Is a Beat in Store for Abbott (ABT) This Earnings Season?

We expect Abbott ABT to surpass expectations when it reports third-quarter 2017 results on Oct 18, before the market opens. Last quarter, Abbott delivered a positive earnings surprise of 3.3%.

Abbott’s strong and impressive earnings track record reflects its estimate beats in each of the past four quarters, delivering an average of 4.6%. Also, the company’s shares have surged 34.6% so far this year. This compares favorably with the industry’s 11.6% registered rally during the same period.

Why a Likely Positive Surprise?

Our proven model conclusively shows that Abbott is likely to beat on earnings this quarter because it has the right combination of two key ingredients. A stock needs to have both a positive Earnings ESP and a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for a likely positive surprise.

Zacks ESP: Abbott has an Earnings ESP of +0.24%, indicative of being confident about an earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Abbott currently carries a bullish Zacks Rank #2, which increases the predictive power of ESP with a higher chance of beating estimates.

Conversely, all Sell-rated stocks (#4 or 5) are cautioned against going into an earnings announcement.

What Is Driving the Better-than-Expected Earnings?

Abbott has been on a healthy growth trajectory in Established Pharmaceuticals Division (EPD) business, delivering encouraging operational sales growth in the trailing few quarters. Major part of this growth was stimulated by a series of strategic actions, including Abbott’s sale of developed market businesses along with acquisitions of CFR Pharmaceuticals in Latin America and Veropharm in Russia.

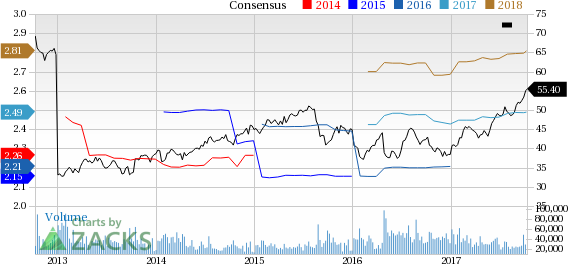

Abbott Laboratories Price and Consensus

Abbott Laboratories Price and Consensus | Abbott Laboratories Quote

The company also continues to expect strong growth in EPD in the upcoming quarters, particularly in China, Russia and several markets in Latin America including Brazil on the back of Abbott’s strong position lies and competitive edge in these geographies. Also, there should be chances of a certain revamp in EPD sales in India in the third quarter, following the business loss that Abbott had incurred due to implementation of a Goods and Services tax (GST) in this country in the second quarter.

There haves been a slew of developments within the medical device space as well. The market is upbeat about Abbott’s FreeStyle Libre Flash Glucose Monitoring System’s recent reimbursement approval in the United Kingdom. Plus, the company has recently announced receipt of Health Canada License for FreeStyle Libre Flash Glucose Monitoring System.

With these positives in place, Abbott’s FreeStyle Libre system stands partially or fully covered in 17 countries, including France, Germany and Japan. We expect this uptrend to further stimulate growth in the Diabetes Care sales segment within Medical group that improved 18.7% in second-quarter 2017 on continued consumer acceptance of FreeStyle Libre in international arenas.

Within Cardiac Arrhythmias and Heart Failure business, the recent FDA approval of Abbott’s Full MagLev HeartMate 3 Left Ventricular Assist System is expected to boost the company’s sales from the third quarter itself.

We are also encouraged about the ongoing synergies from the acquisition of St. Jude Medical on Jan 4, earlier in the year. The comprehensive combined portfolio appears quite promising.

Notably, Abbott projects annual pre-tax synergies of $500 million by 2020, including revenue expansion opportunities as well as operational and SG&A efficiencies.

For the third quarter of 2017, the company forecasts adjusted earnings per share of 64-66 cents. Comparable operational sales growth for the quarter is projected in mid-single digits.

Other Stocks to Consider

Here are a few other companies worth considering from the same space as our proven model shows that they too have the right combination of elements to come up with an earnings beat this quarter:

QIAGEN N.V. QGEN has an Earnings ESP of +2.67% and a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Vertex Pharmaceuticals Incorporated VRTX has an Earnings ESP of +6.84% and a Zacks Rank #1.

Humana Inc. HUM has an Earnings ESP of +0.86% and a Zacks Rank of 1.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Qiagen N.V. (QGEN) : Free Stock Analysis Report

Humana Inc. (HUM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance