Beer-Serving Robots Drive Record Demand for Korea’s Biggest IPO

(Bloomberg) -- Doosan Robotics Inc. is poised to make its market debut on Thursday after raising 421 billion won ($310 million) in South Korea’s biggest initial public offering of the year.

Most Read from Bloomberg

The Suwon-based company, the country’s largest maker of what are known as collaborative robots, priced shares at 26,000 won apiece, at the top of the marketed range. Retail investors offered to buy as much as 33 trillion won of the stock, a record for the year, according to the company.

While robots have long been used in industrial settings for repetitive tasks, Doosan Robotics specializes in robotic arms that work alongside humans on tasks beyond factory floors. These collaborative machines have been deployed for everything from making coffee and deep fried chicken to serving beer and handling luggage at an airport.

“This is a market that’s starting to take off,” Chief Executive Officer Ryu Junghoon said in an interview with Bloomberg News.

Doosan Robotics plans to use the IPO proceeds for strategic acquisitions and overseas expansion. Ryu said the company is considering acquiring a firm with technology that could give robots mobility, such as autonomous vehicles that could ferry objects from one place to another in factories and warehouses. The company now produces 13 robotic arms with different payload and reach options. Its strategy is to build a diversified business using robotic arms, rather than creating humanoid robots, Ryu said.

Doosan Robotics Sells Shares at Top of Marketed IPO Range

Doosan is also experimenting with artificial intelligence, with a goal to make its robots more useful. In August, the company struck an agreement with Microsoft Corp. to use its Azure OpenAI service for a GPT-based robot control system. With GPT integration, a user could say a simple voice command to prepare a dish or two and the robot could figure out an optimal sequence of tasks to complete a meal.

South Korea’s position as a global powerhouse in technology and engineering may give it an edge in the collaborative robot industry, a rapidly emerging sub-sector of the industrial automation market, he said. The global collaborative robot market, valued at $1.2 billion this year, is expected to reach $6.8 billion by 2029, according to a July report by Markets and Markets.

The country, which has the world’s lowest fertility rate, is already the world’s top robot adopter, employing 10 manufacturing workers for every industrial robot, according to the World Robotics 2022 report by the International Federation of Robotics.

Doosan Robotics started in 2015 after Korean conglomerate Doosan Group identified advanced robotics as an area of growth. Ryu, 49, held key posts in the group’s corporate strategy and new projects for about eight years before he was appointed as CEO of Doosan Robotics in 2021.

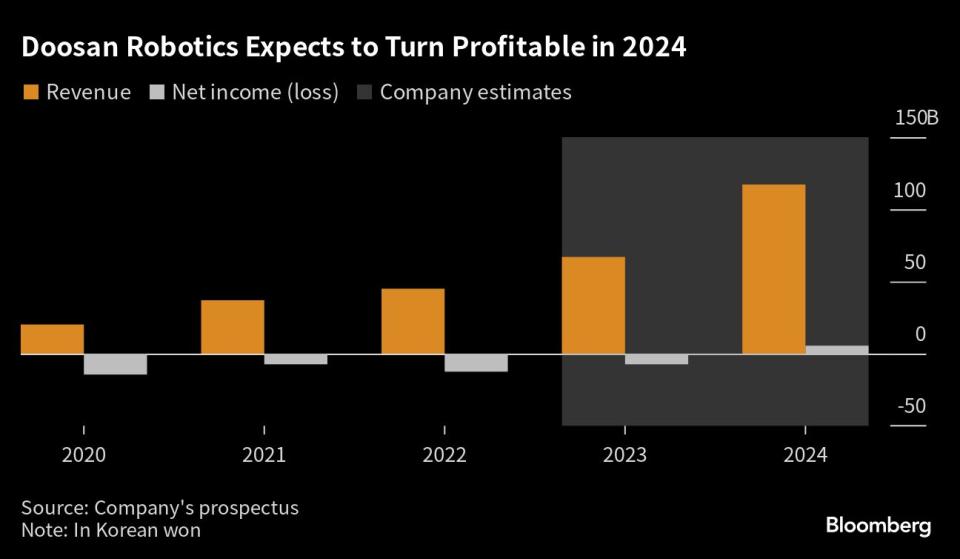

The company reported 45 billion won in revenue in 2022, putting it among what the firm believes are the largest collaborative robot producers in the world. Its customers include Hyundai Motor Co., LG Electronics Inc. and L’Oreal SA, according to the company.

Robotics has become one of the hottest sectors in Korea this year as the government and major local companies stepped up investment. Shares in Rainbow Robotics, backed by Samsung Electronics Co., have shot up about 350% this year.

Douglas Kim, an analyst who publishes on the SmartKarma platform, said Doosan Robotics share price could jump when it starts trading on Thursday. Rainbow Robotics, one of its closest competitors, currently has a market cap of about 3 trillion won, compared to Doosan Robotics’ market value of about 1.7 trillion won at the IPO price of 26,000 won.

“Korea has a very conducive environment for cobot makers,” Ryu said, using the industry term for collaborative robots. “It’s possible more companies will emerge in this space.”

--With assistance from Filipe Pacheco.

Most Read from Bloomberg Businessweek

Aftermath of an Assassination: Inside the India-Canada Crisis

These 10 Graphics Show Just How Broken America’s Child-Care System Is

With Banks Offering 5% Returns, Financial Advisers Fight Irrelevance

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance