Beacon Roofing Supply (NASDAQ:BECN) Reports Sales Below Analyst Estimates In Q2 Earnings

Roofing materials distributor Beacon Roofing Supply (NASDAQ:BECN) fell short of analysts' expectations in Q2 CY2024, with revenue up 6.8% year on year to $2.67 billion. It made a GAAP profit of $1.99 per share, improving from its profit of $1.97 per share in the same quarter last year.

Is now the time to buy Beacon Roofing Supply? Find out in our full research report.

Beacon Roofing Supply (BECN) Q2 CY2024 Highlights:

Revenue: $2.67 billion vs analyst estimates of $2.69 billion (small miss)

Adj EBITDA: $279.4 million vs analyst estimates of $320.1 million (12.7% miss)

EPS: $1.99 vs analyst expectations of $2.54 (21.5% miss)

Gross Margin (GAAP): 25.6%, in line with the same quarter last year

Free Cash Flow was -$82.9 million compared to -$167.8 million in the previous quarter

Market Capitalization: $6.54 billion

“Our Ambition 2025 initiatives drove record quarterly net sales, solid net income margin, and double-digit Adjusted EBITDA margin,” said Julian Francis, Beacon’s President & CEO.

Established in 1928, Beacon Roofing Supply (NASDAQ:BECN) distributes residential and commercial roofing materials and complementary building products.

Building Material Distributors

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Building materials distributors that boast reliable selection and quickly deliver products to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is forcing investment in digital capabilities to communicate with and serve customers everywhere. Additionally, building materials distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

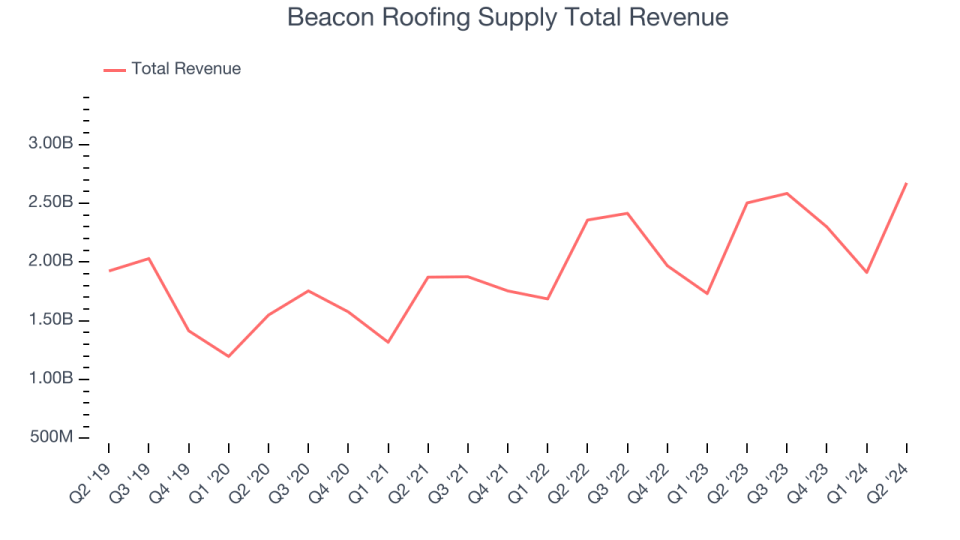

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones tend to grow for years. Unfortunately, Beacon Roofing Supply's 6.2% annualized revenue growth over the last five years was mediocre. This shows it couldn't expand in any major way and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Beacon Roofing Supply's annualized revenue growth of 11.1% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, Beacon Roofing Supply's revenue grew 6.8% year on year to $2.67 billion, missing Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 3% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

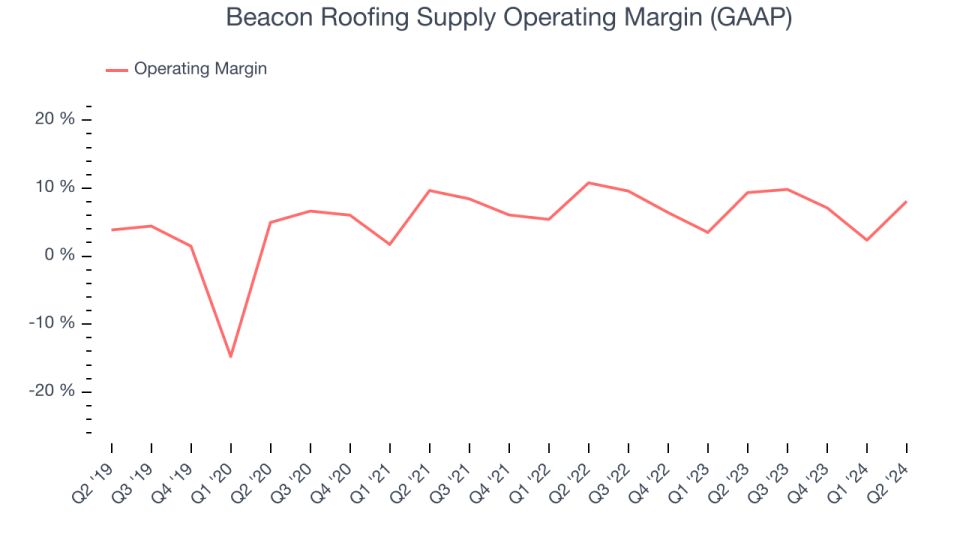

Operating Margin

Beacon Roofing Supply was profitable over the last five years but held back by its large expense base. It demonstrated paltry profitability for an industrials business, producing an average operating margin of 6.2%. This result isn't too surprising given its low gross margin as a starting point.

On the bright side, Beacon Roofing Supply's annual operating margin rose by 7 percentage points over the last five years

In Q2, Beacon Roofing Supply generated an operating profit margin of 8.1%, down 1.3 percentage points year on year. Since Beacon Roofing Supply's operating margin decreased more than its gross margin, we can assume the company was recently less efficient because expenses such as sales, marketing, R&D, and administrative overhead increased.

EPS

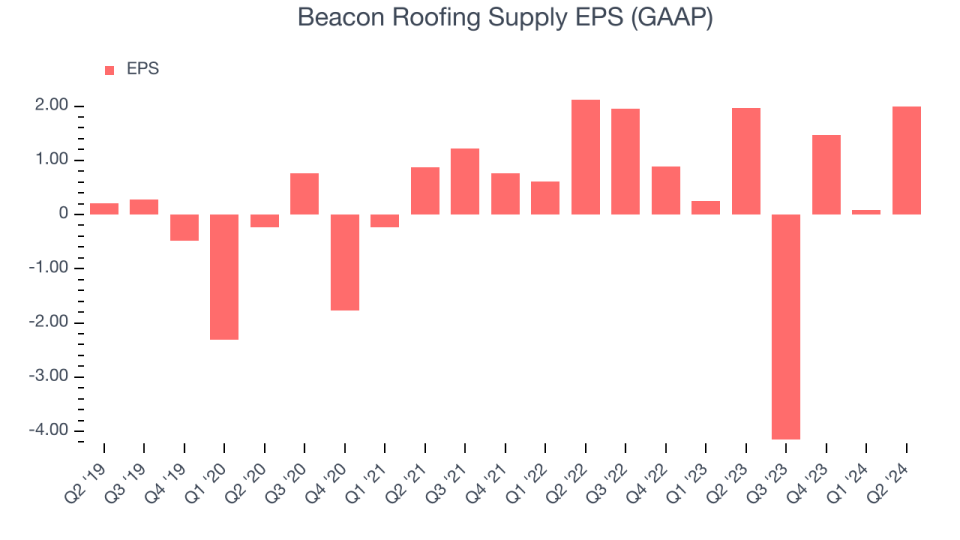

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Beacon Roofing Supply's earnings losses deepened over the last five years as its EPS dropped 3.9% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Beacon Roofing Supply's low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we also analyze EPS over a shorter period to see if we are missing a change in the business. Sadly for Beacon Roofing Supply, its EPS declined by 45.9% annually over the last two years while its revenue grew 11.1%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Beacon Roofing Supply's earnings can give us a better understanding of its performance. Beacon Roofing Supply's operating margin has declined 2.7 percentage points over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don't tell us as much about a company's fundamentals.

In Q2, Beacon Roofing Supply reported EPS at $1.99, up from $1.97 in the same quarter last year. Despite growing year on year, this print missed analysts' estimates. Over the next 12 months, Wall Street is optimistic. Analysts are projecting Beacon Roofing Supply's EPS of negative $0.61 in the last year to flip to positive $6.80.

Key Takeaways from Beacon Roofing Supply's Q2 Results

We struggled to find many strong positives in these results. Its revenue, adjusted EBITDA, and EPS all fell short of Wall Street's estimates. Overall, this quarter could have been better. The stock remained flat at $98.27 immediately following the results.

Beacon Roofing Supply may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.