Bernard Horn's Strategic Moves in Q1 2024: Spotlight on Avnet Inc

Insights into Polaris Global Value Fund's Latest Portfolio Adjustments

Bernard Horn (Trades, Portfolio), a seasoned investment manager since the early 1980s, leads the Boston-based Polaris team, boasting over 150 years of collective industry expertise. The Polaris Global Value Fund (PGVFX), known for its diversified, no-load global mutual fund approach, aims to deliver above-average returns by investing in undervalued assets or companies with strong sustainable free cash flow. Horn's investment philosophy hinges on the significance of country and industry factors in determining security prices and capitalizing on global market inefficiencies caused by investor behavior.

Summary of New Buys

Bernard Horn (Trades, Portfolio) added a total of 3 stocks to his portfolio this quarter. Noteworthy additions include:

LKQ Corp (NASDAQ:LKQ), with 105,000 shares, making up 1.32% of the portfolio and valued at $5.61 million.

Takeda Pharmaceutical Co Ltd (TSE:4502), with 172,200 shares, representing 1.13% of the portfolio, valued at 4,781,060.

F&F Co Ltd (XKRX:383220), with 26,700 shares, accounting for 0.33% of the portfolio and valued at ?1,422,020.

Key Position Increases

Horn also increased his stakes in 13 stocks, with significant boosts in:

Daito Trust Construction Co Ltd (TSE:1878), adding 38,200 shares for a total of 45,500 shares, marking a 523.29% increase in share count and impacting the portfolio by 1.02%, valued at 5,175,780.

LG Electronics Inc (XKRX:066570), adding 42,100 shares for a total of 70,500 shares, a 148.24% increase in share count, valued at ?5,069,190.

Summary of Sold Out Positions

In the first quarter of 2024, Bernard Horn (Trades, Portfolio) completely exited two holdings:

Avnet Inc (NASDAQ:AVT), selling all 110,500 shares, which impacted the portfolio by -1.35%.

Berry Global Group Inc (NYSE:BERY), liquidating all 76,400 shares, causing a -1.25% impact on the portfolio.

Key Position Reductions

Significant reductions were made in 24 stocks, including:

Weichai Power Co Ltd (HKSE:02338), reduced by 1,908,000 shares, resulting in a -67.76% decrease in shares and a -0.77% impact on the portfolio. The stock traded at an average price of HK$14.3 during the quarter and has returned 19.21% over the past 3 months and 29.45% year-to-date.

Publicis Groupe SA (XPAR:PUB), reduced by 32,200 shares, resulting in a -36.19% reduction in shares and a -0.72% impact on the portfolio. The stock traded at an average price of 93.51 during the quarter and has returned 10.72% over the past 3 months and 25.95% year-to-date.

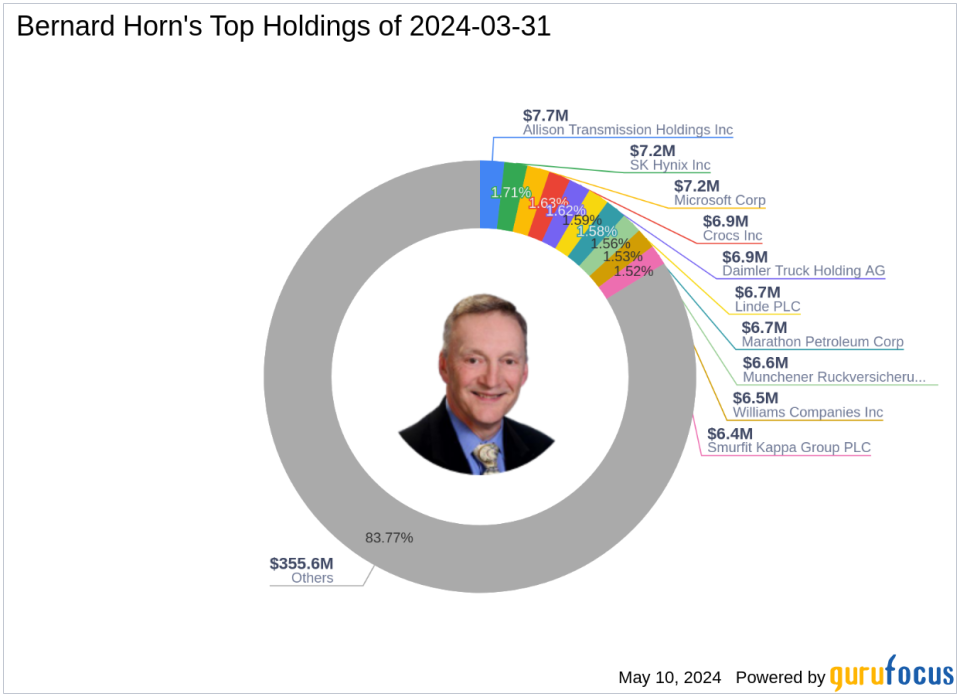

Portfolio Overview

As of the first quarter of 2024, Bernard Horn (Trades, Portfolio)'s portfolio included 94 stocks. The top holdings were:

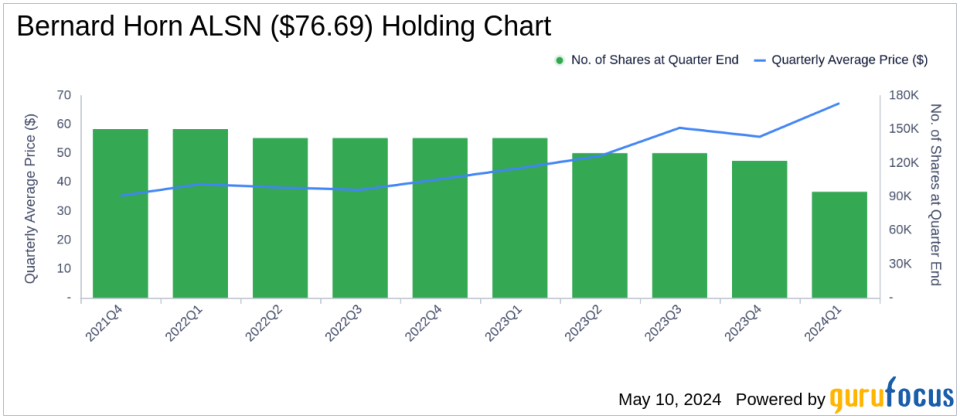

Allison Transmission Holdings Inc (NYSE:ALSN) at 1.81%

SK Hynix Inc (XKRX:000660) at 1.71%

Microsoft Corp (NASDAQ:MSFT) at 1.68%

Crocs Inc (NASDAQ:CROX) at 1.63%

Daimler Truck Holding AG (XTER:DTG) at 1.62%

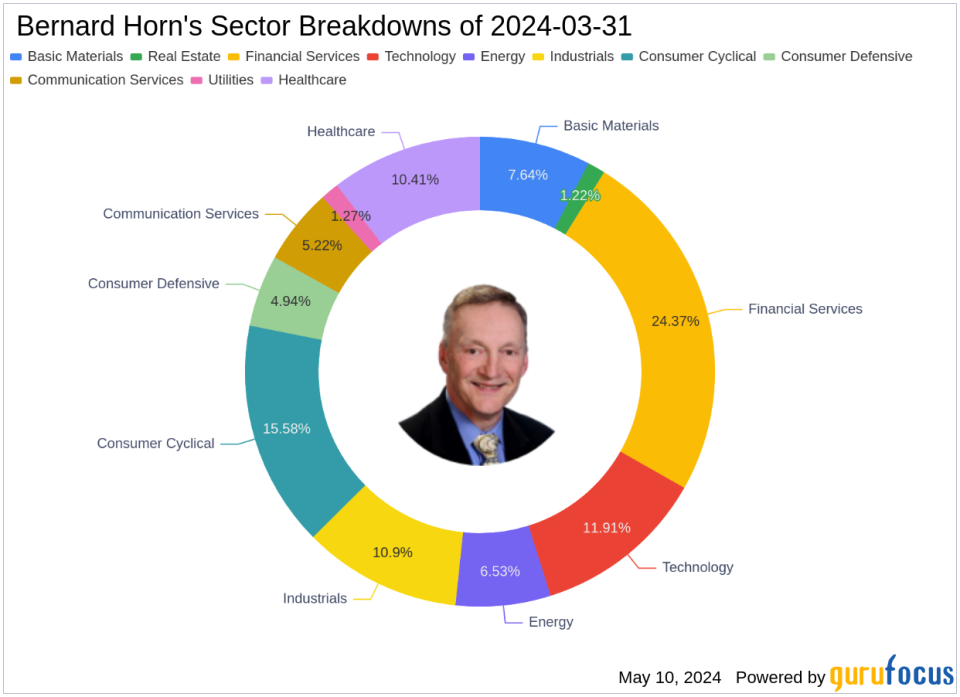

The holdings are mainly concentrated across 11 industries, including Financial Services, Consumer Cyclical, and Technology.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance