Best Dividend Paying Stock in June

Cincinnati Financial, Omnicom Group, and Clorox all share one thing in common. They are on our list of top paying dividend stocks which have helped grow my portfolio income over the past couple of months. A sizeable part of portfolio returns can be produced by dividend stocks due to their contribution to compounding returns in the long run. Below are more huge dividend-paying stocks that continues to add value to my portfolio holdings.

Cincinnati Financial Corporation (NASDAQ:CINF)

Cincinnati Financial Corporation provides property casualty insurance products in the United States. Formed in 1950, and headed by CEO Steven Johnston, the company currently employs 4,925 people and with the company’s market cap sitting at USD $11.45B, it falls under the large-cap group.

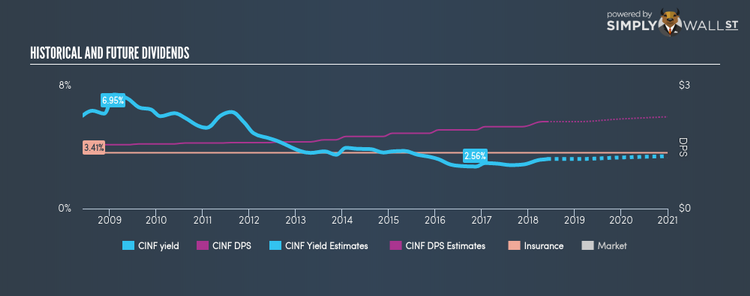

CINF has a good-sized dividend yield of 3.02% and is currently distributing 40.96% of profits to shareholders , with analysts expecting this ratio to be 65.13% in the next three years. CINF’s last dividend payment was US$2.12, up from it’s payment 10 years ago of US$1.56. Much to the delight of shareholders, the company has not missed a payment during this time. The company recorded earnings growth of 34.60% in the past year, comparing favorably with the us insurance industry average of 4.29%. Dig deeper into Cincinnati Financial here.

Omnicom Group Inc. (NYSE:OMC)

Omnicom Group Inc., together with its subsidiaries, provides advertising, marketing, and corporate communications services. Formed in 1944, and currently lead by John Wren, the company size now stands at 77,300 people and with the market cap of USD $16.19B, it falls under the large-cap category.

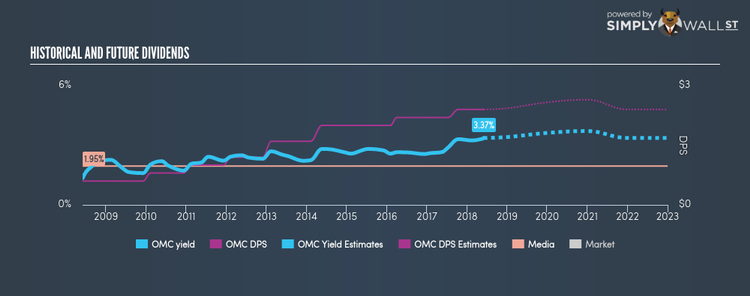

OMC has a good dividend yield of 3.37% and has a payout ratio of 47.92% . Over the past 10 years, OMC has increased its dividends from US$0.60 to US$2.40. They have been dependable too, not missing a single payment in this time. More on Omnicom Group here.

The Clorox Company (NYSE:CLX)

The Clorox Company manufactures and markets consumer and professional products worldwide. Founded in 1913, and currently lead by Benno Dorer, the company now has 8,100 employees and has a market cap of USD $16.33B, putting it in the large-cap stocks category.

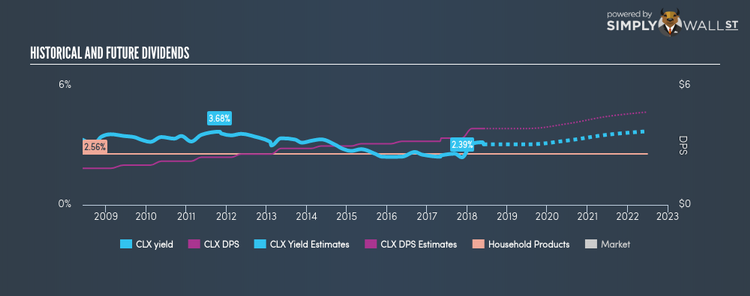

CLX has a good dividend yield of 3.05% and their current payout ratio is 55.69% , and analysts are expecting a 60.96% payout ratio in the next three years. CLX’s DPS have risen to US$3.84 from US$1.84 over a 10 year period. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend. More on Clorox here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance