BARCLAYS: China capital outflows at 'near-record' levels

Reuters

Money is flowing out of China again.

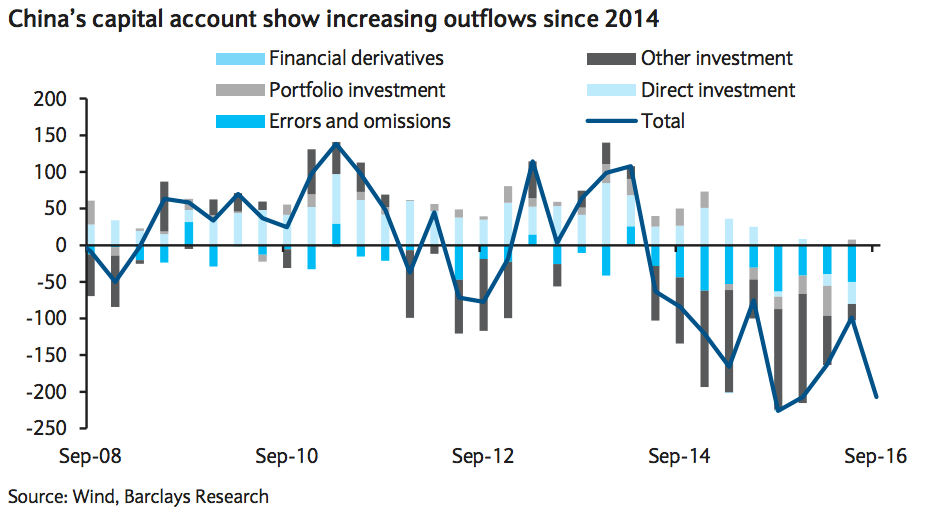

Spurred on by a strengthening dollar and weakening Chinese currency, there was "a near-record net capital outflow" of $207 billion in the third quarter this year, according to a note from Barclays.

Barclays analysts Jian Chang and Yingke Zhou said: "Firmer expectations of a Fed rate hike and a stronger USD under President-elect Trump’s expected fiscal and industrial policies point to continued capital outflow pressures for China, in our view."

"Other indicators, such as banks’ cross-border payments and receipts, and banks’ FX purchase and sales, also point to rising capital outflows," Barclays said.

Here is the chart from Barclays:

Reuters

While the outflows are not quite as severe as those seen in the second half of 2015 after China's market crash, the country has a smaller reserve pile to deal with them.

Propping up the Chinese currency by selling dollars has been a key policy to steady the ship, but it means dipping into the country's foreign exchange reserves.

FX reserves "have fallen by $530 billion since August 2015 to $3.12 trillion as of October this year, the lowest level since 2011," the Barclays analysts said.

This leaves policymakers with the option of tightening regulation rather than fiddling with market pricing. According to a Reuters report this week, the State Administration of Foreign Exchange is restricting foreign transfers worth $5 million or more and cracking down on big investment deals abroad.

RAW Embed

NOW WATCH: These are the best watches for under $400

See Also:

Italy's biggest bank is trying a €13-billion fix for its bad debt problem

'We will bleed:' The car industry's biggest players are terrified by the short-term impact of Brexit

Ex-Barclays CEO Antony Jenkins is joining the board of Blockchain

SEE ALSO: DEUTSCHE BANK: The property bubble 'is the most important macro issue in China'

Yahoo Finance

Yahoo Finance