Barclays bankers feared being ‘rumbled’ in ‘dangerous’ Qatar transaction, jury hears: ‘If you go down the whole place goes down’

Barclays bankers discussed the risk of being “rumbled” and going to jail over emergency fundraising from Qatar in 2008, a jury heard on Friday.

Four former Barclays bankers stand accused of conspiracy to commit fraud by false representation. The UK’s Serious Fraud Office (SFO) alleges that the executives misled investors by hiding the true amount paid to Qatar for a multibillion pound investment at the height of the financial crisis that saved the bank from a state bailout.

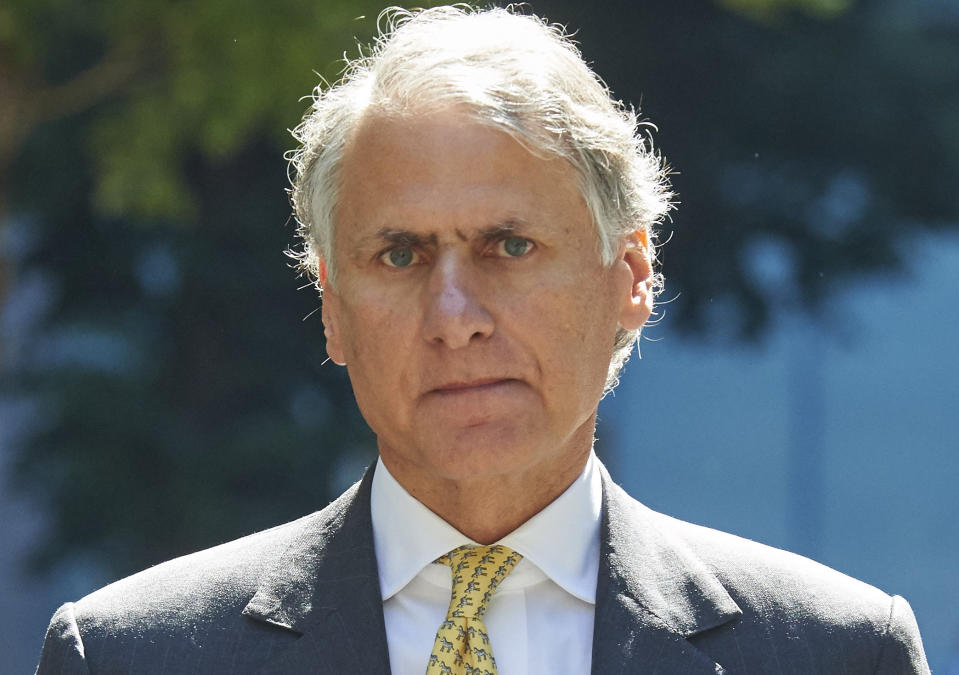

The defendants in the case are: John Varley, who was CEO of Barclays between 2004 and 2011; Roger Jenkins, who formerly ran Barclays Capital’s investment management business in the Middle East and North Africa; Thomas Kalaris, the former CEO of Barclays’ wealth and investment management; and Richard Boath, the former head of European financial institutions group at Barclays Capital.

Varley and Jenkins face two counts, and Kalaris and Boath face one. All four defendants have pleaded not guilty. Qatar is not accused of any wrongdoing.

‘The jeopardy is… people say well that was bulls***’

On Friday, the court was played a recording of a phone call between Kalaris and Boath made on June 11, 2008. The pair discussed the particulars of Qatar’s investment in Barclays and what disclosures would need to be made to the market about it.

“I don’t want to go to jail, so Mark you’ve got to make sure you’re comfortable,” Kalaris said, referencing Barclays’ legal chief at the time Mark Harding. Harding is not accused of any wrongdoing.

The call related to the possible disclosure of a fee paid to Qatar under a separate agreement. The prosecution alleges that this Advisory Service Agreement (ASA) “side deal” was a “smokescreen” to cover fee payments. Qatar was paid a fee of 3.25% for its investment, the Crown alleges, more than double the rate other Barclays investors received at the time.

Kalaris said on the call the jury heard that he was “incredibly sensitive” about the deal and said: “The worst case scenario is somebody says well it’s not economic and I say bullshit, you know, you know, we’re paying this amount of money, in this relationship, with these guys, we’re delighted to do it.”

Boath replies: “Yeah, I mean the jeopardy is that we’re rumbled and people say well that was bullshit, you know, this is just a fee in the backdoor.”

“I mean this is one of these things where you know, if you go down the whole place goes down with you, right?,” Kalaris said.

“That’s correct, we’re all going for the shit – we’ll all be going for the shit food and the bad sex,” Boath said on the tape. “That’s not what I want.”

On Thursday, the jury had heard a recording of a separate call between Kalaris and Boath in which Kalaris jokes that “none of us wants to go to jail here” because “the food sucks and the sex is worse.”

On Friday’s call, Boath went on to describe the discussions over disclosures about the Qatari’s investment as “one of the most dangerous aspects of this whole transaction.”

Edward Brown QC, the SFO’s lead lawyer, told the jury: “It was evident, you may think members of the jury, that Boath and Kalaris were concerned that they felt that they alone should not be held responsible for the consequences of this decision.”

‘A misleading audit trail’

Brown spent much of Friday arguing that the four defendants misled Barclays’ in-house lawyers in order to get sign off that the disclosures made to the market were compliant.

The court was shown a memo discussing the arrangements between Qatar and Barclays at the time. Brown said that the document “was created in an attempt to lay a misleading ‘audit trail’.”

He told the jury: “It would appear that the advice being given by both [Barclays in-house lawyers] Shepherd and Dobson at this time was based on the correctness of the Memo: i.e. that there had been the significant change in the Qataris’ position as to fees, and that genuine services for real value were to be provided.

“Each of the four defendant bankers — Varley, Jenkins, Kalaris, Boath — and Lucas all knew that this advice was therefore predicated on a false basis.”

Christopher Lucas was Barclays CFO at the time. He is named as a co-conspirator in the case but is suffering from a serious illness and has been judged not fit to stand trial.

The case continues and is expected to last up to six months.

Read more about the ‘Barclays four’ case:

The trial of the ‘Barclays Four’ starts this week — here’s what you need to know

Former Barclays execs lied about payments to Qatar, court told

Senior Barclays banker raised concerns about ‘hidden commission’ in Qatar deal, court told

Yahoo Finance

Yahoo Finance