Bank of England: UK banks resilient despite 'global vulnerabilities'

The UK’s banking system could survive a worst-case-scenario economic shock, the Bank of England said on Monday, as it warned of possible “further deterioration” in the global economy.

The central bank on Monday published the results of its annual Financial Stability report, which looks at if the UK’s financial system could cope with a downturn.

All of the UK’s seven biggest lenders passed the closely-watched ‘stress test’, a war-game run by the Bank of England that models a steep decline in UK and global GDP, large falls in asset prices, rising unemployment, and climbing misconduct costs.

The central bank’s Financial Policy Committee said the stress testing scenario was “sufficiently severe to encompass economic risks”, such as the current trade war, unrest in Hong Kong, and Brexit. But the committee warned that “underlying global vulnerabilities remain material, and … there are risks of of further deterioration.”

However, the global economy would have to worsen significantly to meet the levels set out in the stress test. The conditions modelled are worse than the depth of the 2008 financial crisis.

READ MORE: New fund rules could see investors take 'haircut' after Woodford crisis

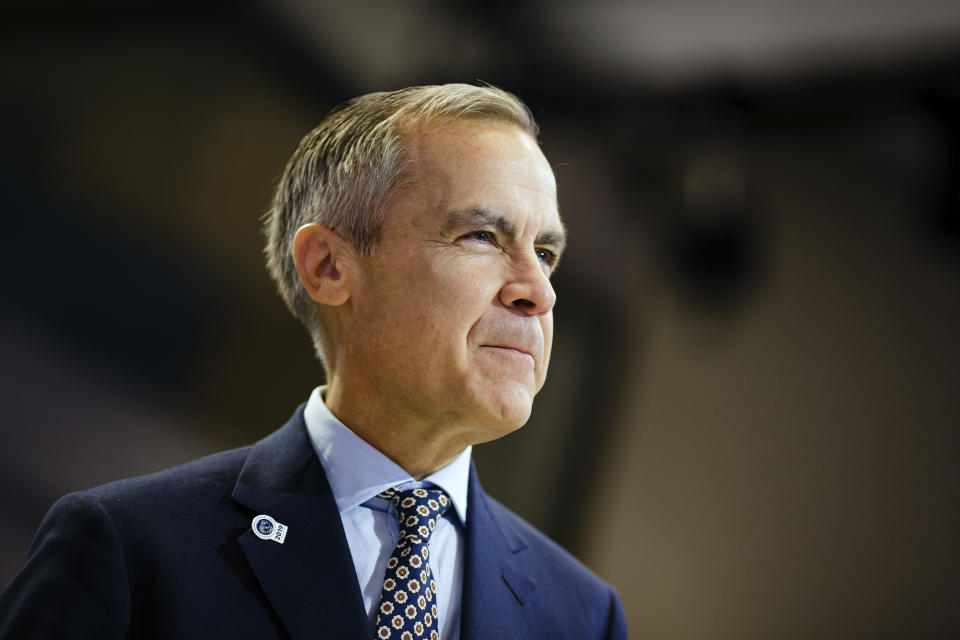

“The core of the UK financial system would be resilient to the crystallization of a number of current risks, ranging from abrupt changes to trading relationships, sharp movements in asset prices and deep economic downturns,” Bank of England governor Mark Carney told journalists on Monday evening.

The stress test found that all of the UK’s major banks would be able to continue lending to households and businesses should the worst happen.

While lending would continue, banks would have to cut dividends to investors and other variable pay, including staff bonuses, by a collective £41bn.

“Investors should be aware that banks would make such cuts if necessary,” Carney said.

While the Bank of England said the system remains resilient, the central bank flagged that ‘leverage lending’ — risky loans made to already indebted companies — was on the rise. Analysts around the world have raised the alarm about loosening credit standards in this market, with about 60% of loans carrying no ‘covenants’ restricting borrower behaviour.

UK banks have extended £76bn in leveraged loans, accounting for around 8% of total loan books. However, these loans would account for 15% of overall losses in stressed scenarios, the Bank of England said.

The Bank of England tweaked capital rules for banks, requiring them to hold more high-quality assets to protect against potential losses but made no change to the overall level of capital required.

Yahoo Finance

Yahoo Finance