Barrick (GOLD) Stock Up 29% YTD: What's Behind The Rally?

Barrick Gold Corporation’s GOLD shares have shot up 28.6% so far this year. The company has also topped its industry’s rise of 20.1% over the same time frame.

The gold mining giant has a market cap of roughly $41.8 billion and average volume of shares traded in the last three months is around 22,900K.

Let’s take a look into the factors that are driving this Zacks Rank #3 (Hold) stock.

What’s Going in Barrick’s Favor?

Higher gold prices have contributed to the rally in Barrick’s shares. Gold has been the bright spot in the first quarter of 2020 as fears over the coronavirus pandemic made it the most attractive safe-haven asset. A slump in crude oil prices, a low interest rate environment and geopolitical tensions also triggered demand for gold. Concerns over supply crunch arising from suspensions of operations by miners per government mandates also contributed to the gain in gold prices.

Gold prices, in early March, surged past the $1,700 an ounce level for the first time in seven years on the virus crisis and a sharp decline in oil prices triggered by Saudi Arabia's price war with Russia. Worries over coronavirus’ impact on the global economy is likely to keep supporting the bullion moving ahead.

Meanwhile, Barrick’s average realized price of gold climbed around 22% year over year in first-quarter 2020 and boosted its margins. Higher gold prices are also expected to continue driving its earnings in the second quarter.

Barrick is also benefiting from its actions to reduce debt. The company cut its total debt by 3.2% year over year to $5.5 billion at the end of 2019. Its total debt further declined to $5.2 billion at the end of the first quarter. Also, the company has a strong liquidity position and generates healthy cash flows, which positions it well to benefit from development, exploration and acquisition opportunities. Barrick’s cash and cash equivalents surged 55% year over year to roughly $3.3 billion at the end of the first quarter.

Barrick also remains focused on its major exploration programs. The company’s growth projects across Turquoise Ridge, Goldrush and Cortez Deep South in Nevada are currently in execution. Construction of the third shaft at Turquoise Ridge is advancing according to schedule and is expected to deliver additional value. The Deep South project is also expected to contribute to Cortez’s production.

In March 2020, Barrick also announced that the proposed expansion of the Pueblo Viejo gold mine will boost the mine life and also contribute to the economy of Dominican Republic till 2040 and beyond. The project will require an initial investment of $1.3 billion for expansion of the process plant and the tailings facility. The investment will extend the mine’s life and unlock potential to increase exports by $22 billion. The Pueblo Viejo expansion will also enable the mine to exploit the lower grades in the ore body.

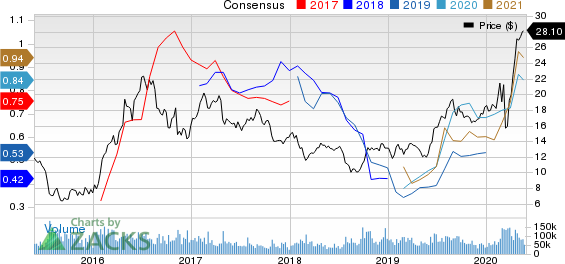

Moreover, earnings estimate revisions have the greatest impact on stock prices. Over the past two months, the Zacks Consensus Estimate for 2020 earnings for Barrick moved up 15.1%. Further, the consensus mark for 2020 earnings is currently pegged at 84 cents per share, which suggests a year-over-year growth of 64.7%.

Barrick Gold Corporation Price and Consensus

Barrick Gold Corporation price-consensus-chart | Barrick Gold Corporation Quote

Stocks to Consider

Better-ranked stocks worth considering in the basic materials space are Agnico Eagle Mines Limited AEM, The Scotts Miracle-Gro Company SMG and Newmont Corporation NEM.

Agnico Eagle has a projected earnings growth rate of 75.3% for the current year. The company’s shares have rallied roughly 53% in a year. It currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Scotts Miracle-Gro has an expected earnings growth rate of 17.7% for the current fiscal year. The company’s shares have gained roughly 56% in the past year. It currently carries a Zacks Rank #2 (Buy).

Newmont has a projected earnings growth rate of 82.6% for the current year. The company’s shares have surged around 86% in a year. It currently has a Zacks Rank #2.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.1% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Newmont Corporation (NEM) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

The Scotts MiracleGro Company (SMG) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance