Is a Beat in the Cards for ProPetro (PUMP) in Q1 Earnings?

ProPetro Holding Corp. PUMP is scheduled to release first-quarter 2020 results on Jun 1, after the closing bell.

The Zacks Consensus Estimate for the to-be-reported quarter’s earnings is currently pegged at 19 cents per share while the same for revenues stands at $403.94 million.

Against this backdrop, let’s dig deep into the factors that might have impacted the company’s performance in the March quarter.

Factors to Consider for Q1 Results

ProPetro’s hydraulic fracturing horsepower is deployed in the Permian Basin, which is widely regarded as the dominant domestic growth area for onshore oil output. Robust volumes from this ‘super’ basin — currently producing almost 4.4 million barrels daily and expected to churn out the same healthy rate in the future as well — should ensure continued work for ProPetro. Thus, the company, through its healthy leverage to the Permian Basin, is likely to have benefited from this multiyear upcycle production by providing hydraulic fracturing and other well-completion services to the E&P firms.

ProPetro’s strong relationship with high-quality customers offers revenue visibility and business certainty. The clients — mostly well capitalized, blue-chip E&P companies with long-term production growth plans in the Permian Basin including the likes of Parsley Energy PE and XTO Energy, a subsidiary of ExxonMobil XOM — are expected to have been less susceptible to the commodity price fluctuations. This, in turn, might have ensured multiyear earnings stability for ProPetro. Moreover, the company is likely to have successfully integrated new team associates with pressure pumping assets from Pioneer Natural Resources PXD.

In the last reported quarter, ProPetro’s revenues of $434.8 million improved 2.2% year over year, driven by an impressive operating efficiency and lower downtime, a trend that most likely continued in the first quarter as well.

What Does Our Model Say?

Ourproven model predicts an earnings beat for ProPetro this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of a positive surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: ProPetro has an Earnings ESP of +81.33%.

Zacks Rank: ProPetro carries a Zacks Rank #3, which increases the predictive power of ESP.You can see the complete list of today’s Zacks #1 Rank stocks here.

Highlights of Q4 Earnings

ProPetro Holding reported fourth-quarter net income per share of 25 cents, missing the Zacks Consensus Estimate of 42 cents. The bottom line too declined from the year-ago figure of 59 cents. This underperformance stems from holiday seasonality and tepid demand for the company’s services as clients — the upstream energy players —take a cautious approach to capital spending amid weak oil and gas prices.

ProPetro’s revenues of $434.8 million missed the Zacks Consensus Estimate by 0.35%. However, the top line inched up 2.2% year over year, driven by better operating efficiency and lower downtime.

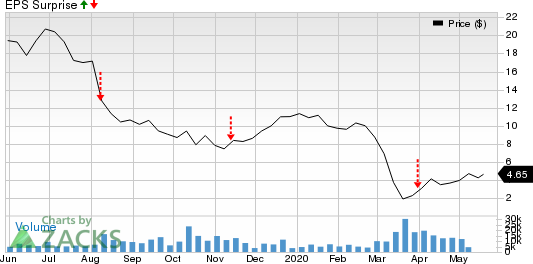

As far as earnings surprises are concerned, this Midland, TX-based player beat the Zacks Consensus Estimate in three of the trailing four quarters and missed the same in the remaining one, the average negative surprise being 27.66%. This is depicted in the graph below:

ProPetro Holding Corp. Price and EPS Surprise

ProPetro Holding Corp. price-eps-surprise | ProPetro Holding Corp. Quote

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Pioneer Natural Resources Company (PXD) : Free Stock Analysis Report

Parsley Energy, Inc. (PE) : Free Stock Analysis Report

ProPetro Holding Corp. (PUMP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance