Barclays profit halves as it sets aside another £1.6bn to cover COVID-19 losses

Barclays (BARC.L) has set aside another £1.6bn ($2.04bn) to deal with loans, mortgages, and credit card debt going bad as a result of the COVID-19 pandemic.

The provision, announced on Wednesday alongside half-year results, took total COVID-19 loss provisions to £3.7bn. Barclays set aside £2.1bn in April to cover an expected spike in bad loans.

Analysts had been expecting additional credit impairment charges of £1.4bn in the second quarter.

READ MORE: Barclays among first banks to sign up to 'net zero' financing pledge

Barclays chief executive Jes Staley told journalists the provisions were based on “conservative economic forecasts” and provided coverage that was “much higher than the actual losses we realised in the economic crisis ten years ago.”

Loss buffers for Barclays’ credit card business could absorb up to 16% of debt going unpaid. During the 2008/09 financial crisis, bad credit card debt peaked at 6.9%.

Barclays’ finance chief Tushar Morzaria said the provisions were based on expectations of “a relatively shallow recovery,” not “a sharp snap back,” and said Barclays could find itself over prepared if the UK recovers more strongly than anticipated.

Barclays said it would likely continue to set aside money to cover future losses as the year progressed. Provisions are expected to be “above the level experienced in recent years” but the pace of growth should slow, the bank said.

READ MORE: UBS profit falls 11% as it braces for jump in losses

The growth of loss absorbing buffers in the second quarter caused a slump in Barclays’ half-year earnings. Income rose 8% compared to last year, reaching £11.6bn, but pre-tax profit more than halved, dropping from £3bn to £1.2bn. Profit attributable to shareholders fell 65% to £695m.

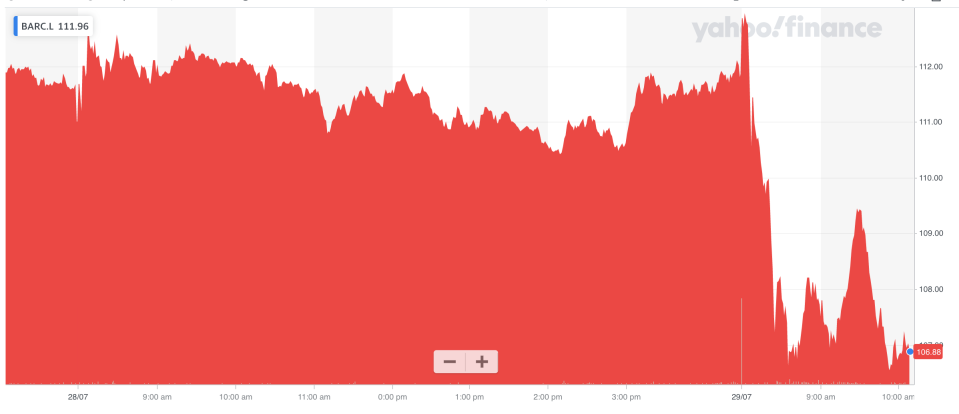

Shares dropped over 4% in London.

“Clearly, we’ve faced extraordinary economic challenges,” Staley said.

The bank has been “focused on supporting our customers, clients, and the UK economy through the COVID-19 pandemic,” he said in a statement.

Barclays has lent £22bn to businesses under various government-loan programme since the crisis began. Staley said demand for COVID-19 support loans had “slowed markedly in the last couple of weeks.”

The bank has also provided 600,000 payment holidays to customers, across mortgages, credit cards, and personal loans.

READ MORE: RBS officially changes name to NatWest Group

When loss provisions are stripped out, Barclays would have seen a 27% jump in half-year profits to £5bn.

The bank was boosted by a strong performance at its commercial and investment bank. Profit at the division jumped almost 30% to £2.2bn, helped by a surge in fixed income trading at its markets business.

Staley said Barclays’ investment bank was “taking a leading role helping clients to access capital markets to raise equity and debt, underwriting c.£620bn of new issuance in the quarter.”

The good work of the investment bank was undone by the consumer and cards business, where revenue slumped 20%. The division lost £606m in the first half of the year.

Staley blamed “the lower interest rate environment, fewer interest earning balances, reduced payments activity and action to provide support for customers,” such as payment holidays.

READ MORE: Amateur investors chase profits during the pandemic

Income in the second quarter was £5.3bn, slightly ahead of analysts’ expectations, but the increase in credit loss provisions meant quarterly profit was below forecasts, at £359m.

“While the remainder of 2020 will be challenging, our diversified model means we can remain financially resilient and continue to support our customers and clients,” Staley said.

Banks have set aside billions to cover an expected surge in bad debt caused by the COVID-19 pandemic. UK GDP collapsed by 25% in just two months as a result of lockdown and the Office for Budget Responsibility (OBR) has said the UK is facing its worst recession in 300 years.

Yahoo Finance

Yahoo Finance