Barclays may have been cleared, but scrutiny of its £12bn Qatar cash call will run on

At first glance it seemed Barclays was fully in the clear.

In a statement to investors the high street bank said the Crown Court had dismissed all fraud charges against the lender relating to its £11.8bn emergency cash call at the height of the financial crisis.

It is a major setback for the Serious Fraud Office (SFO), which has been investigating the 2008 fundraising largely bankrolled by the wealthy Gulf state of Qatar for the last five years.

But it is not game over. It is understood the SFO wants to seek to re-apply the charges against the bank in the coming weeks.

An SFO spokesman said: “We are considering our position in respect of today’s ruling concerning the companies.”

We are considering our position in respect of today’s ruling concerning the companies

Serious Fraud Office

As it stands a criminal trial brought by the SFO will still take place next January - just not against Barclays specifically.

Four former Barclays executives - including its former chief executive John Varley - still face criminal charges related to the fundraising.

Separately, Barclays also faces a $1bn civil case brought by high profile financier Amanda Staveley’s PCP Capital Partners over its dealings with Qatar.

This civil case had been stayed while the criminal case took place - but it could now be accelerated after Monday's developments.

Regulatory probes into Barclays’ 2008 cash calls by City watchdog the Financial Conduct Authority (FCA) and US authorities are also outstanding.

So Barclays has a distance to travel before it can finally put the long shadow of the financial crisis behind it.

The possibility remains that former Barclays bosses could be the only bankers jailed for bringing a lender to the brink of collapse, despite never going cap in hand to the Government for a bailout, unlike rivals Lloyds and RBS.

For the four former executives who still face charges, the battle is only just beginning.

Alongside Mr Varley, former senior investment banker Roger Jenkins, the former boss of Barclays’ wealth division Thomas Kalaris, and the ex-European head of financial institutions Richard Boath have been charged with conspiracy to commit fraud by false representation for the June 2008 cash call.

Mr Varley and Mr Jenkins also face separate charges of conspiracy to commit fraud related to a second capital raising in October that year, as well as a charge of unlawful financial assistance.

If found guilty the maximum prison sentence faced by Mr Varley is 22 years.

The cash calls under the microscope were led by Qatari investors, but also included Abu Dhabi royals and a Singaporean national wealth fund.

Around the same time Barclays lent the Qatari state $3bn (£2.2bn) and agreed so-called “advisory services agreements” with the Qataris worth £322m.

The legality of these “side deals” have been the subject of scrutiny.

The SFO sought to ratchet up the pressure on Barclays in February this year when it extended the charge of unlawful financial assistance from parent company Barclays Plc to its operating company, Barclays Bank plc.

This was significant as Barclays Bank Plc holds banking licences in several countries, including the UK.

However, Barclays’ right to operate on British high streets was never seriously in doubt, as it last month completed a £1bn restructuring to comply with UK ring-fencing laws, creating a new British retail bank that had its own banking licence.

If it goes unchallenged the court’s decision to dismiss the charges against Barclays could lift a further misconduct headache for the lender.

In recent weeks Barclays has been boosted by chief executive Jes Staley being spared a ban by the FCA for attempting to unmask a whistleblower two years ago. He was instead fined £640,000.

Barclays also settled a long-running US case for mis-selling toxic mortgage products in the run up to the financial crisis for $2bn, a lower figure than the City had feared.

The basis of the court’s decision to drop the fraud charges against Barclays has not been disclosed. The judge at Southwark Crown Court, Mr Justice Jay, said it should remain private for the time being while proceedings are live.

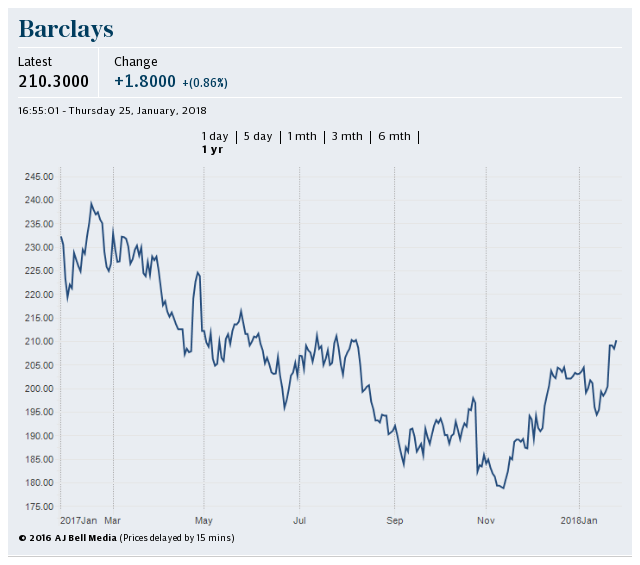

Barclays shares closed up 0.7pc today, lagging behind the FTSE 100 at just over 1pc up, as well as its rivals HSBC and RBS, while it matched Lloyds’ gain. This suggests investors were hardly rejoicing at the news from court.

This story still has a way to run and a potentially explosive trial is on the cards for next January - even if Barclays the company isn’t in the dock.

Yahoo Finance

Yahoo Finance