Bank Of Nova Scotia And Two Other TSX Dividend Stocks To Consider

As global markets navigate through evolving economic landscapes, the Canadian market remains a focal point for investors seeking stability and growth amidst broader international trends. With ongoing advancements in artificial intelligence and shifting leadership within sectors, the emphasis on diversification becomes increasingly pertinent. In this context, dividend stocks like Bank of Nova Scotia present an appealing option for those looking to balance their portfolios with investments that potentially offer both steady income and capital appreciation opportunities.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.52% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 6.83% | ★★★★★★ |

Power Corporation of Canada (TSX:POW) | 5.65% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.60% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.53% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.63% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.41% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 3.97% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.85% | ★★★★★☆ |

Sun Life Financial (TSX:SLF) | 4.70% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top TSX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

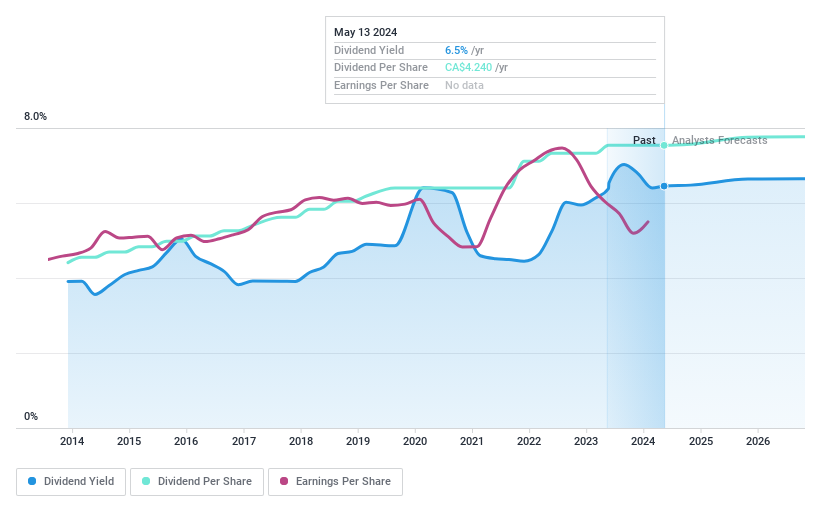

Bank of Nova Scotia

Simply Wall St Dividend Rating: ★★★★★★

Overview: The Bank of Nova Scotia, operating internationally with a focus on regions including Canada, the U.S., Latin America, and the Caribbean, offers a wide range of banking products and services with a market capitalization of CA$80.65 billion.

Operations: The Bank of Nova Scotia generates revenue through Canadian Banking (CA$11.46 billion), International Banking (CA$9.48 billion), Global Wealth Management (CA$5.32 billion), and Global Banking and Markets (CA$5.34 billion).

Dividend Yield: 6.5%

Bank of Nova Scotia recently confirmed a dividend of CA$1.06 per share, demonstrating its consistent shareholder returns. The bank's dividends have shown growth over the past decade, with a current yield placing it in the top quartile of Canadian dividend payers. Financially, Scotiabank is managing its capital efficiently, as evidenced by the redemption of CA$1.5 billion in debentures to optimize Tier 2 capital. Its dividends are well-covered by earnings with a payout ratio at 68.1%, indicating sustainability and reliability in returning value to shareholders.

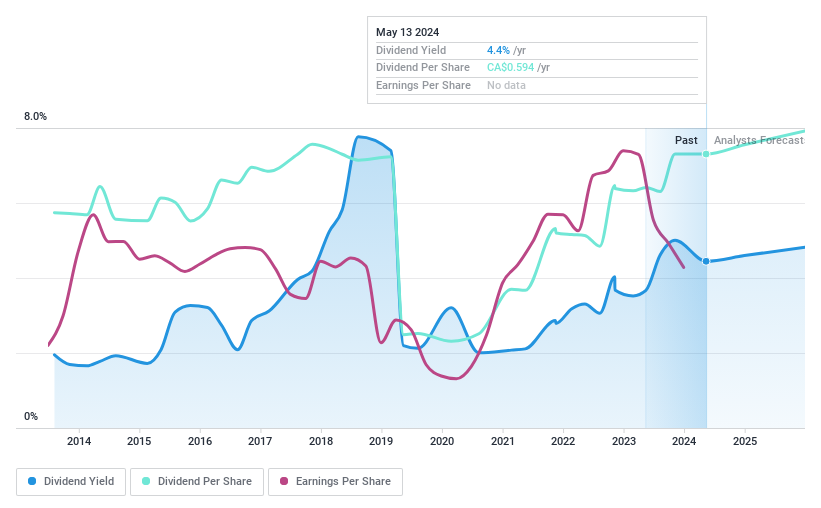

High Liner Foods

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: High Liner Foods Incorporated, with a market capitalization of CA$429.13 million, is engaged in processing and marketing frozen seafood products across North America.

Operations: High Liner Foods generates CA$1.03 billion from its core business of manufacturing and marketing prepared and packaged frozen seafood.

Dividend Yield: 4.5%

High Liner Foods reported a first-quarter net income increase to US$16.6 million, with earnings per share rising from US$0.41 to US$0.49 year-over-year despite a 13% drop in sales volume. The company maintains a quarterly dividend of CAD 0.15 per share, supported by a low cash payout ratio of 8.7% and an earnings coverage payout ratio of 41.5%. However, the dividend yield at 4.52% is below the top tier Canadian average of 6.39%, reflecting potential concerns about its attractiveness to dividend-focused portfolios.

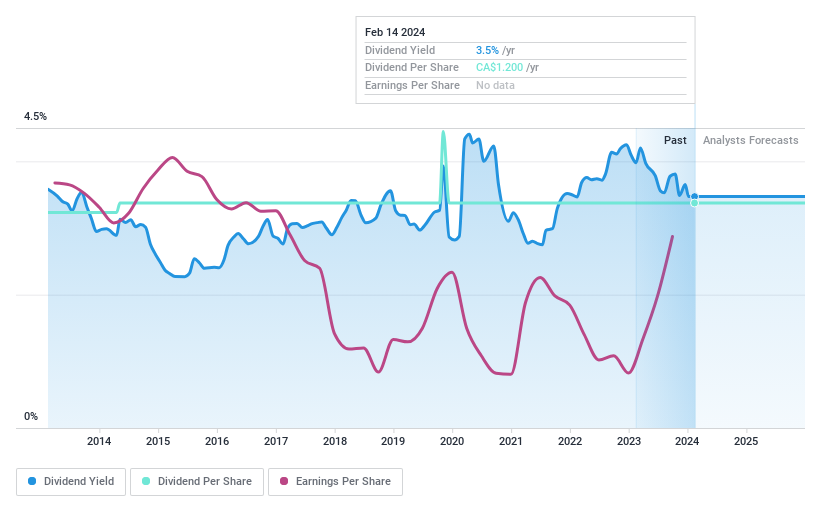

K-Bro Linen

Simply Wall St Dividend Rating: ★★★★★☆

Overview: K-Bro Linen Inc. operates in Canada and the United Kingdom, offering laundry and linen services primarily to healthcare institutions and hotels, with a market capitalization of approximately CA$345.79 million.

Operations: K-Bro Linen Inc. generates CA$330.33 million in revenue from its laundry and linen services across the healthcare and hospitality sectors.

Dividend Yield: 3.7%

K-Bro Linen, while trading at 65.7% below its fair value estimate, offers a modest dividend yield of 3.73%, which is below the top Canadian quartile average of 6.39%. The company's dividends are well-supported with a payout ratio of 73.2% and further bolstered by earnings growth of 174.1% over the past year, indicating potential for future increases in dividend payments. Additionally, recent share buyback announcements could suggest confidence from management in the firm’s valuation and financial health despite a slight decrease in net income as reported in Q1 2024 results (CAD $1.81 million from CAD $2 million).

Seize The Opportunity

Navigate through the entire inventory of 31 Top TSX Dividend Stocks here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:BNSTSX:HLF and TSX:KBL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance