide their business into three main operating segments:

Canadian Banking, which provides a full suite of financial service products to more than 8.5 million Canadian customers. Canadian banking is further divided into the following categories:

Retail and Small Business Banking

Commercial Banking

Wealth Management

International Banking, which provides financial products, services and advice to more than 14 million customers in countries like Latin America, the Caribbean and Central America, and parts of Asia. This segment is a key component of the bank's value proposition to shareholders and will be discussed further in other parts of this article.

Global Banking and Markets, which provides customers with investment banking, corporate banking and capital markets solutions tailored to their specific needs.

Fourth quarter financial performance

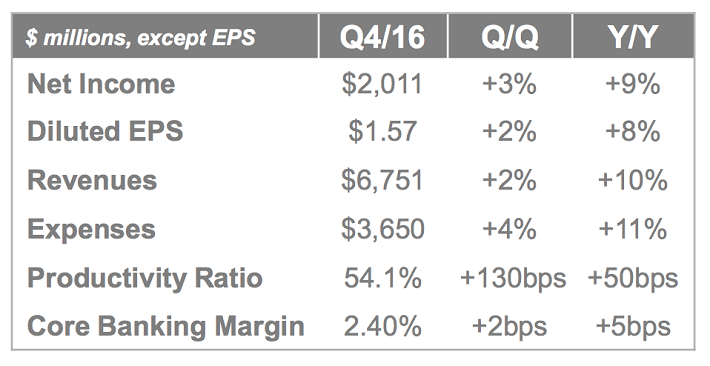

Before exploring the investment prospects of the Bank of Nova Scotia, let's consider their recent earnings release. The bank recently reported earnings for the fourth quarter as well as fiscal year 2016. Their quarterly results are summarized in the following table.

Source: Bank of Nova Scotia Fourth Quarter Earnings Presentation

The bank reported robust growth in a number of important metrics for the fourth quarter, including net income (up 9% year over year), diluted EPS (up 8% year over year ) and revenues (up 10% year over year ).

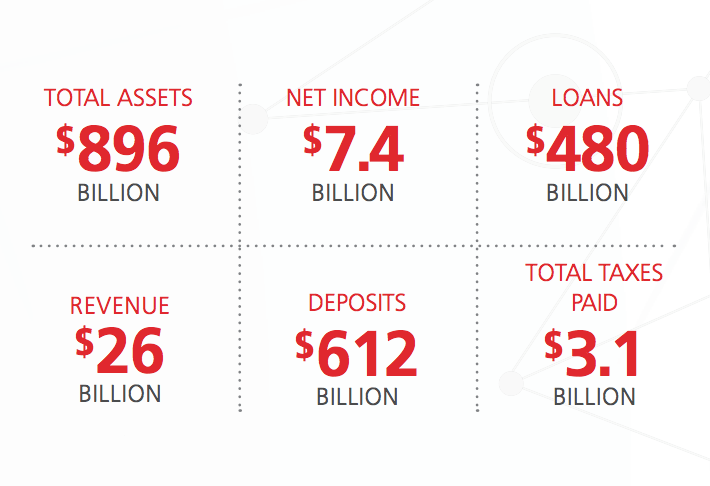

Since Oct. 31 represents the end of fiscal 2016, Scotiabank also provided investors with a summary of their annual financial performance. Here is the data:

Net income of $7,368 million, compared to $7,213 million (up 2%)

Diluted EPS of $5.77 compared to $5.67 (up 2%)

Return on equity (ROE) of 13.8%, compared to 14.6% (down 800bps)

Annual dividends per share of $2.88 compared to $2.72 (up 6%)

The bank incurred a very significant restructuring charge of $275 million (after tax) in the second quarter of this fiscal year. The bank cited "strategic efforts to enhance customer experience, drive a digital transformation and improve its productivity" as the reasons behind the restructuring. Adjusting for this charge improves the numbers mentioned above.

Net income of $7,646 million, compared to $7,213 million (up 6%)

Diluted EPS of $6.00 compared to $5.67 (up 6%)

ROE of 14.3%, compared to 14.6% (down 300bps)

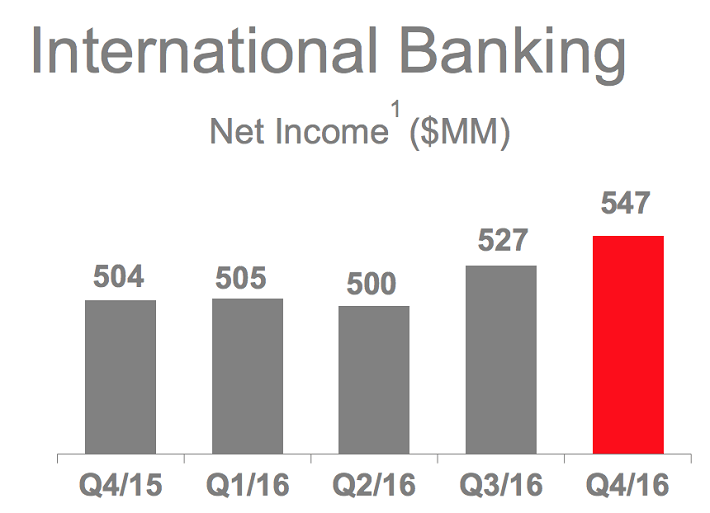

Scotiabank's growth in the quarter and financial year were predominantly driven by their International Banking segment, which produced a record year for net income. This is particularly true for the fourth quarter, as displayed in the following diagram.

Source: Bank of Nova Scotia Fourth Quarter Earnings Presentation

Investment prospects

Scotiabank is a business that has many characteristics that should be appreciated by investors. Here are Scotiabank's strengths:

An international focus that is unique among the Canadian banks

Strong barriers to entry and a wide economic moat

A focus on technology

Great dividend safety and growth prospects

Like any other investment, Scotiabank is not without risk. I will briefly touch on concerns about the Canadian housing market and foreign currency implications before closing with a few comments on valuation.

International focus: Unique among the Canadian banks

An analysis of Scotiabank is not complete without outlining the significance of their international operations. The bank's investments outside of Canada are a central component of their value proposition to shareholders. This is reflected in their marketing as "Canada's international bank."

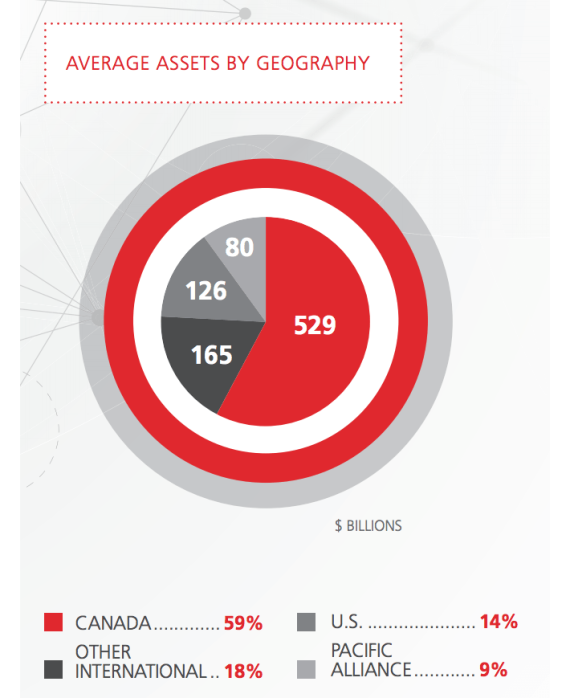

The numbers also support these claims. The bank has a large proportion of their assets held outside of Canada.

Source: Bank of Nova Scotia 2016 Annual Report

Many other metrics suggest that the bank has expanded to the point where the majority of their operations come from outside their home country. Consider the following:

14 million International Banking customers versus 8.5 million in Canadian Banking

3,000 International Banking branches versus 1,000 in Canadian Banking

7,700 International Banking Automated Banking Machines (ABMs) versus 3,900 in Canadian Banking

This international focus gives Scotiabank access to high-growth economies where their market share is much smaller than in Canada. As well, Scotiabank has financial stability that is unseen in these emerging markets, allowing them to make deals for distressed assets that require capital injections to remain viable. International Banking is also a very fragmented market, allowing the bank to execute bolt-on acquisitions that they view as attractive.

It is nearly certain that Scotiabank's International Banking segment will be a key driver of growth in the future.

Strong barriers to entry and a wide economic moat

The Canadian banking industry has very significant barriers to entry. It is very difficult to create a company to compete with a $90 billion behemoth like Scotiabank.

There are two primary reasons for this.

First of all, the banking industry in Canada is a textbook example of an oligopoly. Most of the market share is consumed by the Big 5. Smaller businesses do not benefit from economies of scale and can be crushed by the price competition from larger corporations like Scotiabank.

In the bank's international operations, this is not the case. The market is much more fragmented and oligopolies are not present to the same degree as in Canada. This is desirable as it provides acquisition opportunities for Scotiabank.

Secondly, the banking industry is highly regulated and this results in complexity and increased costs for new entrants to the market. After the Global Financial Crisis, regulators on both sides of the U.S.-Canada border have taken measures to increase transparency, provide more compliance oversight and manage the risk in the financial markets. Established businesses like Scotiabank are more easily able to adapt to these changes than their smaller counterparts.

Scotiabank's economic moat and their presence in an industry with high barriers to entry are a distinct positive for this stock.

A focus on technology

FinTech companies are a looming threat for many of the large banks. Scotiabank is taking direct measures to mitigate these risks and improve their overall customer experience.

On their fourth quarter earnings call, CEO Brian Porter said the following with regard to the bank's technology focus:

"Also, as you know, the Bank has embarked on a major transformation to become a digital leader. Through this effort, we are strengthening and deepening our customer relationships by removing friction points. And we are driving efficiency improvements across the Bank. Our efforts on this front were recently recognized in digital and mobile banking where Forrester Research awarded Scotiabank the highest overall score among our Canadian peers for mobile banking functionality. And earlier this month Forrester ranked our online account opening process number one among our peer group."

Clearly the bank's focus on technology is paying off. They are focusing on improving their digital channels and receiving external recognition as a result.

This bodes wells for their future in the rapidly changing banking industry.

Dividend prospects

The Bank of Nova Scotia provides the two main components of a great dividend investment: safety and growth.

In the banking industry, assuming less risk than your competitors can be a reliable competitive advantage. Alternatively, assuming the same amount of risk as your competitors but pricing that risk more efficiently can have the same effect.

The Bank of Nova Scotia assumes much less risk than many of its counterparts in the United States. This was demonstrated during the Global Financial Crisis of 2007 to 2009 - the bank did not cut its dividend when many American banks (Wells Fargo, Bank of America, Citigroup, etc.) did.

This level of safety is true about the Canadian banks in general. The last time that one of the Big Five cut their dividend was in the 1930s.

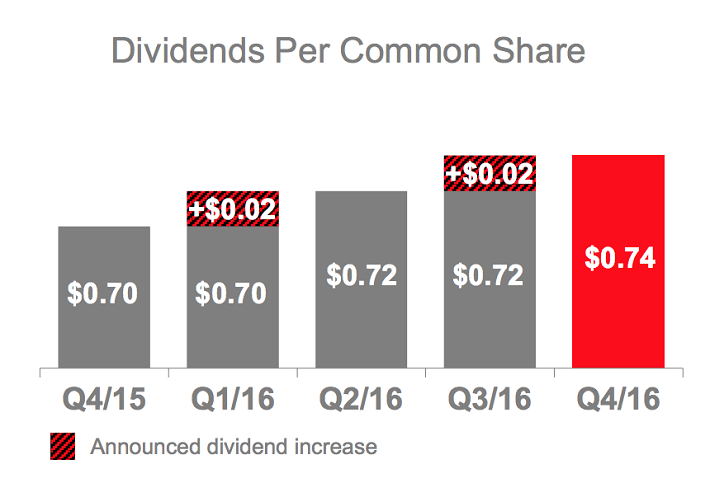

Along with safety, Scotiabank has demonstrated a fantastic rate of dividend growth over the years. As I have mentioned, the Bank of Nova Scotia is a member of the Canadian Dividend Aristocrats Index, which is composed of Canadian corporations with at least five years of consecutive dividend increases.

The bank's record of increasing shareholder income goes even further - they have increased dividend payments in 43 of the last 45 years and have paid a dividend to shareholders every year since their inception in 1832.

Lately there has been a trend of two dividend increases per year, in the second and fourth quarter. For instance:

Fiscal 2016

4th quarter - increased from 72 cents to 74 cents.

2nd quarter - increased from 70 cents to 72 cents.

Fiscal 2015

4th quarter - increased from 68 cents to 70 cents.

2nd quarter - increased from 66 cents to 68 cents.

Fiscal 2014

4th quarter - increased from 64 cents to 66 cents.

2nd quarter - increased from 62 cents to 64 cents.

Source: Bank of Nova Scotia Fourth Quarter Earnings Presentation

The bank has communicated a target payout ratio of 40% to 50%. For fiscal 2016, their payout ratio was 49.6%, which is towards the top line of their guidance on this metric.

This means that we are unlikely to see dividend growth due to payout ratio expansion and that dividend increases will be driven by earnings growth unless the bank is willing to exceed their target payout ratio range.

This should not be cause for concern, though - the bank has a great record for growing earnings over the long run, compounding earnings per share at a rate above 6% for the last decade. If this growth continues, Scotiabank can hike dividend payments at the same 6% pace without increasing their payout ratio.

Concerns about the Canadian housing market

It has been widely publicized that the Canadian housing market is pushing through all-time highs, leading to unaffordable housing in many markets (primarily Toronto and Vancouver). Investors in the Canadian banks are worried this will affect the banks as counterparties on these mortgages.

In some senses, this concern from investors is not surprising. The average Canadian home price is ~$500,000 and the average Canadian annual income is ~$40,000. By assuming massive amounts of debt when purchasing homes, Canadians have been experiencing significant returns when their hyper-leveraged homes increase in value.

This is eerily similar to the behavior exhibited by homeowners before the 2008 housing crash. That being said, the Canadian banking system today is much more sound than the American banking system of 2008.

Fortunately for Scotiabank shareholders, the bank's management is very confident in the quality of their residential mortgage portfolio. On their earnings call, Chief Financial Officer Sean McGuckin said:

"First and foremost, we are very comfortable with our residential mortgage book, which we believe is high-quality, low-risk and well-diversified."

Besides management's confidence, there are other reasons to believe that Scotiabank will be isolated from a meaningful downturn in housing prices. The major factor is the large proportion of their home loan portfolio insured through the Canada Mortgage and Housing Corp. (CMHC).

For U.S. readers unfamiliar with this entity, the CMHC insures mortgages where the borrower fails to meet the requirement of a 20% down payment. With CMHC insurance, borrowers can buy a home with as little as 5% down. Insurance premiums are then paid on a monthly basis along with mortgage payments to ensure that the financial institution is paid back in the event of a mortgage default.

Source: Scotiabank Fourth Quarter Earnings Presentation

A large proportion (57%) of Scotiabank's Canadian residential mortgage portfolio is insured by the CMHC. This compares favorably to their peer group - for example, Toronto-Dominion (often considered the most conservative of the Big 5) has only 50% of their portfolio insured.

Further mitigating the risk of a housing crisis is the 50% LTV of uninsured mortgages, which is much lower than the minimum (80%).

These two factors should protect Scotiabank from a housing downturn and help ensure future profitability.

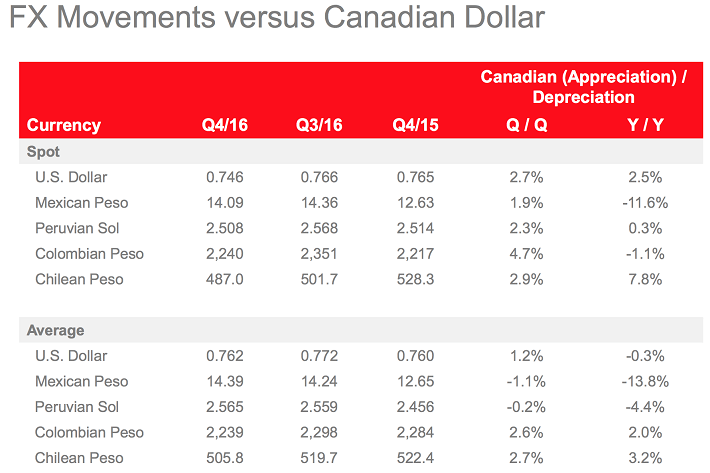

Foreign exchange implications

Scotiabank is Canada's international bank. This means that much of their revenue is incurred in currencies other than the Canadian dollar. Swapping these earnings back to Canadian dollars for reporting purposes may be a headwind in some periods and a tailwind in others.

For U.S.-located investors, this present a double-headache, as the bank reports international earnings in Canadian dollars which must then be converted to U.S. dollars if purchasing their shares on the New York Stock Exchange.

This section will analyze the risks surrounding foreign exchange fluctuations for an investment in the Bank of Nova Scotia.

The Canadian dollar is currently weak due to concerns about their domestic economy. This means that earnings incurred from Scotiabank's significant international operations are worth more when converted back to the Canadian dollar. Due to this effect on earnings, this trend is something that Scotiabank's management has a close eye on.

Source: Bank of Nova Scotia Fourth Quarter Earnings Presentation

If the Canadian economy strengthens, driving the dollar up, this could present a headwind for the earnings of Scotiabank. Similarly, if the dollars falls further, international earnings will be worth even more in domestic currency.

While it is difficult to speculate on the future movements of exchange rates, it is something that investors in Scotiabank should keep in mind.

A note on valuation

After the positive earnings release, Scotiabank's share price rose accordingly. It is very important to consider the valuation of this company before making an investment.

Based on fiscal 2016 EPS of $6.00 and the closing price of $74.09 on Dec. 1, Scotiabank is currently trading at 12.34 times last year's earnings.

This company is still very cheap compared to the overall market, and affordable compared to selected peers. Toronto-Dominion trades at a PE of 14.22 and Bank of Montreal trades at a PE of 13.19.

Bank of Nova Scotia is not overvalued after their stock price appreciation.

Looking ahead

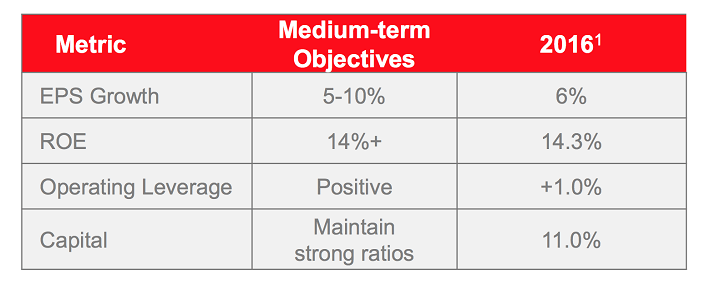

It appears as though Scotiabank will continue to demonstrate robust growth moving forwards.

The bank has medium term goals of 5% to 10% EPS growth and a 14%-plus return on equity, as communicated in the following table.

Source: Bank of Nova Scotia Fourth Quarter Earnings Presentation

As mentioned, the bank has exceeded 6% compound growth in earning per share over the past decade. They have shown in the past that they are capable of achieving this type of growth.

They also have many of the characteristics of a great dividend investment. They are expanding rapidly into international markets, have a stable customer base in Canada and their focus on technology bodes well for future growth. Despite these positives, the stock still trades at a reasonable valuation.

Scotiabank is a high-quality stock that makes a compelling buy at current levels. The company ranks in the top 20% of stocks with 25-plus years of steady or rising dividends using The 8 Rules of Dividend Investing.

Disclosure: I am not long any of the stocks mentioned in this article.

Start a free 7-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with BNS. Click here to check it out.

The intrinsic value of BNS

Yahoo Finance

Yahoo Finance