Bear of the Day: Avis Budget Group (CAR)

Avis Budget Group (CAR) is a leading vehicle rental company, boasting an average rental fleet of nearly 650,000 vehicles. The company has three popular brands under its umbrella: Avis, Budget, and Zipcar. Avis operates in roughly 180 countries, with more than 11,000 car and truck rental locations throughout the world.

Q3 Profit Misses Expectations

Avis’s top and bottom line numbers missed the Zacks Consensus Estimate. Adjusted net income came in at $223 million compared to $265 million in the year-ago quarter.

Revenue slightly decreased to $2.75 billion from $2.78 billion in Q3 2018.

The company also revised their 2019 guidance downwards, and now expects revenue between $9 billion and $9.2 billion. Adjusted net income is projected to fall in a range of $3.35 and $4.20 per share.

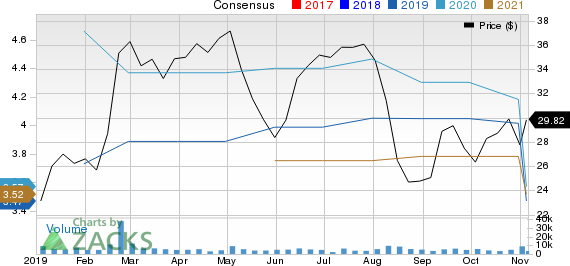

Analysts have turned bearish on Avis, with four cutting estimates in the last 60 days for fiscal 2019.

Earnings are expected to see negative growth for the year, and the Zacks Consensus Estimate has dropped 58 cents for that same time period from $4.05 to $3.47 per share.This sentiment has stretched into 2020. While earnings growth could turn positive, our consensus estimate has dropped 73 cents in the past two months.

CAR is now a Zacks Rank #5 (Strong Sell).

Shares of the rental car company have seen decent growth since January, up around 30%, but the stock took a major hit after its Q3 earnings release; CAR plunged 11% in the wake of the report. The S&P 500 is up about 25.6% in comparison.

Bottom Line

Like other car rental businesses, Avis has been impacted by consumers choosing to use ride-hailing services like Uber (UBER) and Lyft (LYFT) over traditional rental cars. There’s also the oversupplied used-car market that the company is dealing with.

But, management said it has made “further progress” on partnerships with ride-hailing companies; it has increased its ride-share fleet by almost 60% in Q3 compared to Q2.

Investors who are interested in adding a transportation peer to their portfolio should take a look at Zacks Rank #2 (Buy) ranked Hertz Global (HTZ), up over 36% year-to-date.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

Lyft, Inc. (LYFT) : Free Stock Analysis Report

Hertz Global Holdings, Inc (HTZ) : Free Stock Analysis Report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance