Berry Global (BERY) Q2 Earnings Beat, Sales Decline 12.9%

Berry Global Group, Inc. BERY reported second-quarter fiscal 2023 (ended Mar 31, 2023) adjusted earnings (excluding 54 cents from non-recurring items) of $1.96 per share, which surpassed the Zacks Consensus Estimate of earnings of $1.85 per share. Our estimate for fiscal second-quarter earnings was $1.84 per share. The bottom line increased 1.6% year over year due to lower costs.

Net sales of $3,288 million missed the Zacks Consensus Estimate of $3,775 million. Our estimate for net sales in the reported quarter was $3,324.7 million. The top line decreased 12.9% year over year due to a 6% dip in volumes. Selling prices declined $143 million due to the pass-through of lower resin costs. The impacts of foreign currency headwinds were $80 million in the quarter.

In the fiscal second quarter, Berry Global’s cost of goods sold decreased 15% to $2,682 million. Selling, general and administrative expenses declined 18.5% year over year to $220 million. Berry Global reported an operating EBITDA of $541 million, up 1.3% year over year. Adjusted operating income in the quarter jumped 2.3% year over year to $341 million.

Segmental Discussion

Consumer Packaging – International sales were $1,059 million, down 7% from the year-ago quarter. Our estimate for segmental revenues was $993.2 million. The decline is primarily due to a $57-million impact from unfavorable foreign currency movement and a 5% decrease in volumes. Operating income of $75 million fell 22.7% year over year. The segment accounted for 32.2% of the quarter’s net sales.

Consumer Packaging – North America’s sales were $774 million, down 12.1% year over year due to a 3% decline in volumes and an $80-million impact from a decrease in selling prices. Our estimate for segmental revenues was $823.8 million. Operating income jumped 9.4% year over year to $93 million. The segment accounted for 23.5% of the total net sales.

Revenues generated from the Health, Hygiene & Specialties segment amounted to $677 million, down 17.6% year over year due to a decrease in selling prices, unfavorable foreign currency impact and volume declines. Our estimate for segmental revenues was $716.2 million. Operating income of $34 million declined 50.7% year over year. The segment accounted for 20.6% of the total net sales in the reported quarter.

Revenues from the Engineered Materials segment fell 16.7% year over year to $778 million due to a $75-million decrease in selling prices, a 7% decline in volumes and unfavorable foreign currency movements. Our estimate for segmental revenues was $791.5 million. Operating income of $99 million increased 10% year over year. The segment accounted for 23.7% of the quarter’s net sales.

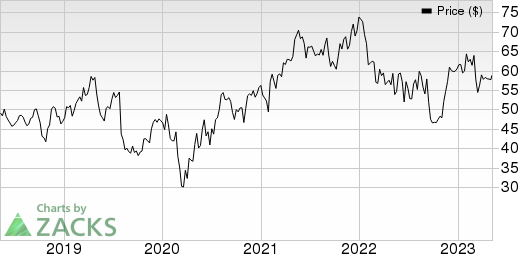

Berry Global Group, Inc. Price, Consensus and EPS Surprise

Berry Global Group, Inc. price-consensus-eps-surprise-chart | Berry Global Group, Inc. Quote

Balance Sheet and Cash Flow

At the end of second-quarter fiscal 2023, Berry Global had cash and cash equivalents of $696 million compared with $1,410 million at the end of fiscal 2022. Current and long-term debt totaled $9,307 million compared with $9,255 million at the end of fiscal 2022.

At the end of the fiscal quarter, Berry Global generated net cash of $168 million from operating activities against $14 million used in the year-ago period. Capital expenditure totaled $385 million compared with $367 million in the year-ago quarter. Adjusted free cash outflow at the end of the fiscal second quarter was $217 million compared with $381 million cash outflow in the year-ago period.

In the same time period, BERY returned $187 million to shareholders through $155 million in share repurchases and $32 million in dividends. The company expects to repurchase shares worth at least $600 million in fiscal 2023.

FY23 Guidance

Berry Global expects adjusted earnings of $7.30-$7.80 per share in fiscal 2023. The mid-point of the guided range — $7.55 — lies above the Zacks Consensus Estimate of earnings of $7.40 per share.

BERY anticipates cash flow from operations of $1.4-$1.5 billion, while the free cash flow is expected to be $800-$900 million in fiscal 2023.

Zacks Rank & Stocks to Consider

BERY currently carries a Zacks Rank #3 (Hold). Some better-ranked companies from the Industrial Products sector are discussed below:

Ingersoll Rand Inc. IR presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks.

IR’s earnings surprise in the last four quarters was 12.6%, on average. In the past 60 days, estimates for Ingersoll Rand’s 2023 earnings have increased 2%. The stock has rallied 13.9% in the past six months.

Parker-Hannifin Corporation PH presently sports a Zacks Rank of 1. The company delivered a trailing four-quarter earnings surprise of 12.4%, on average.

In the past 60 days, estimates for Parker-Hannifin’s fiscal 2023 (ending June 2023) earnings have increased 1.6%. The stock has gained 15.7% in the past six months.

Allegion plc ALLE presently carries a Zacks Rank of 2. ALLE’s earnings surprise in the last four quarters was 12.5%, on average.

In the past 60 days, Allegion’s earnings estimates have increased 4.1% for 2023. The stock has gained 3.1% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Parker-Hannifin Corporation (PH) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Berry Global Group, Inc. (BERY) : Free Stock Analysis Report

Allegion PLC (ALLE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance