Banking app Revolut becomes UK's latest unicorn with $250m funding

Revolut, the fast-growing banking app, has become the UK’s latest “unicorn” after completing one of the biggest funding rounds for a fintech start-up.

The company has raised $250m (£179m) at a valuation of $1.7bn, in an investment round led by DST Global, the venture capital arm of the Russian tech investor Yuri Milner.

It means the London-based app has seen its valuation jump four-fold in nine months following a surge in users.

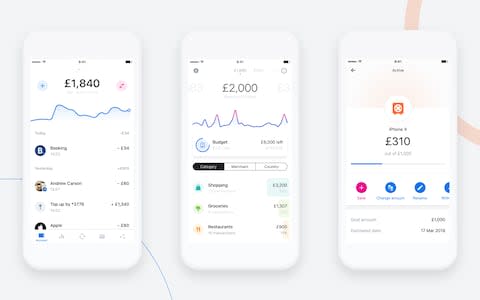

Revolut has no branches but allows users to convert money between dozens of currencies at interbank rates and send money instantly over an app, and now has 2m accounts across Europe.

Nikolay Storonsky, a former Lehman Brothers and Credit Suisse trader who founded the company in 2014, has set a target of 100m users within five years, aiming to rapidly expand abroad to hit the milestone.

Revolut is currently only available in Europe but plans to expand to the US, Canada, Singapore, Hong Kong and Australia this year. Mr Storonsky said that while the cash injection will be partly used to increase staff numbers, from around 350 to 800 by the end of the year, much of the new funding would be used to build up the capital reserves needed to launch in new markets.

The company said in February that it had broken even, making it relatively unique among the UK’s fast-growing technology companies in turning a profit

It does not offer overdrafts, but charges some customers £6.99 for extra features and perks, as well as offering loans through the app.

The company has applied for a European banking licence, which will allow it to introduce features such as direct debits and allow salaries to be paid directly into accounts. Mr Storonsky said he expected the licence to be granted around October.

DST is one of the world’s most successful technology investors having backed Facebook in its early days as well as Spotify, Airbnb and Twitter. Silicon Valley venture capitalists Index Ventures and Ribbit Capital also backed the company.

Yahoo Finance

Yahoo Finance