Beam Therapeutics (BEAM) Q1 Loss Narrows, Revenues Miss

Beam Therapeutics Inc. BEAM incurred a loss of $1.21 per share in the first quarter of 2024, narrower than the Zacks Consensus Estimate of a loss of $1.45. The company had recorded a loss of $1.33 per share in the year-ago quarter.

Total revenues, comprising license and collaboration revenues, came in at $7.4 million in the first quarter compared with $24.2 million in the year-ago period. The top line missed the Zacks Consensus Estimate of $14 million.

Quarter in Detail

Research and development expenses amounted to $84.8 million in the first quarter, down almost 14.8% from the year-ago quarter’s level.

General and administrative expenses totaled $26.7 million, increasing around 14.1% year over year.

As of Mar 31, 2024, BEAM had cash, cash equivalents and marketable securities worth $1.1 billion compared with $1.2 billion as of Dec 31, 2023.

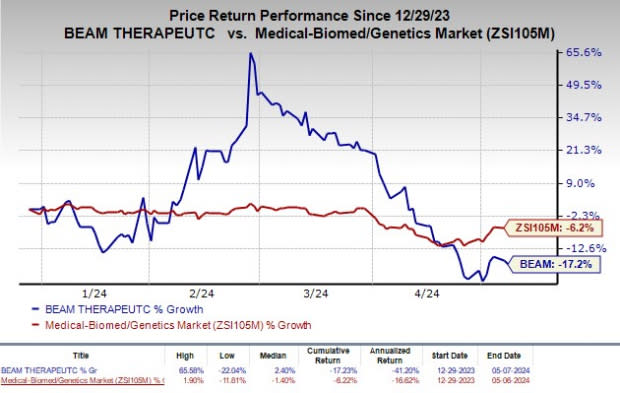

Shares of BEAM have plunged 17.2% in the year-to-date period compared with the industry’s 6.2% decline.

Image Source: Zacks Investment Research

Pipeline Updates

The company is developing its leading ex-vivo genome-editing candidate, BEAM-101, in the phase I/II BEACON study for the treatment of adult patients with sickle cell disease.

The company has completed dosing and engraftment for the three patients in the sentinel cohort of the BEACON study. Data from multiple patients in the study is expected in the second half of 2024.

Meanwhile, following clearance by the data monitoring committee, dosing in the expansion cohort of the BEACON study is anticipated to begin imminently.

Beam Therapeutics is also developing an in vivo base editor BEAM-302 for the treatment of alpha-1 antitrypsin deficiency (AATD).

The company received clearance for its clinical trial authorization application by the United Kingdom Medicines and Healthcare Products Regulatory Agency for BEAM-302 in March 2024. A phase I/II study on BEAM-302 for treating AATD is expected to begin later in the first half of 2024.

Meanwhile, the company is looking to initiate a clinical study on BEAM-301 for the potential treatment of glycogen storage disease 1a in the United States. An investigational new drug application for BEAM-301 is expected to be filed later in the first half of 2024.

Beam Therapeutics Inc. Price, Consensus and EPS Surprise

Beam Therapeutics Inc. price-consensus-eps-surprise-chart | Beam Therapeutics Inc. Quote

Zacks Rank & Stocks to Consider

Beam Therapeutics currently has a Zacks Rank #4 (Sell).

Some top-ranked stocks in the healthcare sector are Third Harmonic Bio, Inc. THRD, Ligand Pharmaceuticals Incorporated LGND and Entera Bio Ltd. ENTX, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Third Harmonic Bio’s 2024 loss per share have narrowed from $1.65 to $1.35. Year to date, shares of THRD have rallied 8.8%.

THRD’s earnings beat estimates in three of the trailing four quarters and missed the same once, the average surprise being 37.72%.

In the past 60 days, estimates for Ligand’s 2024 earnings per share have improved from $4.42 to $4.56. Year to date, shares of LGND have risen 2.5%.

Earnings of LGND beat estimates in each of the trailing four quarters, the average surprise being 84.81%.

In the past 60 days, estimates for Entera Bio’s 2024 loss per share have narrowed from 75 cents to 25 cents. Year to date, shares of ENTX have surged 311.7%.

ENTX’s earnings beat estimates in three of the trailing four quarters and missed the same once, the average surprise being 10.66%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Beam Therapeutics Inc. (BEAM) : Free Stock Analysis Report

Entera Bio Ltd. (ENTX) : Free Stock Analysis Report

Third Harmonic Bio, Inc. (THRD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance