Beacon (BECN) Enhances Metal Roofing Portfolio With Buyouts

In a move to enhance service for metal roofing contractors, Beacon Roofing Supply, Inc. BECN acquired Extreme Metal Fabricators, LLC in Key Largo and Palm City, Florida, and Integrity Metals, LLC in Gainesville and Vero Beach.

Extreme Metal has operated for over a decade with a team of craftspeople, estimators and operators, ensuring high-quality metal panel roofing systems. This acquisition will expand BECN’s product offerings, providing customers with a broader range of roofing and complementary products, including waterproofing and restoration.

Integrity Metals, recognized for its dedication to customer service and ethical practices, complements Beacon’s culture seamlessly. Engineers, architects, and contractors trust Integrity Metals for their expertise and reliability. The integration of Beacon and Integrity Metals in Florida will benefit employees, customers, and suppliers.

The move expands BECN's residential and commercial roofing product catalog to include metal solutions. This will help meet the demands of Florida's contractors for durable and attractive roof protection while specializing in the evolving building codes of Florida and its counties.

Focus on Expansion

Beacon has undertaken several strategic initiatives to drive its long-term ambition of growing and enhancing customer experience. One of the primary initiatives includes footprint expansion and increasing its market reach. Beacon is targeting business expansion through bolt-on acquisitions, divestitures and new branch openings.

BECN continues to focus on expansion to drive growth through acquisitions and the addition of greenfield locations. On Jun 12, 2024, the company expanded its service footprint with new locations in Terrell, TX, and Everett and Spokane, WA, aimed at supporting residential and commercial roofers and specialty waterproofing contractors. The company plans to open 25 branches in 2024.

Since the announcement of the Ambition 2025 strategic plan (on Feb 24, 2022), Beacon acquired 18 companies, which added 66 branches to its portfolio. The company expanded its footprint by opening three new locations and completing two acquisitions in the first three months of 2024. In May, it acquired Smalley & Company, headquartered in Denver, CO. Smalley serves customers at 11 locations in Arizona, California, Colorado, Nevada, New Mexico and Utah.

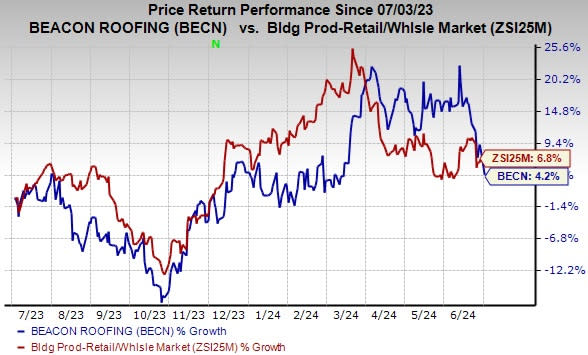

Image Source: Zacks Investment Research

Shares of Beacon — the largest distributor of residential and non-residential roofing materials in the United States and Canada — moved up 4.2% in the past year compared with the Building Products - Retail industry’s 6.8% rise. The company is likely to benefit from diligent pricing execution, productivity, and cost-saving initiatives. Also, its emphasis on Ambition 2025 initiatives, strategic investments and acquisitions bode well.

Zacks Rank & Key Picks

Beacon currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the Zacks Retail-Wholesale sector.

Brinker International, Inc. EAT currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

It has a trailing four-quarter earnings surprise of 213.4%, on average. EAT’s shares have surged 90.5% in the past year. The Zacks Consensus Estimate for EAT’s 2024 sales and earnings per share (EPS) indicates 5.2% and 41.9% growth, respectively, from year-earlier actuals.

Wingstop Inc. WING sports a Zacks Rank #2 (Buy) at present. It has a trailing four-quarter negative earnings surprise of 21.4%, on average. The stock has appreciated 115.4% in the past year.

The Zacks Consensus Estimate for WING’s 2024 sales and EPS indicates a rise of 27.9% and 37.1%, respectively, from year-ago levels.

El Pollo Loco Holdings, Inc. LOCO currently carries a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 19.4%, on average. LOCO’s shares have risen 22.2% in the past year.

The Zacks Consensus Estimate for LOCO’s 2025 sales and EPS indicates 3.8% and 9.9% growth, respectively, from the prior-year figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Beacon Roofing Supply, Inc. (BECN) : Free Stock Analysis Report

El Pollo Loco Holdings, Inc. (LOCO) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance