Best Growth Stock in June

Want to add more growth to your portfolio but not sure where to look? Companies such as dotDigital Group and Firestone Diamonds are deemed high-growth by the market, with a positive outlook in all areas – returns, profitability and cash flows. Below I’ve put together a list of great potential investments for you to consider adding to your portfolio if growth is a dimension you would like to firm up.

dotDigital Group Plc (AIM:DOTD)

dotdigital Group Plc provides intuitive software as a service and managed services to digital marketing professionals in the United Kingdom. Formed in 1999, and run by CEO Milan Patel, the company currently employs 238 people and with the company’s market capitalisation at GBP £217.08M, we can put it in the small-cap category.

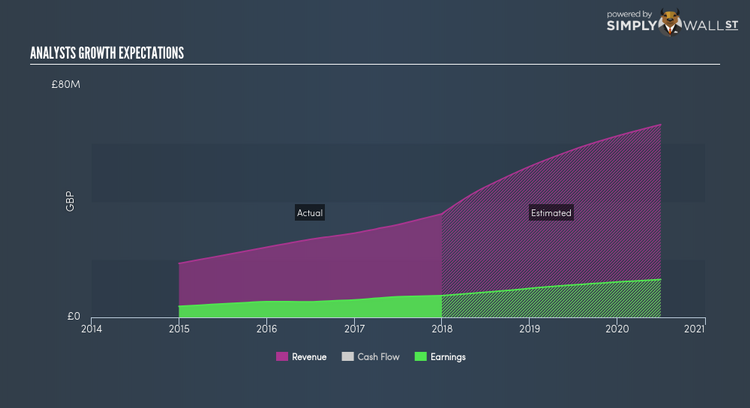

DOTD is expected to deliver a buoyant earnings growth over the next couple of years of 22.80%, bolstered by an equally impressive revenue growth of 74.00%. It appears that DOTD’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. Furthermore, the 93.28% growth in operating cash flows indicates that a large portion of this earnings increase is high-quality, day-to-day cash generated by the business, rather than one-offs. DOTD’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Thinking of investing in DOTD? Other fundamental factors you should also consider can be found here.

Firestone Diamonds plc (AIM:FDI)

Firestone Diamonds plc mines, explores for, and develops diamond properties in Lesotho and Botswana. Formed in 1998, and currently headed by CEO Stuart Brown, the company employs 202 people and with the company’s market capitalisation at GBP £32.49M, we can put it in the small-cap category.

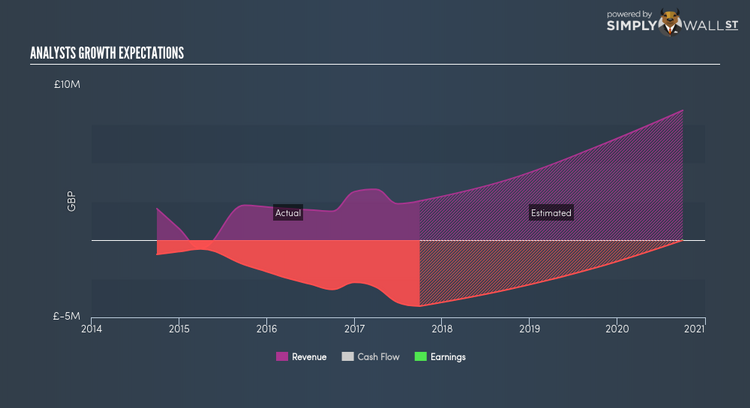

FDI’s forecasted bottom line growth is an exceptional triple-digit, driven by underlying sales, which is expected to more than double, over the next few years. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. FDI ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Considering FDI as a potential investment? Other fundamental factors you should also consider can be found here.

Premier Veterinary Group plc (LSE:PVG)

Premier Veterinary Group plc provides various services to third party veterinary practices in the United Kingdom, the United States, Denmark, the Netherlands, the Republic of Ireland, France, and Germany. Founded in 1969, and headed by CEO Dominic Tonner, the company now has 61 employees and with the stock’s market cap sitting at GBP £0.00, it comes under the small-cap category.

An outstanding 61.30% earnings growth is forecasted for PVG, driven by strong underlying sales growth over the next few years. It appears that PVG’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. Moreover, the 70.35% growth in operating cash flows shows that a decent part of earnings is driven by robust cash generation from operational activities, not one-off or non-core activities. PVG’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Thinking of investing in PVG? Check out its fundamental factors here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance