Is a Beat in the Cards for Microchip (MCHP) in Q4 Earnings?

Microchip Technology Incorporated MCHP is scheduled to report fourth-quarter fiscal 2020 results on May 7.

The company anticipates fiscal fourth-quarter net sales to grow 3% sequentially, per the business update provided on Apr 8. Notably, Microchip generated net sales of $1.29 billion in the fiscal third quarter.

The company stated that there has been growth in bookings in the fiscal fourth quarter. Management attributes the surge to be triggered by coronavirus crisis-led supply chain disruptions.

Notably, the Zacks Consensus Estimate for fiscal fourth-quarter revenues is currently pegged at $1.33 billion, suggesting decline of 0.2% from the year-ago quarter.

Per the previous guidance provided in the last earnings call, non-GAAP earnings per share were projected in the range of $1.35-$1.51 per share.

In the past 30 days, the Zacks Consensus Estimate for fiscal fourth-quarter earnings moved up 7.9% to $1.36 per share. Nevertheless, the consensus mark indicates a decline of 8.1% from the prior-year reported figure.

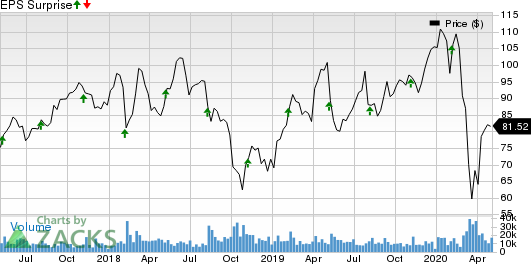

Notably, the company has surpassed the Zacks Consensus Estimate for earnings in the trailing three quarters, while matching the same once. It has a trailing four-quarter positive earnings surprise of 3.35%, on average.

Microchip Technology Incorporated Price and EPS Surprise

Microchip Technology Incorporated price-eps-surprise | Microchip Technology Incorporated Quote

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Microchip this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

Microchip has an Earnings ESP of +0.76% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Factors to Note

Microchip is likely to have benefited from growing clout of microcontrollers, primarily the latest Bluetooth 5.0 dual-mode audio solutions in the fiscal fourth quarter. Robust demand for 8-bit, 16-bit and 32-bit microcontrollers might have contributed to the performance in the quarter to be reported.

Moreover, incremental adoption of the company’s META-DX1 suite of Ethernet products is likely to have driven microcontrollers’ fiscal fourth-quarter performance.

Notably, the Zacks Consensus Estimate for microcontrollers revenues currently stands at $695 million, indicating sequential growth of 1.3%.

Additionally, Microchip’s fiscal fourth-quarter results are likely to reflect synergies from acquisitions including Microsemi, Micrel and Atmel.

Further, solid demand for Microsemi’s solutions in Data Center, and Communications end-markets, fueled by coronavirus crisis-induced demand for cloud and networking solutions, is likely to have aided the fiscal fourth-quarter performance.

Microchip is likely to have benefited from design wins for its latest PolarFire imaging solutions, primarily for 4K high resolutions, which is expected to have driven FPGA (or Field Programmable Gate Array) revenues in the fiscal fourth quarter. Further, the incremental adoption of new RT PolarFire FPGA that supports high-performance requirements of complex space applications is likely to get reflected in the fiscal fourth-quarter results.

Markedly, the Zacks Consensus Estimate for FPGA revenues currently stands at $95 million, indicating sequential growth of 2.6%.

However, headwinds pertaining to Huawei ban and economic slowdown led by coronavirus crisis are likely to have weighed on the fiscal fourth-quarter performance.

Additionally, increasing expenses on product development amid stiff competition from peers including Cirrus Logic CRUS and Silicon Laboratories, is likely to have limited profitability in the quarter to be reported.

Notable Product Roll Outs in Q4

During the quarter under review, Microchip expanded portfolio of Power Electronics with the introduction of smaller and highly efficient new Silicon Carbide (SiC) power modules.

Moreover, the company rolled out embedded development solutions to aid developers to securely connect to cloud platform utilizing Bluetooth, Wi-Fi, and narrow band 5G technologies, which expanded its IoT solutions portfolio.

Other Stocks that Warrant a Look

Here are a couple of other companies, which also have the right combination of elements to post an earnings beat this quarter:

Inphi Corporation IPHI has an Earnings ESP of +20.04% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Etsy ETSY has an Earnings ESP of +18.31% and a Zacks Rank #2.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS) : Free Stock Analysis Report

Etsy, Inc. (ETSY) : Free Stock Analysis Report

Inphi Corporation (IPHI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance