Bank transfer fraud victims lose £236m in 2017 – and banks paid just £60.8m back

More than £230m was paid to fraudsters using bank transfers last year but only a quarter of this sum was recovered and reimbursed to victims, a new report has revealed.

This is the first time an industry body has released specific data showing the extent of bank transfer fraud, following Telegraph Money's calls for this crucial information to be reported and shared.

There were 43,875 cases of authorised push payment (APP) scams reported in 2017, according to UK Finance.

These scams involve people being duped into making payment to fraudsters often posing as the police, the bank, utility or telecomms firms, solicitors or builders over phone, text or email.

The criminals will seem legitimate and often know, or guess, details about their victims to make their story more plausible.

A common ruse sees the fake bank employee or police officer duping the victim into moving their savings into a "safe account" following "suspicious activity" spotted on their card or bank account.

UK Finance found that the majority of APP scam victims were individuals, who lost an average of £2,784 each in 2017. Businesses suffered greater losses of £24,355 per case, on average.

In tens of thousands of cases, the money lost was never recovered; just £60.8m of the £230m was returned to victims.

Banks and building societies are currently able to wash their hands of responsibility when customers fall victim to bank transfer fraud. They are not obliged to offer refunds, as they say the payment was authorised and they followed the customer's instructions.

This isn't the case with unauthorised payments or scams on credit and debit cards where banks must reimburse customers unless the victim is deemed negligent.

But changes are afoot.

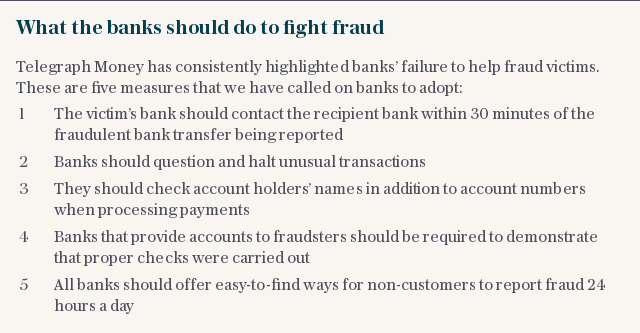

Following a super-complaint from Which?, the consumer lobby organisation, in September 2016 and an extensive campaign by Telegraph Money to better protect victims of bank transfer fraud, the Payment Systems Regulator (PSR) has announced it will introduce a new industry code from September this year.

These guidelines can be referenced by institutions and the Financial Ombudsman Service when dealing with new cases of APP fraud.

The new standards will include a reimbursement model. The PSR said this will "set out the circumstances" when banks and building societies may be responsible for refunding scam victims that have "acted appropriately".

However the code will not be applied retroactively, so historical cases won't be considered. Victims who were tricked into making transfers abroad will also not be taken into account.

The date when the reimbursement model will be implemented has yet to be set.

Yahoo Finance

Yahoo Finance