Barrick's (GOLD) Earnings and Sales Surpass Estimates in Q4

Barrick Gold Corporation GOLD recorded net earnings (on a reported basis) of $1,387 million or 78 cents per share in fourth-quarter 2019 against a net loss of $1,197 million or $1.02 per share in the year-ago quarter.

Barring one-time items, adjusted earnings per share (EPS) rose 183.3% year over year to 17 cents. The figure also beat the Zacks Consensus Estimate of 14 cents.

Barrick recorded total sales of $2,883 million, up 51.4% year over year. The figure also surpassed the Zacks Consensus Estimate of $2,858.9 million.

2019 Highlights

For 2019, the company reported profits of $3,969 million or $2.26 per share against a net loss of $1,545 million or $1.32 a year ago.

Revenues rose 34.2% year over year to $9,717 million in 2019.

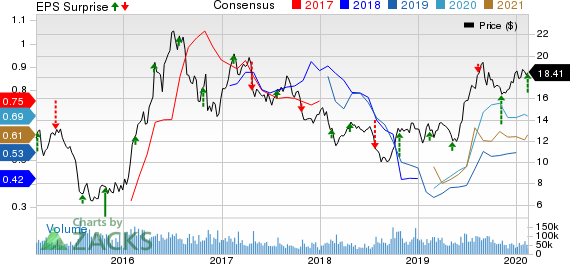

Barrick Gold Corporation Price, Consensus and EPS Surprise

Barrick Gold Corporation price-consensus-eps-surprise-chart | Barrick Gold Corporation Quote

Operational Highlights

Total gold production were 1.44 million ounces in the fourth quarter, up 14% year over year from 1.26 million ounces. Average realized price of gold was $1,483 per ounce in the quarter, up 21.3% from $1,223 per ounce in the year-ago quarter.

Cost of sales went up 6.7% year over year to $1,046 per ounce. All-in sustaining costs (AISC) rose 17.1% year over year to $923 per ounce in the quarter.

Copper production increased 7.3% year over year to 117 million pounds. Average realized copper price was $2.76 per pound, flat year over year.

Financial Position

At the end of 2019, Barrick had cash and cash equivalents of $3,314 million, up 110.9% year over year. As of Dec 31, 2019, the company’s total debt was roughly $5.5 billion compared with $5.7 billion as of Dec 31, 2018.

Net cash provided by operating activities rose 60.5% year over year to $2.8 billion for full-year 2019.

The company’s board also announced a 40% dividend hike for fourth-quarter 2019 to 7 cents per share. It is payable on Mar 16, 2020 to shareholders of record at the close of business as of Feb 28, 2020.

Guidance

For 2020, the company anticipates attributable gold production in the range of 4.8-5.2 million ounces at AISC of $920-$970 per ounce. Cost of sales is expected in the range of $980-$1,030 per ounce.

The company expects copper production in the range of 440-500 million pounds at AISC of $2.20-$2.50 per pound and at cost of sales of $2.10-$2.40 per pound.

Capital expenditure is projected between $1,600 million and $1,900 million.

Price Performance

Barrick’s shares have gained 43.6% in the past year compared with the industry’s 41.1% rally.

Zacks Rank & Key Picks

Barrick currently carries a Zacks Rank #3 (Hold).

Few better-ranked stocks in the basic materials space are Daqo New Energy Corp DQ, Sibanye Gold Limited SBGL and Impala Platinum Holdings Limited IMPUY, each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Daqo New Energy has an expected long-term earnings growth rate of 29%. The company’s shares have rallied 119.4% in the past year.

Sibanye has an expected long-term earnings growth rate of 20.4%. Its shares have returned 150.5% in the past year.

Impala Platinum has an expected long-term earnings growth rate of 26.5%. The company’s shares have surged 214.3% in the past year.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Impala Platinum Holdings Ltd. (IMPUY) : Free Stock Analysis Report

Sibanye Gold Limited (SBGL) : Free Stock Analysis Report

DAQO New Energy Corp. (DQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance