Bear of the Day: Nutrien (NTR)

Nutrien NTR, a current Rank #5 (Strong Sell), is a leading integrated provider of crop inputs and services through its leading global retail network. Analysts have taken a bearish stance on the company’s outlook across the board.

Image Source: Zacks Investment Research

In addition, the company is in the Zacks Fertilizers industry, which is currently ranked in the bottom 14% of all Zacks industries. Let’s take a closer look at how the company currently stacks up.

Nutrien

Nutrien shares have faced a rocky road over the last year, down more than 20% and widely underperforming relative to the S&P 500. Quarterly results have consistently come in below expectations as of late, with NTR falling short of the Zacks Consensus EPS estimate by an average of 35% across its last four releases.

The less-than-ideal performance from shares has boosted its yield considerably, paying 4.2% on an annual basis.

Keep an eye out for the company’s upcoming quarterly release expected on May 8th, as current consensus expectations suggest a 67% pullback in earnings on 12% lower sales. Revenue expectations have been similarly taken lower, with the $5.4 billion expected down 1% since the beginning of February.

Image Source: Zacks Investment Research

Bottom Line

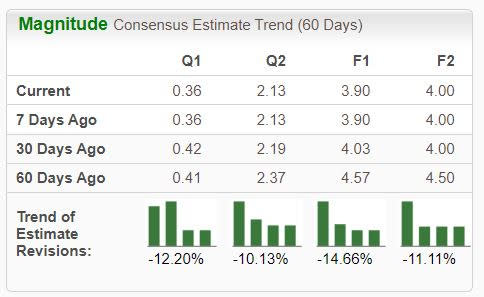

Analysts' negative earnings estimate revisions paint a challenging picture for the company’s shares in the near term.

Nutrien NTR is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy). These stocks sport a notably stronger earnings outlook and the potential to deliver explosive gains in the near term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance