Bed Bath & Beyond Plummets on 4th-Quarter Sales Decline

- By James Li

Shares of Bed Bath & Beyond Inc. (NASDAQ:BBBY) plunged more than 10% on Wednesday on the back of the company releasing double-digit sales decline during the fiscal fourth quarter of 2020.

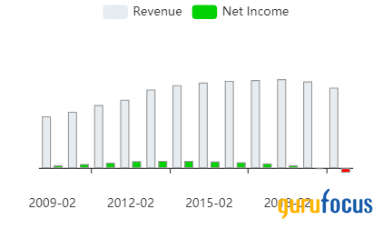

For the three months ending Feb. 27, the Union, New Jersey-based home furnishings retailer reported net income of $9 million, or 8 cents in diluted earnings per share, compared with net loss of $65 million, or 53 cents in diluted loss per share, in the prior-year quarter. Despite this, revenue of $2.619 billion tumbled 16% from the prior-year quarter revenue of $3.107 billion, further missing the Refinitiv consensus estimate of $2.63 billion.

Store closures and divestments weigh on revenues

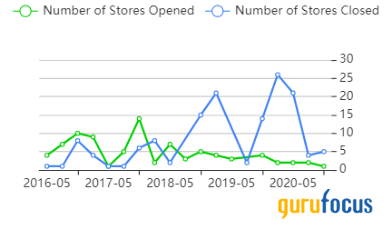

Although the company reported comparable sales growth of 4% during the quarter, its third consecutive quarter of positive sales growth, net sales tumbled 16%, driven by unfavorable impacts from non-core banner divestitures and planned store closures. The company said that it closed 144 stores during fiscal 2020 as part of its network optimization program.

The company announced in December 2020 that it will sell its Cost Plus World Market brand to Kingswood Capital Management, a Los Angeles-based private equity firm.

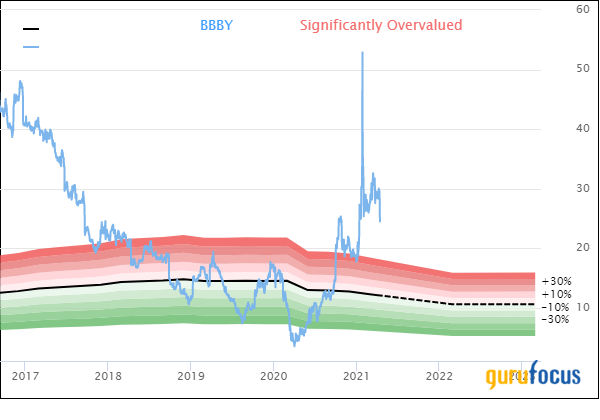

Stock tumbles as company earnings guidance also misses consensus estimates

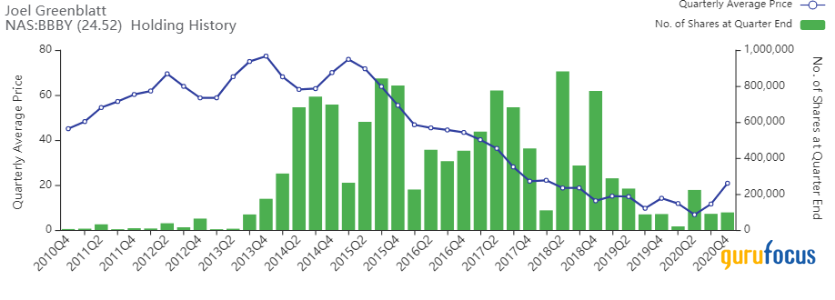

Shares of Bed Bath & Beyond closed at $24.52, down 12.21% from Tuesday's close of $27.93 on the fourth-quarter sales decline and lower-than-expected earnings guidance for fiscal 2021. Despite this, the stock remains significantly overvalued based on Wednesday's price-to-GF Value ratio of 2.03.

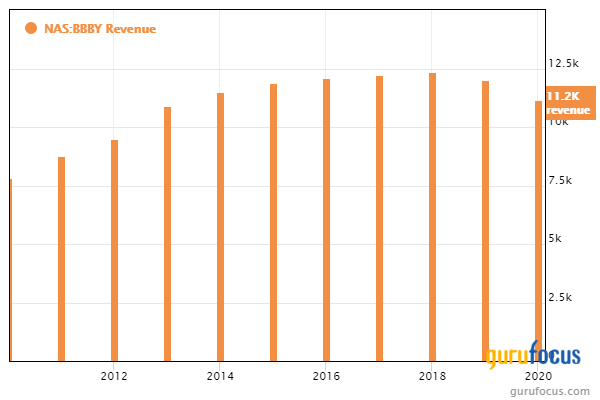

The company reaffirmed its fiscal 2021 net sales guidance range of between $8 billion and $8.20 billion, compared to the consensus estimate of $8.18 billion according to Refinitiv and down from the fiscal 2020 net sales of approximately $9.233 billion. Bed Bath & Beyond also mentioned that fiscal 2021 first-quarter net sales are expected to increase 40% from fiscal 2020 first-quarter net sales in spite of the non-core banner divestitures and disruptions due to the coronavirus pandemic.

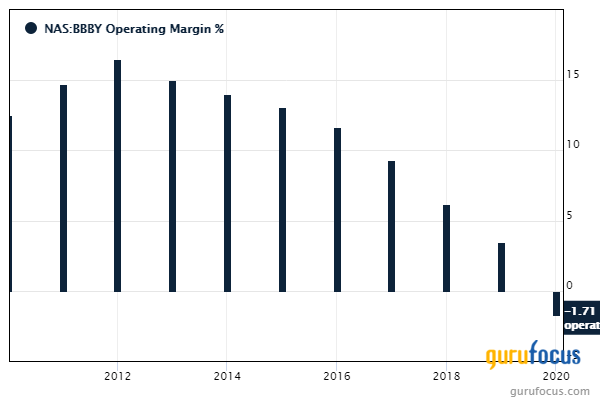

According to GuruFocus, Bed Bath & Beyond's three-year revenue growth rate of 3.2% outperforms over 62% of global competitors. Despite this, profit margins and returns are underperforming more than 60% of global competitors, suggesting low profitability even though the Piotroski F-score ranks 7 out of 9.

Gurus with holdings in Bed Bath & Beyond include Jim Simons (Trades, Portfolio)' Renaissance Technologies, Jeremy Grantham (Trades, Portfolio)'s GMO, Paul Tudor Jones (Trades, Portfolio)' Tudor Investment and Joel Greenblatt (Trades, Portfolio)'s Gotham Asset Management.

Disclosure: No positions.

Read more here:

Top 5 1st-Quarter Buys of Steven Scruggs' FPA Queens Road Small Cap Fund

Microsoft Dials Up Merger With Nuance Communications

737 Max Production Issues Resume Haunting Boeing

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance