BCE to Expand Rural Broadband Infrastructure in Manitoba

BCE Inc’s BCE subsidiary Bell MTS planned to invest in broadband infrastructure across Manitoba and provide locals with new investment and job opportunities. The company plans to expand its broadband services to several communities in Manitoba, including East St. Paul, Gimli, Headingley, Ste. Anne, Teulon and West St. Paul.

This expansion program will provide high-capacity fiber connections with download speeds of up to 1.5 Gbps. Since 2017, the company has invested more than $1.3 billion in Manitoba to roll out its broadband fiber, 5G and wireless home Internet networks.

The program’s objective is to connect hard-to-reach communities and bridge the connectivity gap. The company's wireless home Internet service has helped customers in more than 60 rural and remote communities to access fast and reliable broadband connectivity, added the company.

BCE, Inc. Price and Consensus

BCE, Inc. price-consensus-chart | BCE, Inc. Quote

The company has also invested about $400 million to deploy high-capacity fiber connections in Winnipeg, added the company. It has helped the company to connect with more than 50% of homes and businesses.

BCE provides wireless service, data communications, telephone and high-speed Internet to small and medium businesses. The company continues to invest heavily in pure fiber and a 5G network to support Canada’s economic recovery.

In March, the company partnered with Palo Alto Networks to launch two cloud-native application protection platform solutions to help Canadian business organizations improve the cloud security of their systems. The solutions offer a prevention-first approach and real-time visibility to ensure the protection and defense of enterprise data in the cloud.

Prior to that, the company introduced faster Internet and mobile technology in Atlantic Canada. The company's Bell Gigabit Fibe 3.0 service offers symmetrical download and upload speeds up to 3 Gbps, available to customers in Fredericton and Moncton, New Brunswick.

The introduction of faster Internet speeds and mobile technology in Atlantic Canada will benefit the region greatly, providing customers with a better overall experience.

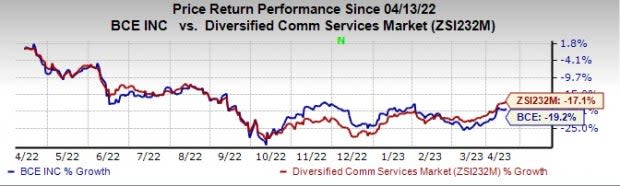

BCE currently has a Zacks Rank #4 (Sell). Shares of the company have lost 19.2% in the past year compared with the sub-industry’s decline of 17.1%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are Arista Networks ANET, Cadence Design Systems CDNS and Pegasystems PEGA, each presently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks’ 2023 earnings has increased 11% in the past 60 days to $5.85 per share. The long-term earnings growth rate is anticipated to be 14.2%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 14.2%. Shares of ANET have increased 25.7% in the past year.

The Zacks Consensus Estimate for Cadence’s 2023 earnings has increased 10% in the past 60 days to $4.97 per share. The long-term earnings growth rate is anticipated to be 19.1%.

Cadence’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 10.5%. Shares of CDNS have increased 35% in the past year.

The Zacks Consensus Estimate for Pegasystems’ 2023 earnings has increased 101.5% in the past 60 days to $1.35 per share.

Pegasystems’ earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, the average surprise being 11.2%. Shares of the company have declined 36.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BCE, Inc. (BCE) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Pegasystems Inc. (PEGA) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance