Best-In-Class Growth Stocks

Xtreme Drilling is one of many stocks the market is bullish on. Its expected double-digit top-line and bottom-line growth exceeds its peers, and its financially stable position lessens the chances of risk. If your holdings could benefit from diversification towards growth stocks, whether it be in reputable tech stocks or green small-caps, take a look at my list of stocks with a bright future ahead.

Xtreme Drilling Corp. (TSX:XDC)

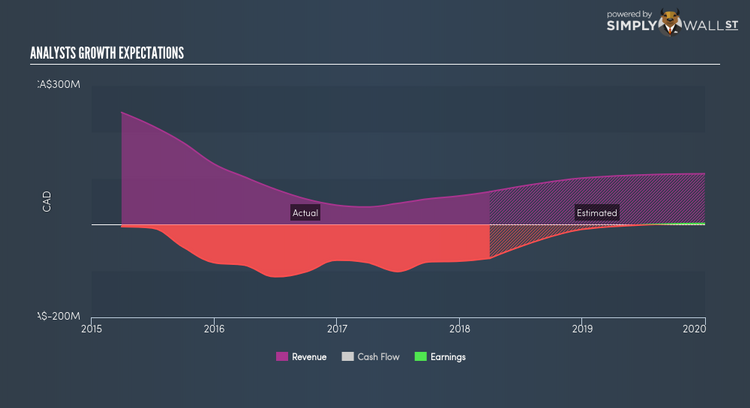

Xtreme Drilling Corp., together with its subsidiaries, provides onshore drilling services in the United States. Established in 2005, and currently headed by CEO Matthew Porter, the company size now stands at 282 people and with the market cap of CAD CA$164.21M, it falls under the small-cap group.

Could this stock be your next pick? Have a browse through its key fundamentals here.

K-Bro Linen Inc. (TSX:KBL)

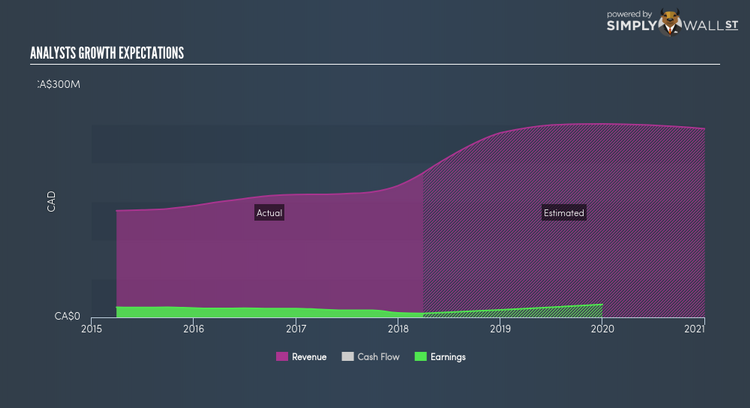

K-Bro Linen Inc., together with its subsidiaries, engages in the processing, management, and distribution of general linen and operating room linen to healthcare institutions, hotels, and other commercial accounts in Canada. Formed in 1954, and now led by CEO Linda McCurdy, the company now has 2,200 employees and with the company’s market cap sitting at CAD CA$373.87M, it falls under the small-cap stocks category.

KBL’s forecasted bottom line growth is an exceptional 63.49%, driven by the underlying double-digit sales growth of 33.09% over the next few years. An affirming signal is when net income increase also comes with top-line growth. Even though some cost-reduction initiatives may have also pushed up margins, in the case of KBL, it does not appear too severe. KBL’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Should you add KBL to your portfolio? Other fundamental factors you should also consider can be found here.

VersaBank (TSX:VB)

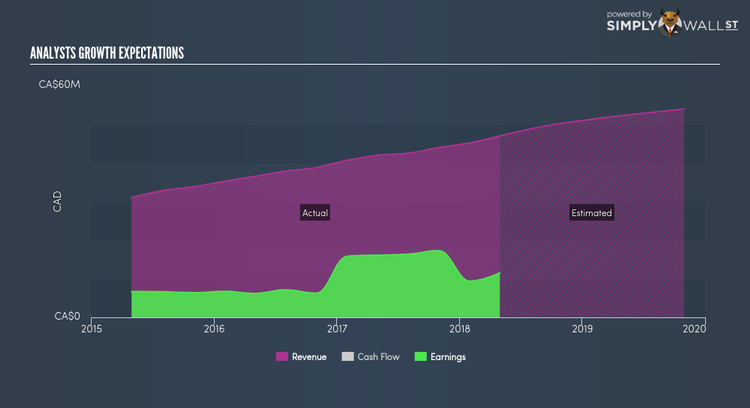

VersaBank, a schedule 1 bank, provides banking products and services in Canada. Established in 1979, and now led by CEO David Taylor, the company currently employs 80 people and with the market cap of CAD CA$148.29M, it falls under the small-cap stocks category.

Should you add VB to your portfolio? Have a browse through its key fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance