Is A Beat Likely for Chevron (CVX) This Earnings Season?

Chevron Corporation CVX is scheduled to release fourth-quarter 2020 results on Friday Jan 29, before the opening bell.

The Zacks Consensus Estimate for the to-be-reported quarter is pegged at a loss of 9 cents per share while the same for revenues stands at $27.64 billion.

Against this backdrop, let’s consider the factors that are likely to impact the company’s December-quarter results.

Factors at Play

Chevron's cost-reduction efforts are consistently encouraging. In view of the historic oil market crash and coronavirus-induced weak demand for the commodity, the company is expected to have spent $14 billion in 2020. The current capex estimate implies a 30% reduction from the initial forecast of $20 billion. The company is also targeting $1 billion in operating cost cuts. All these strategic moves are expected to have driven the fourth-quarter earnings and cash flows higher.

With the increase in oil prices that has been under continuous pressure ever since the coronavirus hit global energy demand hard, the outlook for Chevron seems positive. Per the U.S. Energy Information Administration, the fourth quarter of 2020 began with WTI prices trending at $38.72 per barrel. The same exited the period at $48.52. This price rise is expected to have bettered Chevron’s upstream earnings in the quarter under review. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings from the upstream segment is pegged at $442 million, indicating growth from the sequential quarter’s reported figure of $235 million.

However, the positive effect of cost savings and higher realized commodity prices is likely to have been partially offset by lower downstream segment earnings. In the third quarter of 2020, a fall in refined products’ sales margins hampered the segmental profit, a trend that most likely continued in the fourth quarter as well. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings from the downstream segment is pegged at $223 million, suggesting a fall from the sequential quarter’s reported figure of $292 million.

What Does Our Model Say?

Our proven Zacks model predicts an earnings beat for Chevron this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Chevron has an Earnings ESP of +11.71%.

Zacks Rank: Chevron carries a Zacks Rank #3, which increases the predictive power of ESP.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Highlights of Q3 Earnings & Surprise History

Chevron reported adjusted third-quarter earnings per share of 11 cents. The Zacks Consensus Estimate was of a loss of 29 cents. This outperformance reflects the integrated energy major’s successful cost-reduction initiatives, which allowed it to lower operating expenses and capital spending by 12% and 48%, respectively, from the year-ago levels in the face of falling commodity prices.

However, the bottom line compared unfavorably with the year-ago adjusted profit of $1.55 per share due to extremely weak oil and natural gas price realizations plus a decline in refined products’ margins.

The company generated revenues of $24.5 billion, which missed the Zacks Consensus Estimate of $26 billion and also declined 32.3% year over year.

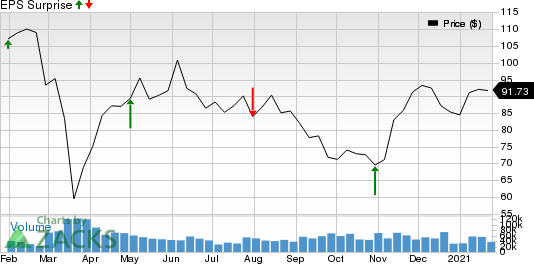

As far as earnings surprises are concerned, this San Ramon, CA-based Chevron boasts a pleasant record, having surpassed the Zacks Consensus Estimate in three of the trailing four quarters while missing the same in the remaining quarter, the average beat being 42.47%. This is depicted in the graph below:

Chevron Corporation Price and EPS Surprise

Chevron Corporation price-eps-surprise | Chevron Corporation Quote

Other Stocks to Consider

Some other firms worth considering from the energy space on the basis of our model that shows that these too have the right combination of elements to beat on earnings this season are as follows:

NuStar Energy L.P. NS has an Earnings ESP of +21.21% and a Zacks Rank #2, currently. The company is scheduled to release earnings on Feb 4.

PattersonUTI Energy, Inc. PTEN has an Earnings ESP of +4.99% and is Zacks #3 Ranked, currently. The company is scheduled to release earnings on Feb 4.

Plains All American Pipeline, L.P. PAA has an Earnings ESP of +17.00% and is a #3 Ranked stock, currently. The firm is scheduled to release earnings on Feb 9.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Plains All American Pipeline, L.P. (PAA) : Free Stock Analysis Report

NuStar Energy L.P. (NS) : Free Stock Analysis Report

Chevron Corporation (CVX) : Free Stock Analysis Report

PattersonUTI Energy, Inc. (PTEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance