BD's (BDX) FDA-Approved Test to Offer Wider Testing Access

Becton, Dickinson and Company BDX, popularly known as BD, recently received the FDA’s approval for the use of self-collected vaginal specimens for human papillomavirus (HPV) testing when cervical specimens cannot otherwise be obtained. The approval is expected to enable women to self-collect vaginal specimens for HPV testing in a healthcare setting, including non-traditional locations such as retail pharmacies or mobile clinics.

Per estimates, HPV is the cause of virtually all cervical cancer and HPV testing is the preferred screening method by the American Cancer Society in the United States. The BD Onclarity HPV Assay is FDA-approved for HPV primary testing without the need for a traditional Pap smear performed with a speculum. The latest approval of self-collected samples will likely provide a less invasive testing option and improve access to testing for individuals who face barriers to cervical cancer screening.

The latest regulatory clearance is expected to significantly strengthen BD’s foothold in the global Integrated Diagnostic Solutions (IDS) business unit, which is part of its broader Life Sciences arm.

Significance of the Approval

Per the American Cancer Society, approximately 50% of cervical cancer diagnoses are in never-screened people, and 10% of diagnoses occur in under-screened individuals. Additionally, 25% of women in the United States do not receive regular cervical cancer screening, according to the National Cancer Institute. However, cervical cancer is preventable, and screening plays an important role in early detection and prevention.

Per BD, various factors including physical and geographic inaccessibility and financial insecurity (including lack of health insurance coverage), among others, result in inadequate screening. Self-collection will likely improve cervical cancer screening access, especially in underserved populations. With vaginal self-collection as an option for cervical cancer screening, women are expected to be more inclined to participate in such care, with never-screened women demonstrating a more than two-fold increase in acceptance and participation. This, in turn, will enable healthcare providers an alternative option to identify a high-risk HPV infection in more convenient care settings.

Per management, self-collection will likely provide greater access to testing and BD Onclarity is expected to enable healthcare providers to determine the specific HPV strains present in the samples and, more precisely, identify and treat individuals at high risk and avoid unnecessary treatments for women at low risk.

Industry Prospects

Per a report by Mordor Intelligence, the global HPV Testing and Pap Test market is estimated at $6.21 billion in 2024 and is anticipated to reach $10.33 billion by 2029 at a CAGR of 10.7%. Factors like the increasing number of cervical cancer cases worldwide, a growing number of cervical cancer screening programs and the introduction of advanced technologies are likely to drive the market.

Given the market potential, the latest regulatory approval is expected to significantly strengthen BD’s business worldwide.

Recent Developments in Life Sciences Arm

This month, BD reported its second-quarter fiscal 2024 results, wherein its Life Sciences segment’s revenue growth was driven by the IDS unit. IDS unit’s performance reflected high single-digit growth in BD’s Microbiology platforms, including Blood Culture, TB and ID/AST and volume strength across the BD Vacutainer portfolio. The segment’s Biosciences business unit also recorded high-single-digit growth in Clinical Reagents, driven by BD’s growing FACSLyric Clinical Cell Analyzer and FACSDuet Sample Preparation System installed base.

Last month, BD announced the global commercial release of new cell sorters, the new BD FACSDiscover S8 Cell Sorters. This will likely enable researchers in a broader range of fields (including cell biology, cancer research and immunology) to provide insights that were previously invisible in traditional flow cytometry experiments.

Price Performance

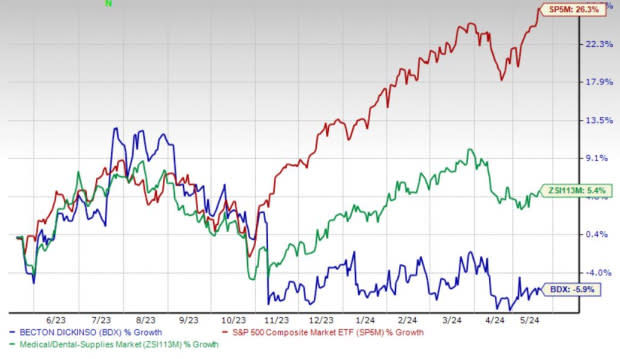

Shares of BD have lost 5.9% in the past year against the industry’s 5.4% rise and the S&P 500's 26.3% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, BD carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Veeva Systems Inc. VEEV and Ecolab Inc. ECL.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 29.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita’s shares have gained 35.2% compared with the industry’s 23.8% rise in the past year.

Veeva Systems, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 24.1%. VEEV’s earnings surpassed estimates in each of the trailing four quarters, with the average being 8.5%.

Veeva Systems has gained 25.5% compared with the industry’s 47.6% rise in the past year.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.5%. ECL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.3%.

Ecolab’s shares have rallied 32.9% against the industry’s 10.9% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance