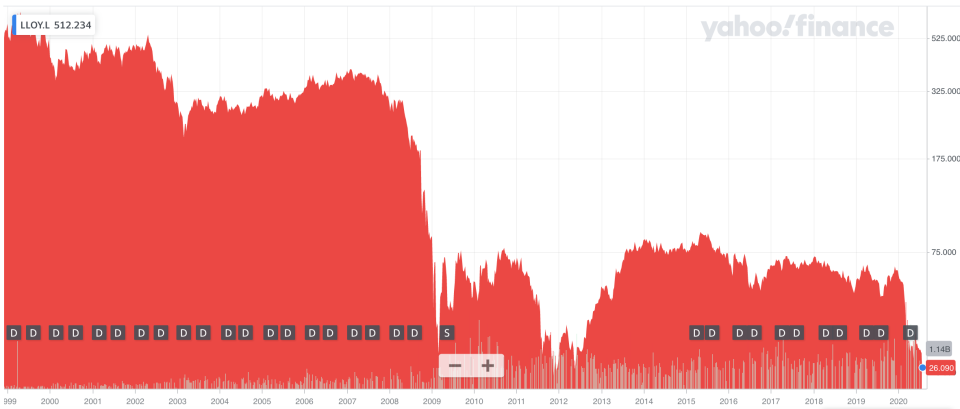

Bank stocks plunge as full impact of COVID-19 becomes clear

European bank stocks plunged on Thursday, as earnings from some of the continents biggest names stoked fears that the impact of COVID-19 on lenders’ bottom lines will be worse than predicted.

Higher-than-forecast loss provisions at Lloyds Bank (LLOY.L), tumbling profits at Standard Chartered (STAN.L) and BBVA (BBVA.MC), and mounting concerns about the state of the global economy spooked investors across the continent, sparking a sector-wide sell-off.

The Euro Stoxx Bank index (EXX1.DE), which tracks Europe’s biggest banks, fell over 3%. The MSCI European Banks index (CB5.L), which includes British as well as European lenders, fell 2.6%.

Tumbling financial stocks, coupled with broader concerns about Europe’s economy, dragged major stock markets lower. The FTSE 100 (^FTSE) was off 2% by lunchtime, while the DAX (^GDAXI) had lost almost 3%. Spain’s IBEX 35 (^IBEX) had fallen 2.7%.

READ MORE: Lloyds falls to loss as it sets aside extra £2.4bn for COVID-19

The sell-off came as Lloyds set aside almost £1bn more than the market had expected to cover loan losses in the second quarter. The loss buffers wiped out half-year profits and chief executive António Horta-Osório warned: “We have seen the UK economy deteriorate since the first quarter.”

Shares slumped as much as 9% to trade at an 8-year low.

Standard Chartered delivered better-than-expected results but still saw profits fall by 40% in the first half of the year. Shares dropped 4% in London.

In Madrid, BBVA fell 8.8% after it said its second quarter profit had halved. Performance was weighed down by a €644m (£581m, $757m) charge to cover COVID-19 loan losses.

All three sets of results came a day after Barclays (BARC.L) missed expectations with its half-year results and Santander (SAN.MC) announced the largest loss in its 163-year history. Share price declines at both Barclays and Santander extended into a second day on Thursday.

READ MORE: Historic loss at Santander as UK arm takes £5.5bn write-down

First quarter results from all these lenders captured some of the impact of COVID-19, but the numbers published this week mark the first reporting period entirely during the pandemic.

The results give a clearer picture of its impact on banks. So far, it has been worse than both analysts and investors expected.

“Banks have struggled because of low and falling base interest rates, their main source of profit,” said Fawad Razaqzada, a market analyst at ThinkMarkets.

At the same time, lenders face rising costs. The pandemic’s effect on economies has forced lenders to set aside billions to cover an expected surge in bad loans, mortgages, and credit card debt.

Fears are now growing that banks yet to report half-year results will follow peers in missing City forecasts. Shares in NatWest Group (NWG.L), which reports half-year results on Friday, fell 5.2%. HSBC (HSBA.L), which publishes next week, fell 3%.

READ MORE: Barclays profit halves as it sets aside another £1.6bn to cover COVID-19 losses

In Paris, BNP Paribas (BNP.PA), Crédit Agricole (ACA.PA), and Société Générale (GLE.PA) all fell over 3%. BNP kicks off half-year bank earnings in France on Friday.

In Italy, UniCredit (UNI.MI) fell 3.3%, Intesa Sanpaolo (ISP.MI) dropped 2.2%, and Mediobanca (MB.MI) fell 3.8%.

In Germany, Deutsche Bank (DBK.DE) fell 5% despite reporting better-than-expected profits and revenues on Wednesday. German GDP data published on Thursday showed the economy suffered its steepest decline since the 1970s in the second quarter of 2020.

READ MORE: Deutsche Bank steps up COVID-19 impact provisions amid ongoing restructure

One of the few European banks to escape the sell-off relatively unscathed was Credit Suisse (CSGN.SW). The Swiss lender on Thursday reported its best half-year profit in a decade, at SwFr 2.5bn (£2.1bn, $2.7bn). Return on tangible equity — a key measure of bank performance — was 11% and Credit Suisse reaffirmed plans to pay a dividend.

Even still, shares were down 0.5% by lunchtime, unwinding a rise seen earlier in the day.

Panic spread beyond banks to insurers and other financial stocks. In London, Legal & General (LGEN.L) fell 7% and Prudential (PRU.L) fell 5.3%. Money manager St. James Place (STJ.L) dropped 5%.

Yahoo Finance

Yahoo Finance