Beazley (LON:BEZ) Share Prices Have Dropped 31% In The Last Three Years

Beazley plc (LON:BEZ) shareholders should be happy to see the share price up 18% in the last month. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 31% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

Check out our latest analysis for Beazley

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate three years of share price decline, Beazley actually saw its earnings per share (EPS) improve by 29% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Revenue is actually up 13% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Beazley further; while we may be missing something on this analysis, there might also be an opportunity.

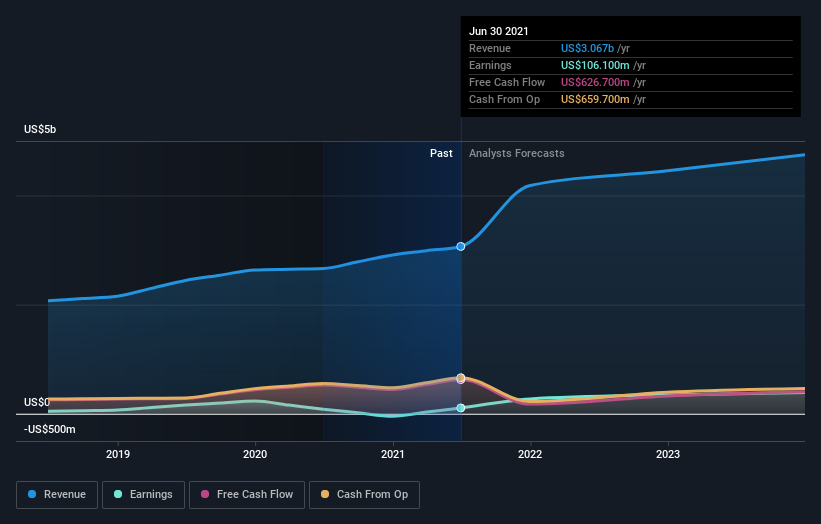

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Beazley's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Beazley's TSR, which was a 28% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

While the broader market gained around 24% in the last year, Beazley shareholders lost 15%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 1.6% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Beazley by clicking this link.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance